Content

Some state institutions are exempt because they provide essential services . Churches and most faith-based organizations such as religious schools, missions, or missionary organizations.

The IRS provides information to help you determine which form to file. Be the first to know when the JofA publishes breaking news about tax, financial reporting, auditing, or other topics.

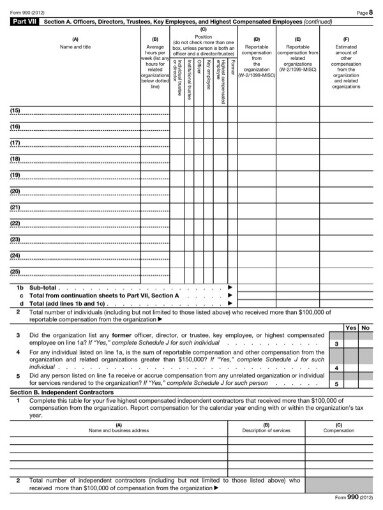

If your Form 990-N was accepted, your nonprofit’s electronic filing will be listed on the IRS Tax Exempt Organization Search tool. Help us promote nonprofits and make an even greater impact in communities. Learn more about how the 2020 Census will impact the work of charitable nonprofits and what you can do to secure a fair, accurate, and complete count. He is registered with the IRS as an Enrolled Agent and specializes in 501 and other tax exemption issues. Form 990 collects even more information, such as disclosure of potential conflicts of interest, compensation of board members and staff, and other details having to do with financial accountability, governance and avoidance of fraud.

What Nonprofits Need To Know About Irs Form 990

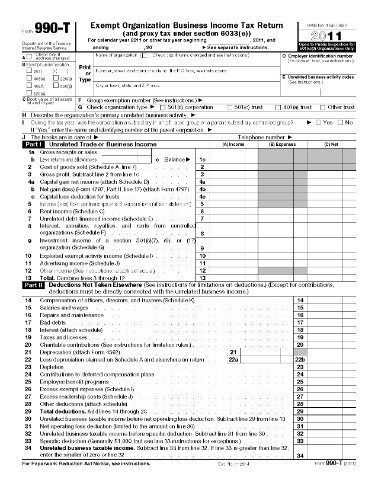

In order to qualify to file Form 990-EZ, a nonprofit should have gross income of more than $50,000, but less than $200,000 during the past fiscal year. In addition, the total valuation of all assets should be less than $500,000. If an organization’s assets are worth more than that, a full Form 990 will be required, regardless of revenue.

Also, nonprofits with assets collectively valued greater than $500,000 must file Form 990, even if their revenue is less than $200,000. It’s important that all organizations never neglect to both file the Form 990 and to do so on time. If an organization does not file a Form 990 for three years in a row, its tax-exempt status will be automatically revoked by the IRS. The type of Form 990 to be filed by an organization depends on the filing year and the gross receipts of the organization. 990-NThis form must be filed by organizations that aren’t required to file Form 990 or Form 990-EZ.

- Data covers returns filed from 2011 to the present and is regularly updated.

- The state of Montana and the state of New Jersey filed a lawsuit stating that the IRS had violated the Administrative Procedure Act by waiving the donor disclosure requirements without allowing the public to comment on the new procedure.

- The IRS extended this requirement to all other tax-exempt organizations.

- If a charitable nonprofit fails to file the 990 on time, there can be penalties for late filing and income tax liability.

- Form 990-EZ is annual information return filed by small-medium sized public charities and certain other nonprofits, at least as measured by gross revenue.

- This identifier can be used to fetch their filed Form 990 as a XML file.

Some organizations, such as political organizations, churches and other religious organizations, are exempt from filing an annual Form 990. If your nonprofit loses its tax-exempt status, it cannot receive tax-deductible contributions. It will be included in the IRS List of Automatically Revoked Organizations. Contributions donors make to such a nonprofit after the date its name was published on the IRS list of automatically revoked organizations are not tax deductible. The IRS publishes the list of organizations whose tax-exempt status was automatically revoked because of failure to file a required Form 990, 990-EZ, 990-PF or Form 990-N (e-Postcard) for three consecutive years.

