Content

A little research can yield some big savings, both when making a purchase and on your energy bill for years to come. Here at Energy Saver, we often get questions about what kind of financial assistance is available to make energy efficient purchases more affordable. There are many different types of energy incentives and understanding each one is key to maximizing your total savings. Incentives vary by state but here are some of the most common. Use up to 30% less energy in your home by outfitting it withENERGY STAR certified products, available across more than 75 categories. ENERGY STAR certified products are independently certified save energy, save money and protect the environment.

- Qualifying improvements must have been placed into service in the taxpayer’s principal residence located in the United States before Jan. 1, 2012.

- One exception to this is fuel cell property, which is limited to $500 for each one-half kilowatt of capacity of the property.

- This credit is set to expire December 31, 2021, in accordance with Public Law No.

- The minimum amount of the credit for qualified plug-in electric drive vehicles is $2,500 and the credit tops out at $7,500, depending on the battery capacity.

Grant Thornton LLP has launched ptvault.x, a new platform to help companies manage personal-property taxes. The cloud-based platform provides Grant Thornton’s clients with data transparency and reduced complexity. Americans with income from a farming or fishing business can avoid making any estimated tax payments by filing and paying their entire tax due on or before March 1, according to the IRS. The U.S. Supreme Court put a new New York grand jury on the brink of getting eight years of Donald Trump’s tax returns and other financial records, ending months of delay by rejecting his bid to keep the information private.

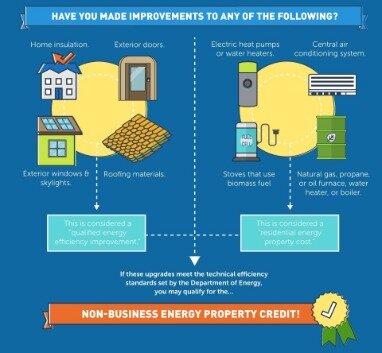

Nonbusiness Energy Property Credit

Disabled Access Credit is a non-refundable credit for small businesses that incur expenditures for the purpose of providing access to persons with disabilities. An eligible small business is one that had no more than 30 full-time employees or earned $1 million or less in the previous year. The business may qualify for up to $5,000 in tax credits. Section 179D Commercial Buildings Energy Efficiency Tax Deduction is a tax incentive that takes the form of a deduction rather than a credit. A reduced deduction of $0.60 per square foot is available to owners of buildings with systems that partially qualify. Part of this credit is worth 10 percent of the cost of certain qualified energy-saving items you added to your main home last year.

Be careful though for only expenditures on qualified energy efficient improvements prescribed by the IRS will qualify. To learn more about what products may qualify for the tax credit, refer to the Energy Star website.

NATP recently surveyed tax pros to find out what their preference for the 2021 Tax Day would be. More than 70% of respondents indicated their support of a filing date later than the current April 15. Above all, don’t be intimidated by the different options available.

93% of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching. TaxSlayer Pro makes tax filing simpler and less stressful for millions of Americans with exceptional, easy-to-use technology. An authorized IRS e-file provider, the company has been building tax software since 1989. With TaxSlayer Pro, customers wait less than 60 seconds for in season support and enjoy the experience of using software built by tax preparers, for tax preparers. All the latest tax news and advice delivered straight to your inbox.

The Iowa credit is coupled with the Internal Revenue Code as amended to and including January 1, 2016. Qualified solar energy electric property described in Section 25D of the Internal Revenue Code.c. While the IRS advises you to keep all your appliance certifications for your records, you are not asked to submit any of those documents along with your taxes. The certifications, however, are required to obtain the geothermal credit in the first place, so they should be kept on file.

