Content

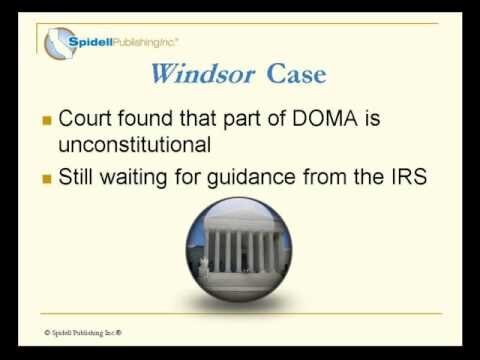

Pedersen v. Office of Personnel Management is a case filed by GLAD in Connecticut on behalf of same-sex couples in Connecticut, Vermont, and New Hampshire, in which GLAD repeats the arguments it made in Gill. On November 9, 2010, the American Civil Liberties Union filed United States v. Windsor in New York on behalf of a surviving same-sex spouse whose inheritance from her deceased spouse had been subject to federal taxation as if they were unmarried. New York is part of the Second Circuit, where no precedent exists for the standard of review to be followed in sexual-orientation discrimination cases.

- Employees must be permitted to take family and medical leave to care for an ill same-sex spouse.

- Should a same-sex couple be married in Minnesota and then subsequently need to file in another state that does not recognize same-sex marriage, that state may require the spouses to file as individuals even if they file jointly with the IRS.

- In Massachusetts he held that the same section of DOMA violates the Tenth Amendment and falls outside Congress’ authority under the Spending Clause of the Constitution.

- Individuals who are legally married have begun to receive green cards following the Supreme Court decision on DOMA.

- Dragovich v. Department of the Treasury, No. (N.D. Cal.), a class action in which California same-sex couples seek equal access to California’s long-term care insurance program for public employees and their families.

On December 11, the Supreme Court appointed Vicki C. Jackson, a professor of constitutional law at Harvard Law School, as an amicus curiae to argue the two additional questions it posed. BLAG filed its own petition for certiorari, in order to enable the court to rule on the constitutionality of DOMA, even if it were to decide that it lacked jurisdiction to hear the DOJ’s petition. Despite its approval of the ruling, the Justice Department filed a notice of appeal on June 14, 2012, to facilitate BLAG’s defense of the statute.

District Court

We will continue to monitor any further developments on this issue, and continue to provide updates as we see the result of the Supreme Court’s decision being implemented.

Marriages formed in Minnesota may not receive the same recognition from other states that do not legally recognize same-sex marriages. Married same-sex couples may not, for example, be eligible for divorce if they move to a state that does not recognize their marriage, and employers in other states may not be required to grant spousal health benefits if the relevant plan is subject to state law. Conversely, under Minnesota’s law, marriages from other jurisdictions where same-sex marriage is legally recognized will be recognized in Minnesota, effective August 1, 2013. The ruling on DOMA will have major effects on families concerning a number of different federal rights which provide necessary marital benefits. Some areas that are affected include military family benefits, social security benefits, multiple areas of tax categories, hospital visitation rights, and healthcare benefits.

Even if the court had left DOMA completely intact, it would have almost surely faced a political challenge in Congress. The debate over the constitutional right to marriage, meanwhile, will continue at the state level for now. 8 case was dismissed, the two couples who initially challenged the law in court and their lawyers called both cases victories for gay rights. The gay rights movement saw a significant victory at the Supreme Court Wednesday, even as the court dodged the fundamental issue of whether marriage is a constitutionally-protected right for all couples, gay or straight. “The Social Security law uses the wage earner’s ‘place of domicile’ as the relevant state law for assessing who is a spouse for benefits purposes,” the After DOMA report said. “The Social Security law states that a person is considered a spouse if the courts of the state at the time of application would find that the couple was validly married.” In many cases, however, people in a legal same-sex union – who are otherwise entitled to claim a Social Security spousal or family benefit – will live in a state that does not sanction same-sex marriages.

In 1998, the first anti-same-sex marriage amendment was added to the constitution of a U.S. state, though it was not until 2002 that a federal marriage amendment was first introduced in the U.S. In an op-ed written on March 7, 2013, for The Washington Post, Clinton again suggested that DOMA was necessary in order to preclude, at that time, the passage of a constitutional amendment banning same-sex marriage and urged the Supreme Court, which would shortly hear arguments on United States v. Windsor, to overturn DOMA.

