This time, Adams and her husband filed as usual in mid-February of 2020, but no refund arrived. Food delivery and other expenses were piling up, as the couple sheltered in a borrowed RV to avoid contracting COVID-19. After extensive sleuthing and hours on the phone, she learned that the IRS had pulled her return for a review because of some kind of error. When this had happened in previous years, she had gotten a letter identifying the problem with her forms. But this time she received nothing, and the IRS representative she reached couldn’t say anything more. The IRS logjam is particularly difficult for low-income people who rely on tax refunds and stimulus checks.

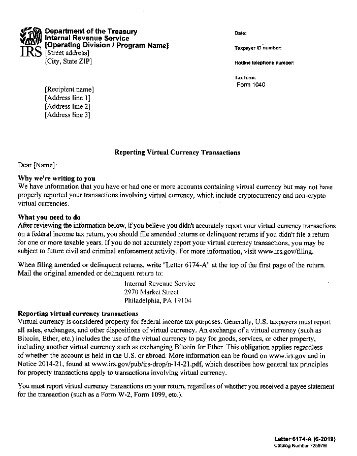

President Donald J. Trump, for example, is the midst of a battle with the IRS over a $72.9 million tax refund claimed and received after prior losses. WASHINGTON — The Internal Revenue Service has started sending letters to taxpayers that may need to take additional actions related to Qualified Opportunity Funds . Real IRS letters have either a notice number or letter number on either the top or bottom right-hand corner of the letter. If there’s no notice number or letter, it’s likely that the letter is fraudulent. We’ll give you some tips on how to detect whether or not you’ve received a fake IRS letter in the mail. Oregon’s Logging Industry Says It Can’t Afford New Taxes. But Prices Have Never Been Higher and Profits Are Soaring.The problems may not dissipate this year.

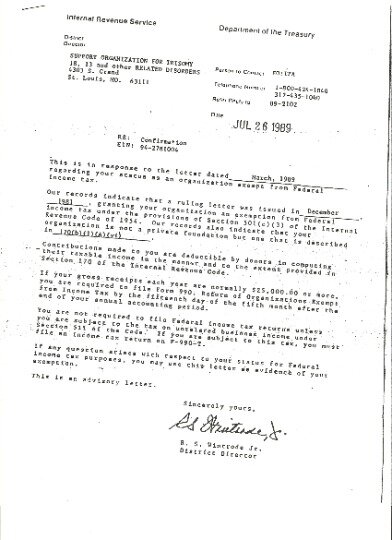

While it is certainly not a duty that any individual looks forward to engaging in, it is essential that taxpayers handle their taxes promptly and properly. While the penalties may start with fines and interest, they can quickly escalate if the investigator or auditor believes that willfulness motivated the tax failure. Therefore, most taxpayers dutifully endeavor to ensure that their taxes are filed on time and all obligations are satisfied. The IRS sends these identity verification letters to taxpayers after receiving an e-filed/paper-filed tax return, before processing a refund. Sometimes this is to randomly verify identification as a measure to prevent identity theft and to test and strengthen IRS internal controls. In other instances, this is to verify the identity as a duplicate tax return might have been filed using the same Social Security number. If you have filed your tax return and received this notice, you can disregard the message.

Similarly, you might get an email from someone pretending to be from the IRS, and they might ask for similar information from you over threats of financial penalties or imprisonment. These practices are known as “phishing.” Hackers and con-artists are “phishing” for personal information from unsuspecting taxpayers. You can give them the notice number or letter number that’s on the correspondence, and an IRS representative will tell you whether or not it’s legitimate.

Why Am I Getting This Letter?

Ideally, communication with the IRS is straightforward. You send your completed tax return by the filing deadline, and within a few weeks it sends you any refund you’re owed. If you e-file your taxes and request a direct deposit of your refund, the communication process is even faster and simpler. In case of married filing jointly returns, both taxpayer and spouse IDs have to be provided.

She co-developed an online DIY tax-preparation product, serving as chief operating officer for seven years. She is the current treasurer of the National Association of Computerized Tax Processors and holds a bachelor’s in business administration/accounting from Baker College and an MBA from Meredith College. Read the letter thoroughly, take steps to verify it really is from the IRS and then follow the letter’s instructions. An accurate and timely response can help you resolve issues with the least amount of stress.

- On Jan. 30, the IRS was still processing 4.6 million cases that involve amended returns and other special requests.

- The offers for financial products you see on our platform come from companies who pay us.

- And, so long as you know the key features of a real IRS letter, you’ll never be victimized by IRS impersonators.

- If you e-file your taxes and request a direct deposit of your refund, the communication process is even faster and simpler.

Remember that the IRS is a very detail-oriented agency. Each letter should come with very specific instructions on how to respond to its queries. The letter will usually have bullet points that detail each instruction. If the content of an IRS letter seems rushed or vague, it’s likely that it could be a fake IRS letter.