Residential Energy Tax Credits (

Fifty percent of the federal residential energy property credit provided in Section 25D of the Internal Revenue Code. This credit is set to expire December 31, 2021, in accordance with Public Law No. Sixty percent of the federal residential energy property credit provided in Section 25D of the Internal Revenue Code.c. Sixty percent of the federal residential energy property credit provided in Section 25D of the Internal Revenue Code.b. Fifty percent of the federal residential energy property credit provided in Section 25D of the Internal Revenue Code.c. Fifty percent of the federal residential energy property credit provided in Section 25D of the Internal Revenue Code.b.

| Photo by Dennis Schroeder, National Renewable Energy Laboratory. The Nonbusiness Energy Property Credit can be applied towards any residential energy property costs that were paid or incurred in 2013. It can also be put towards 10% of the cost of qualifiedenergy efficiency improvementsthat are new and can be expected to remain in use for at least five years, and meet energy efficiency requirements. No more than $5 million of tax credits will be issued for calendar years beginning on or after January 1, 2015. The annual tax credit allocation cap also includes the solar energy system tax credits provided in rule .

The Latest On Residential Energy Credits

You can apply this home energy tax credit towards 30% of the cost of alternative energy equipment installed on or in your home. Many homeowners have been waiting to see what tax incentives the government is offering for energy efficient home improvements made to homes in 2013. By taking advantage of the 2014 residential energy tax credit, homeowners who have invested in energy-saving measures to their homes may be able to reduce their tax burden, if they qualify.

For nonresidential installations, the completion sheet must indicate the date the installation was placed in service. Solar energy systems installed during the 2015 calendar year shall be eligible for approval under Iowa Code section 42211L. Solar energy systems installed during the 2014 calendar year shall be eligible for approval under Iowa Code section 42211L.

Cut Taxes And Save On Energy Bills With Home Energy Credits

In order to qualify for the credit, improvements must have been placed in service in the taxpayer’s principal residence no later than December 31, 2020. If the department receives applications for tax credits in excess of the annual aggregate award limitation, the department shall establish a waitlist for the next year’s allocation of tax credits. The applications will be prioritized based on the date the department received the applications and shall first be funded in the order listed on the waitlist. If the annual aggregate cap is reached for the final year in which the federal credit is available, no applications will be carried over to the next year. Placement on a waitlist shall not constitute a promise binding the state that persons placed on the waitlist will actually receive the credit in a future year. The availability of a tax credit and approval of a tax credit application pursuant to subrule 42.48 in a future year is contingent upon the availability of tax credits in that particular year.

Fifty percent of the federal energy credit provided in Section 48 of the Internal Revenue Code. This credit is set to expire December 31, 2016, in accordance with Public Law No. The amount of tax credit claimed by a taxpayer related to paragraphs 42.48″a” and”b ” cannot exceed $5,000 per separate and distinct installation. The amount of tax credit claimed by a taxpayer related to paragraphs 42.48″c” and”d” cannot exceed $20,000 per separate and distinct installation. The term “separate and distinct installation” is described in subrule 42.48. Sixty percent of the federal energy credit provided in Section 48 of the Internal Revenue Code. “Separate and distinct installation” is described in subrule 42.48.

The solar energy system must be installed on or after January 1, 2012, to be eligible for the credit. You need your 1040 form to place the tax credit amount derived in Form 5695 in the appropriate line, which in this case is Line 52. You are asked to attach the above form to your tax return. The residential energy credits form is a composite of various different credits, not just the geothermal credit. You could be eligible for solar, fuel cell or other credits on the same form. Fill out whichever credits you are eligible for and include them into the tabulation. To claim your geothermal tax credit, you need IRS form 5695, Residential Energy Credits, for the year when you had the equipment installed.

Tweets From @homeenergyed

The credit can be applied to the first $25,000 of the cost of purchase of the system. If the lessor is entitled to the Iowa solar energy system tax credit, the lessee will not be entitled to such a credit.d. Any invoices or receipts from the purchase and installation of the geothermal pumping system will assist you in calculating your total costs. Installation charges are included in the tax credit calculation, so calculating them can help you save significant amounts, since there is no upper limit on the 30 per cent tax credit. Only those parts of the geothermal pump that are directly related to the pump’s efficiency qualify for the tax credit. Optional enhancements are not included; neither is ductwork.