Explanatory Notes

On July 8, 2010, Tauro issued his rulings in both Gill and Massachusetts, granting summary judgment for the plaintiffs in both cases. He found in Gill that Section 3 of the Defense of Marriage Act violates the equal protection of the laws guaranteed by the Due Process Clause of the Fifth Amendment to the U.S. In Massachusetts he held that the same section of DOMA violates the Tenth Amendment and falls outside Congress’ authority under the Spending Clause of the Constitution. Those decisions were stayed after the DOJ filed an appeal on October 12, 2010.

Many scholars have theorized that the ruling in Windsor have elevated classifications on the basis of sexual orientation to be considered under a ‘rational basis with bite’ evaluation; and have found the analysis to be closely synonymous with how classification of religion are reviewed. The Ninth Circuit court also observed that the majority in Windsor shifted the burden from the same-sex couple to the government when it wrote that the government has to “justify disparate treatment of the group”. The marriage can take place in a State or other Country where that ceremony was legal, and will confer eligibility to apply for lawful permanent residence. The Department of Homeland Security treats same-sex spouses equally for the purposes of obtaining a green card if the spouse is a foreign national. Legally married same-sex seniors on Medicare are eligible for equal benefits and joint placement in nursing homes. Medicaid announced in August 2013 that “all beneficiaries in private Medicare plans have access to equal coverage when it comes to care in a nursing home where their spouse lives”.

For employers based in other states, these coverage requirements currently will depend upon whether or not those states recognize same-sex marriage. The plan administrator would want to avoid the potential liability of overlooking a same-sex spouse of which the plan was unaware. To this end, we recommend proactive communications with participants on this issue. If an employer offers health plan coverage to same-sex partners already, this change likely would save the company money in the long run. Presently, employer contributions toward health plan coverage are considered taxable income to a participant with a same-sex spouse; these amounts are subject to employment and income taxes.

In February 2014, the Justice Department expanded recognition of same-sex marriages in federal legal matters, including bankruptcies, prison visits, survivor benefits and the legal right to refuse to testify to incriminate a spouse. Likewise in June 2014, family medical leave benefits under the Family and Medical Leave Act of 1993 were extended to married same-sex couples in all of the U.S. With respect to social security and veterans benefits, same-sex married couples who live in states where same-sex marriage is recognised are eligible for full benefits from the Veterans Affairs and the Social Security Administration . The VA and SSA can provide only limited benefits to married same-sex couples living in states where same-sex marriage isn’t legal, with Congress required to amend federal law to rectify that inequity. After its passage, DOMA was subject to numerous lawsuits and repeal efforts. Supreme Court declared Section 3 of DOMA unconstitutional under the Due Process Clause, thereby requiring the federal government to recognize same-sex marriages conducted by the states. In Obergefell v. Hodges, the Court held that same-sex marriage was a fundamental right protected by both the Due Process Clause and the Equal Protection Clause.

Frequently Asked Questions: Defense Of Marriage Act (doma)

Employers are now permitted by federal law to grant same-sex spouses the same benefits that are available to all other spouses with the accompanying favorable tax treatment. The biggest impact will be on retirement and welfare benefits subject to the Employee Retirement Income Security Act (“ERISA”), and employers will also be required to expand eligibility for leave under the Family and Medical Leave Act (“FMLA”). If an employer does not offer health plan coverage to same-sex spouses, a decision overturning DOMA would require you to do so (assuming that coverage to opposite-sex spouses is already provided), which would increase the employer’s costs. The IRS looks at a couple’s state of residence when determining marital status. Under this method, a same-sex couple that is legally married in New York may be considered “unmarried” if they move to a state that does not recognize same-sex unions, such as Illinois. In contrast, other federal agencies look at the state in which the wedding took place when determining marital status. Under this method, the same-sex couple that is legally married in New York is considered married by DoD, no matter where the couple lives.

If DOMA is struck down, the employer would no longer have to pay FICA taxes on this amount, and the employer may be able to obtain refunds of FICA payments made in the past, to the extent the limitations period has not expired. Employers also would be spared the associated reporting obligations. In the short-run, however, plan sponsors would likely incur some programming and communications costs.

On Aug. 29, 2013, the IRS issued Revenue Ruling , stating that employees who pay for employer-provided health insurance for their same-sex spouse may treat these costs as excludable from federal income taxes, even if they live in a state that doesn’t recognize their marriage. It was the first federal court of appeals decision to hold that laws that classify people based on sexual orientation should be subject to heightened scrutiny. Like the lower court, the Second Circuit held that the Spyer-Windsor marriage was valid under New York law, citing precedents on that question from several state appellate court decisions, two of which preceded Spyer’s death. Where New York law is unclear, the Second Circuit must adopt a predictive approach, as it did in this case.