Some, but not all, included inserts pushing back their deadlines. Brenneman had filed an amendment to her 2018 taxes via snail mail, along with a $108 check to pay the balance due, in early March 2020, when the virus that causes COVID-19 was first spreading across America. A few weeks later, as the nation went into lockdown, Congress tasked the IRS with delivering $270 billion in economic impact payments. As the agency struggled to administer the unprecedented program during a pandemic, Brenneman’s tiny tax payment may have gotten lost in the shuffle. The IRS says you won’t need to call it for most notices.

You can also write to us at the address in the notice or letter. Pay as much as you can, even if you can’t pay the full amount you owe. You can pay online or apply for an Online Payment Agreement or Offer in Compromise. To get a copy of your IRS notice or letter in Braille or large print, visit the Information About the Alternative Media Center page for more details. Your notice or letter will explain the reason for the contact and give you instructions on how to handle the issue. WASHINGTON — A letter sent to thousands of Americans by the IRS is now being called a mistake.

What You Need To Verify Your Identity

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Once you’ve cleared up the problem, take steps to avoid receiving letters in the future. Many can be avoided by simply filing an accurate tax return. Careless mistakes will almost certainly trigger an IRS notice. Take special care with your return, check the math, review the rules, and sign on the bottom line. Other notices may advise you of corrections to your tax return.

If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. TurboTax helps decrease your risk of an audit by importing data such as W-2 and 1099 info directly from more than 100,000 employers, which reduces the chances of mis-entered information. TurboTax also checks your return for errors and common audit triggers, and guarantees your calculations will be 100% accurate. Mail the letter and any requested documents to the address the IRS provides—it’s usually in the upper left-hand corner of the notice. Include the bottom tear-off part of the notice that includes your name, address and Social Security number. The IRS will provide you with a deadline for satisfying the request.

How To Report Irs Scams

If you have questions or aren’t exactly sure how to strategically meet the IRS’s demands, it can be wise to work with a tax professional. Ted Kleinman can assist with IRS audits, foreign disclosure issues, and an array of IRS tax problems. To schedule a no-obligation consultation schedule an appointment today.

If you have another tax issue to discuss with the IRS, address it in a separate letter. The IRS is not in the business of chasing people for amounts that aren’t due. If they’re satisfied you’ve paid what you owe, they will move on. Be patient as this may take some time to work through with the IRS.

You will often wait for replies from the department for months at a time. In some instances, you will need to verify your identity with the IRS. This helps prevent an identity thief from getting your refund.

If you can’t register for ID Verify online or don’t have the required documentation, please contact us using the toll-free number listed on your letter. We need to notify you of delays in processing your return.

If you disagree with the change, send a letter explaining why you disagree, and include any information or documents that support your position. Also be sure to include any tear-off portion of the notice. You might need to be patient because it typically takes at least 30 days for the IRS to respond. Of course, your first fear when receiving a letter from the IRS is probably that you’re being audited. And mail is, in fact, how the IRS would notify you if you were being audited.

However, sometimes the IRS will send a letter to let you know there’s a hitch in the communication process. It’s important to note that the IRS will not contact you by email or social media. If you receive that kind of contact from someone claiming to be an IRS representative, be wary of a scam. We think it’s important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us.

Before you panic and assume the worst – such as a full-blown audit – take a breath. If we can’t verify your identity over the phone, we may ask you to schedule an appointment at your local IRS office to verify your identity in person.

This means the IRS may be scrutinizing whether you incorrectly applied tax deductions or credits disallowed on previous returns to the current year. It’s important to keep a copy of all notices or letters with your tax records. Each notice or letter contains a lot of valuable information, so it’s very important that you read it carefully. If we changed your tax return, compare the information we provided in the notice or letter with the information in your original return. The agency sent letters to more than 109,000 people stating either part or all of their stimulus check would be used to cover 2007 taxes.

Information Menu

Sign up to receive our biggest stories as soon as they’re published. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries.

At this point, you should have a basic idea regarding why the IRS contacted you. In some situations you may not be required to take further action. In other cases, the IRS may need you to send them information about an aspect of or your overall tax return. In still other cases, the IRS may be notifying you that you are likely an identity theft victim or that you have an unpaid tax obligation.

For those who want even more protection, TurboTax offers Audit Defense, which provides full representation in the event of an audit, for an additional fee. If you’re confused by the letter and not sure how to respond, the IRS can answer most questions by phone ( ). If the issue is serious, however, it might be better to put your questions in writing. The letter will give you specific instructions on what to do to resolve the problem. If you miss the response deadline, it could make your case worse.

Letter Identification

Investors who made an election to defer tax on eligible gains invested in that entity may also be subject to examination for an invalid election. Most IRS letters have a notice number listed on the top right hand corner of the letter. With your IRS letter in hand, you can use our IRS letter decoder to find more information about the letter and plan your course of action. Simply input this code, and we’ll let you know why you received the letter, how serious it is, and what steps you need to take.

You can also call the IRS and request a fax number where you can send all the documents, including your photo and other ID forms. Double-check on the documents to be sent to make sure it matches the notice to avoid further delays. A tax professional can also assist you in handling the identity verification request. To help fight identity theft, the IRS sometimes sends identity verification letters to some taxpayers.