If you’re VAT registered then you will need to be accounting for your sales revenue split out by destination and also by tax rate. As an e-commerce business, you don’t want to be out of stock when a customer is trying to buy from you. So, staying up to date on your inventory is essential to ensure you can meet consumer demands without overstocking items. If you are running a brand new business with less than six figures in total sales, you might be able to get by with the default reports in Shopify as well as a spreadsheet or two.

Getting started with Shopify accounting and bookkeeping

By automating your Shopify bookkeeping with Link My Books, you can focus on growing your eCommerce business while staying on top of your finances effortlessly. Taking the time to choose the right software will make your Shopify bookkeeping more efficient and less time-consuming in the long run. An accountant might look at how much we spend on goods or how much we get from selling things.

Want More Helpful Articles About Running a Business?

Regardless of what your mom and best friend might tell you, your business isn’t a special snowflake. Whether you are using Shopify, WooCommerce, Magento, BigCommerce, or something else, here are some best practices that all eCommerce businesses should follow. Between the Xero App Marketplace and Shopify App Store, there are thousands of third-party apps you can use.

Shopify Bookkeeping Best Practices (+ How To Enhance Your Bookkeeping With Reconcilely)

Get the best software for your business.Compare product reviews, pricing below. You can also add “guided setup” for your account with a live bookkeeper for $50 per session. You can set up Shopify to add tax at checkout, but you will need to remit the tax yourself and make provision for paying it.

It’s free, easy to set up and use with little to no accounting knowledge, and easily accessible online and via its mobile app (for Android and iOS). Thanks to Shopify, 1.75 million business owners are making money online selling physical and digital products. If you’re among them, having an efficient, accurate Shopify accounting solution is crucial both for IRS compliance and a clear picture of your company’s financial health. To effectively manage your Shopify business, it’s crucial to maintain accurate inventory records.

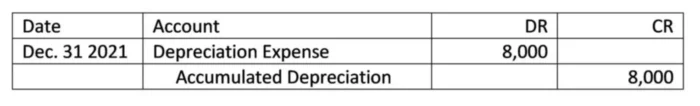

Use Accrual Accounting

- We don’t need to wait until the end of the month or year to find out if we are making a profit or loss.

- If your work is project-based, you can even use Freshbooks’ handy project management tools to stay on top of deliverables.

- Its user-friendly interface makes it easy to navigate and use for both accountants and eCommerce businesses.

- The platform’s Basic Plan is available to retailers for $29 per month, though additional pricing plans with extra functionality are available for $79 and $299 per month.

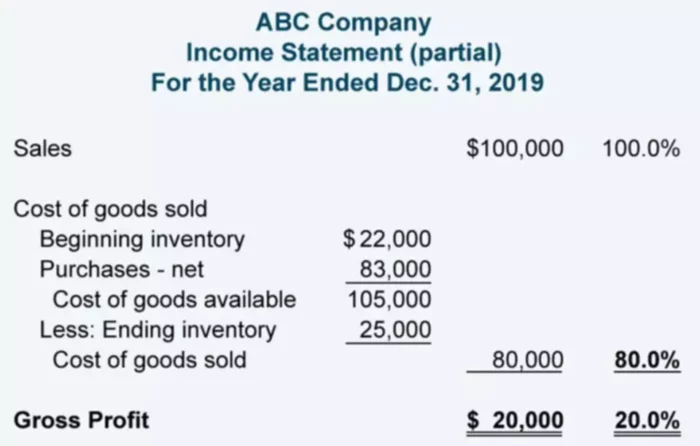

Mismatches in revenue tracking can also cause inaccurate reporting. For example, if there’s a mismatch between tracking revenue and tracking the Cost of Goods Sold (COGS), it will skew profit margins. The payout amount is actually made up of a combination of sales, fees, refunds, gift cards, taxes, and other transactions.

Now that you have the figures from the payout report you can begin to enter them into your accounting software or spreadsheet. To do all of this yourself manually and get it all right takes patience and a lot of time. That’s why most Shopify sellers use accounting integrations like Link My Books or work with e-commerce specialist accountants such as ecommerceaccountants.co.uk. When you are wearing multiple hats in your eCommerce business, it can be too easy to stay in the weeds. Setting a system where you view your financial reports and key metrics on a regular basis- even 10 minutes once a week – can be beneficial.

That’s why bookkeeping software must offer features like multi-person sign-off and restricted access to inventory data. Shopify stores integrate with accounting software like Xero and using the Reconcilely app can enable real-time reconciliation so that you can keep track of all sales, refunds, fees, and more. Accounting takes that financial data and analyzes it to create reports, like profit and loss statements, balance sheets, and tax returns. It’s about interpreting the numbers to understand the financial health of your business and make informed decisions. In other words, QuickBooks serves as a central hub for all of your financial data, offering detailed reports ranging from profit/loss statements and expense reports to balance sheets and cash flow reports. By leveraging these automation integrations for Shopify bookkeeping, you can streamline processes and save valuable time while maintaining accurate financial records for your eCommerce business.

You can also download our free customizable checklist – feel free to modify with any specificities for your Shopify bookkeeping process. It’s important to be able to see the transactions that make up each payout, and record them to the correct Chart of Accounts. Let’s drill down into the specifics of how some Shopify transactions should be accounted for. You can try this tool free for 30 days (no credit card required) to see if it meets your needs.

One disadvantage of this tool is that you have to pay monthly to add users besides yourself to your account. While $10 per month per user isn’t expensive in itself, that cost could add up if several team members need access. Ecommerce Accountants are the leading accountancy in the UK for ecommerce businesses and we have been working closely alongside their friendly team for a number of years.