The state of residence is, of course, a non-issue for heterosexual couples. But it’s a conundrum for what the Williams Institute estimates are 38,000 same-sex couples who were married where same-sex unions are legal but now live in a state where they are not recognized. Extending Social Security benefits to same-sex couples is one of the biggest financial consequences of last week’s decision by the U.S. On July 25, Chief Judge Carol Bagley Amon stayed the case pending the resolution of Windsor by the Second Circuit. A spokesman for House Speaker Boehner said BLAG would not appeal the ruling, On July 7, 2011, the DOJ announced that after consultation with BLAG it would no longer raise objections to “bankruptcy petitions filed jointly by same-sex couples who are married under state law”.

Golinski v. Office of Personnel Management was a challenge to Section 3 of DOMA in federal court based on a judicial employee’s attempt to receive spousal health benefits for her partner. In 2008, Karen Golinski, a 19-year employee of the Ninth Circuit Court of Appeals, applied for health benefits for her wife. When the application was denied, she filed a complaint under the Ninth Circuit’s Employment Dispute Resolution Plan. Chief Judge Alex Kozinski, in his administrative capacity, ruled in 2009 that she was entitled to spousal health benefits, but the Office of Personnel Management announced that it would not comply with the ruling. On February 24, the Department of Justice notified the First Circuit Court of Appeals that it would “cease to defend” Gill and Massachusetts as well. On July 1, 2011, the DOJ, with a filing in Golinski, intervened for the first time on behalf of a plaintiff seeking to have DOMA Section 3 ruled unconstitutional, arguing that laws that use sexual orientation as a classification need to pass the court’s intermediate scrutiny standard of review.

The ruling in Windsor led to a series of state and federal lawsuits being filed against same-sex marriage bans and affected other discrimination rulings. A year after the Windsor ruling was announced, there was at least one state or federal lawsuit against every state same-sex marriage ban. In February 2015, the United States Department of Labor issued its final rule amending the definition of spouse under the FMLA in response to Windsor. The revised definition of “spouse” extends FMLA leave rights and job protections to employees in a same-sex marriage or a common-law marriage entered into in a state where those statuses are legally recognized, regardless of the state in which the employee works or resides. As a result of the Windsor decision, married same-sex couples—regardless of domicile—have tax benefits , military benefits, federal employment benefits for employees of the U.S Government and immigration benefits. All same-sex couples who are legally married are recognized as such for federal tax purposes, even if the state where they live does not recognize their union. When New York adopted a law to permit same-sex marriage, it sought to eliminate inequality; but DOMA frustrates that objective through a system-wide enactment with no identified connection to any particular area of federal law.

Employees must be permitted to take family and medical leave to care for an ill same-sex spouse. In an e-mail, Todd Solomon, an employee benefits partner at law firm McDermott Will & Emery LLP in Chicago, identified the following as key benefits implications for private-sector organizations now that Section 3 of DOMA has been struck down. The Court of Appeals for Veterans Claims stayed Cardona, which challenges the constitutionality of section 3 of DOMA and certain federal regulations, pending resolution of Windsor. Golinski and Pedersen are both cases in which district courts held Section 3 of DOMA unconstitutional, though instead of appealing to the Courts of Appeal, an appeal was filed directly with the Supreme Court (docket numbers 12–16 and ). The Supreme Court declined the petitions the day after Windsor was announced, with Justice Kagan recusing in Golinski. Gill and Massachusetts were decided in separate opinions in the District Court by the same judge on the same day and a single opinion in the Court of Appeals, which found Section 3 unconstitutional.

The Supreme Court denied these petitions on June 27, 2013, following its decision in Windsor. On March 3, 2009, GLAD filed a federal court challenge, Gill v. Office of Personnel Management, based on the Equal Protection Clause and the federal government’s consistent deference to each state’s definition of marriage prior to the enactment of DOMA. The case questioned only the DOMA provision that the federal government defines marriage as the union of a man and a woman. However, political discussion of the possibility of using a constitutional amendment to restrict marriage rights was not unheard of in the 1990s. In January 1996, for example, the House Judiciary Committee for the state of Hawaii voted 12–1 in favor of passing bill HB 117, which was aimed at amending the constitution of Hawaii to define marriage as involving one man and one woman.

