Content

Another thing I look at when assessing a tax software is its ability to handle complex returns. You will also be asked if you have certain kinds of income or deductions treated differently for state tax purposes than federal tax purposes. Just to back up here, in this particular test, I indicated that I was a single filer living in California with $50,000 of W-2 wages as my only income and who takes the standard deduction.

You would be surprised to find out what some vague official filing guide info translates to in the real world, including, no, you don’t need to do that etc. although is says to do that on paper. Collecting the data all year requires discipline, but there is nothing you can do to avoid the confusion of the easy-step maze of questions that the layman mostly will not understand. Steve, the advantage of an accountant probably won’t show on this year’s taxes. The advantage of an accountant is that he / she can tell you where to make changes that will save you taxes and other headaches next year.

Ability To Handle Complex Returns

His response was a glitch in the computer without an apology offered. I went to a different accountant next year but he was rushing the whole time I was with him. I heard about turbo tax next year and have been doing my own taxes because I can be careful and take my time plus it saved hundreds on fees.

I stopped filing my own taxes when I started the business and had way to many documents to file every year including my W-2s from my employer and at least 10 other misc documents. I need someone who knows tax laws etc, especially now since I am filing for two states for ’09 .

We’ve been fairly conservative over the years so we’ll just have to see what happens. I’m secretly hoping that my accountant will come out better to justify the costs. Typically, food and beverage can only be deducted at 50% when you are traveling for business. However in the case of running a large event like a conference, it should be deducted at 100%. 2016 was the first year that I held my conference, The Sellers Summit. And as part of running an event, I spend a lot of money on food and beverage to feed the attendees.

The Outcome Of Accountant #1

The advantages and disadvantages of using TurboTax over a CPA involve your willingness to work with financial numbers and the amount of time you have. With the exception of a simple return, it takes 4-5 hours of work for most people to complete their tax forms and file. If you don’t have that time, a CPA is a good investment to consider. If you do have the time, the TurboTax will help you create a high-quality return for a budget-friendly price. If you hire a CPA to do your taxes for you, then you just hand over your financial records and you’re done. When you use TurboTax software, then you are forced to commit more time resources to the process.

Although TurboTax doesn’t have any in-person offices you can visit to get help with your tax return, they do offer TurboTax Live. This add-on lets you talk to an EA or CPA to get unlimited help and tax advice for the whole year, and reviews of your return. Fees for the Live service range from $79.99 to $199.99, depending on which package level you select. It seems like hiring an accountant is a good idea. Like you said, hiring one would save you a ton of time, in the long run. If I owned a business, I wouldn’t ever do my own taxes. Not sure how old this article is and my apologies if I missed the answer to my question in one of the comments.

The 7 Best Tax Preparation Software Programs

But that being said, it’s nice to have a tax expert available to ask questions regarding any borderline deductions that could trigger an audit. The accountant prepares and file all of our taxes for us. All we have to do is provide him with all of the necessary data. Everything sounds pretty straightforward except for one thing. In this article I will cover all the pros and cons that come along with using a CPA or filing your taxes through a software, such as Turbo Tax.

- You’ll find Turbo and many other resources like tax calculators and expense estimators at the bottom of the main TurboTax website.

- Once our accountant received our tax information, things proceeded much more smoothly but what annoyed me was that it was difficult to reach him to ask even the most basic of questions.

- With a history of tax preparation going back 40+ years, TurboTax has plenty of experience in the tax filing arena.

- Get virtual, one-on-one tax guidance and on-demand preparation from a tax professional.

- The advantages and disadvantages of using TurboTax over a CPA involve your willingness to work with financial numbers and the amount of time you have.

- Generally, it works only for people who don’t plan to claim any deductions or credits other than the standard deduction, the earned income tax credit or the child tax credit.

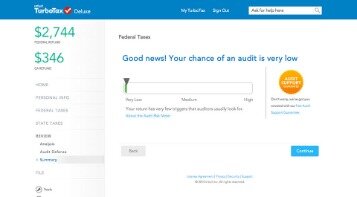

So I’d have to pay an additional $80 to TurboTax in order to get a deduction that will result in $30 of tax savings! After you’ve told TurboTax about all your income items, it’s time to get to the good stuff — deductions and credits. If you’re not comfortable with this, simply click “No Thanks” at the bottom of the second screen. This will not affect your tax return in any way. TurboTax is a top-of-the-line tax software, but it doesn’t come cheap and tends to upsell users on various services. That said, if your return is pretty much comprised of documents that others prepared for you — such as your W-2 or a 1099-DIV from your brokerage — your chance of being audited is extremely small.

Cost-effective — the service is competitively priced and is powered by Ernst & Young LLP , an organization with more than 100 years of experience in tax preparation. In recent history, we have seen sweeping federal tax reform enacted under the Tax Cuts and Jobs Act of 2017. In 2020, a significant tax relief bill, the federal CARES Act was passed in response to the COVID-19 pandemic. The economic impact of the pandemic has been challenging, with millions receiving unemployment. These funds offer a lifeline, but they’re not tax-free income.

Turbotax Deluxe Edition

TurboTax has plenty of experience in the tax filing arena. When you use TurboTax Live, you can get answers to specific questions or help with certain sections of your return.

Income status isn’t the only reason why a tax return can be complicated for some households. You might earn income from different states, which would require different tax returns to be filed. TurboTax is going to charge you separately for each state return you complete and file online. Changes in family structure, especially marriage or divorce, can have a big impact on your taxes as well. You’ll also find that rental properties, with rental income, is a complex issue that may need the help of a CPA.

In addition to extensive tax experience, Lisa also has a very well-rounded professional background. She has held positions as a public auditor, controller, and operations manager.

Lisa Lewis is a CPA and the TurboTax Blog Editor. Lisa has 15 years of experience in tax preparation.

File With A Tax Pro We Do The Work.

In other words, you don’t pay until you choose to complete and send the information to the appropriate tax authority. Therefore, saving your balance due until the end ensures you’re billed for any extra services you’ve used. The reason TurboTax works this way is that there are extra features you might enable along the way as you file. One other “con” is that you won’t know exactly what you owe until you’ve completed your return. Here’s a summary of TurboTax plan prices, including the TurboTax live feature. And TurboTax Live experts have an average of 15 years of tax help experience, meaning you can be assured they know current tax laws. Know that if you have self-employed income or if you own rental real estate, you’ll have to use one of the next two versions we talk about here.