DOMA instructs all federal officials, and indeed all persons with whom same-sex couples interact, including their own children, that their marriage is less worthy than the marriages of others. The federal statute is invalid, for no legitimate purpose overcomes the purpose and effect to disparage and to injure those whom the State, by its marriage laws, sought to protect in personhood and dignity. By seeking to displace this protection and treating those persons as living in marriages less respected than others, the federal statute is in violation of the Fifth Amendment.

Musk, who leads several futuristic companies, including Tesla Inc, Neuralink and Boring Co, moved to the Lone Star State from California in December to focus on the electric-car maker’s new plant in the state and his SpaceX venture. Earlier on Tuesday, Musk tweeted, “Creating the city of Starbase, Texas,” without elaborating further. German exports to the UK plunged by almost a third in the first month under post-Brexit trading arrangements, new figures have revealed. The end of the Brexit transition period was blamed by Germany’s official statistics body for a 30pc year-on-year plunge in exports to the UK in January but economists predicted the trade slump will ease. New customs rules for exporters exacerbated a tumble in trade already triggered by the Covid crisis amid complaints of post-Brexit arrangements causing higher costs and delays for businesses. January’s drop compares to a 15.5pc fall in imports from Germany over 2020 but the latest slump in trade was still not as severe as the worst months of the first lockdown. The tumble in German imports at the start of the UK’s life outside the EU was also worsened by many businesses stockpiling in December as Brexit talks went down to the wire.

However, it appears that federal tax reporting and withholding will continue to be required for any benefits provided to domestic partners or same-sex spouses whose marriage is not recognized in their state of residence. The particular terms of these plans should be reviewed and revised as appropriate. For plans with benefits provided through insurance, this result should be automatic, since Minnesota is permitted to regulate the terms of insurance and likely will require insurance issued in Minnesota to cover same-sex spouses. We anticipate that Minnesota will be issuing guidance on when these changes must be made. Joint filing of income taxes can create substantial savings for married couples, yet under DOMA, couples in state-recognized same-sex marriages were eligible for joint filing within their state while still required to file as single with the IRS. Even more confusingly, some state returns borrow from the filer’s federal returns, so couples were required to file a mock joint federal return with the state to accompany their state tax return, while also filing individual federal returns.

Now that same-sex couples have the ability to marry in a dozen states plus D.C., companies that currently offer same-sex domestic partner benefits will need to decide whether to continue offering same-sex domestic partner benefits in those places as well, if section 3 of DOMA is struck down. We expect the Supreme Court to issue its decisions on same-sex marriage next week. Whichever way the Court rules, employers will likely grapple with the implications for their benefit plans. The 5-4 court ruling is the most significant advance for gay and lesbian troops since the ban on homosexuals serving openly in the military was repealed in 2011. But while the end of Don’t Ask, Don’t Tell enabled gays to serve openly a range of healthcare, housing and other benefits remained closed to their spouses and partners because of DOMA. The U.S. Supreme Court has struck down Section 3 of DOMA which prevented the federal government from recognizing marriages of same-sex couples, because it violated the constitution’s “equal protection” promise.

On June 26, 2013, the Supreme Court of the United States overturned Section 3 of the Defense of Marriage Act (“DOMA”) in United States v. Windsor. Prior to the Supreme Court’s decision, Section 3 of DOMA, a federal law, had defined marriage as the union between one man and one woman. Therefore, under DOMA, a same-sex couple who had been married in a state legally recognizing same-sex marriage would still be considered single under federal law, creating numerous challenges for same-sex spouses and their employers. Section 3 of DOMA has been overturned by the Supreme Court for a violation of Fifth Amendment personal liberty protections; the Court also recognized that marriage is a matter traditionally regulated by the states. Indeed, Section 2 of DOMA, which permits individual states to deny recognition of same-sex marriages formed in other states, still remains in force.

Under DOMA, no federal tax benefits (including pre-tax or tax-free benefits) could be provided to domestic partners and same-sex spouses unless the partner qualified as the employee’s dependent. This has required employers with benefits programs that extend to domestic partners or same-sex spouses to make tax withholdings on benefits and to report taxable income for domestic partners and same-sex spouse benefits. Now, all federal pre-tax and tax-free benefits applicable to spouses will extend to any same-sex spouse who is considered “lawfully married” under the laws of the state in which the couple resides. For Minnesota employers, this means that federal income tax reporting and withholding will not be required for any same-sex employees who are Minnesota residents.