Federal Filing Requirements For Nonprofits

Additionally, you can avoid paying user fees and filing additional documents with the IRS by submitting your Form 990 each and every year. services he provides by considering the nonfinancial sections of Form 990. “By paying closer attention to the narrative sections, I am able to help my clients market their services and their organizations to potential donors,” he said. Religious organizations generally are not required to file this form. A nonprofit can file the shorter Form 990-EZ if the organization has less than $200,000 in gross receipts and less than $500,000 in total assets at the end of the year.

Wikipedia® is a registered trademark of the Wikimedia Foundation, Inc., a non-profit organization. Meanwhile Holden Karnofsky of the nonprofit charity evaluator GiveWell has criticized Form 990 for not providing sufficient information about what a charity does or where it operates. However GiveWell does still use Form 990 to answer some questions when investigating charities. This is based on statistics published by the IRS from 2012 to the most recent completed year. Public Inspection IRC 6104 regulations state that an organization must provide copies of its three most recent Forms 990 to anyone who requests them, whether in person, by mail, fax, or e-mail. Part II is the signature block where an officer of the organization attests under penalty of perjury that the information is true, correct, and complete to the best of their knowledge. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

Steps To Forming A 501(c) Nonprofit Corporation

Unlike income tax returns that are private, this form is open to public inspection. The IRS is really serious about getting all small nonprofits to file Form 990-N. If you don’t file the form for any single year, the IRS will merely send your nonprofit a reminder notice.

Starting in 2000, political organizations were required to file Form 990. IRS Publication 557 details the rules and regulations that have to be followed by an organization in order to obtain tax-exempt status. In addition to the form, the organization may be required to attach various schedules–A through O and R–to the form in order to provide supplemental information. The organization can determine the schedules they are required to use based on answers to questions throughout the form. One of the most commonly used schedules that organizations use to provide supplemental information to Form 990 is Schedule O. For example, if the organization can receive tax-deductible contributions, it must indicate whether it has provided donors with the required substantiation for their donations. Form 990 is intended to provide the government and interested members of the public with a snapshot of the organization’s activities for that year.

Data covers returns filed from 2011 to the present and is regularly updated. Form 990 is required to be filed by most tax-exempt organizations under section 501. Organizations described by any of these sections must file Form 990 even if the organization has not applied for a determination letter from the Internal Revenue Service.

Like all versions, Form 990-EZ is due on the 15th of the 5th month, following the end of the fiscal year. There is a paper version of the form which may be filed by mail, as well as the ability to file electronically with the IRS .

Part III is a statement of the organization’s accomplishments, including its mission statement and the expenses and revenues for the organization’s three largest program services. Organizations that use Form 990 are federal income tax-exempt under the tax categories that are outlined in Section 501, Section 527, and Section 4947 of the Internal Revenue Code . If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). Form 990 initially requires the organization to describe its mission or other significant activities. The organization must then disclose financial details on its revenues, expenses, assets and liabilities.

Nonprofits that engage in for-profit business enterprises can be subject to corporate income taxes on their unrelated business income. The income must be generated by a business that is “regularly” carried out and that is “unrelated” to the exempt function of the nonprofit to be considered unrelated business income. Form 990 provides the IRS with pertinent information regarding a nonprofit’s activities, finances, and income. The purpose is to ensure that they continue to meet all the rules and regulations necessary to qualify as a nonprofit organization. The majority of nonprofits must submit this information form to the IRS.

If your nonprofit has never filed, call the IRS Exempt Organizations Hotline at and ask that an account be established for the organization to allow filing of the e-Postcard. However, IRC Section 115 organizations are not required to file a Form 990. Since the University of California is both an IRC Section 115 and IRC Section 501 organization, by law, the University is not required to file Form 990. Therefore, we are unable to provide a Form 990 to those individuals or agencies that request it. Form 990 is used by tax-exempt organizations, nonexempt charitable trusts and section 527 political organizations to report income and calculate taxes owed to the federal government. When I accepted the role of treasurer I learned that no forms have been filed in 25 years. We are still very small with very little income and no paid employees.

A six-month extension is available by filing IRS Form 8868 by the original due date of the return. Like all versions, the long-version of Form 990 is due on the 15th of the 5th month, following the end of the fiscal year. An incorporated nonprofit or an unincorporated nonprofit in the state that don’t plan to apply to the IRS for exemption from federal income tax, don’t have to file a Form 990. grant applications to get a more comprehensive picture of the organization. “The 990 gives me a snapshot of the financial health, governance, and operations of our applicants in one document,” she said. “I can’t emphasize enough how important it is for nonprofits to sell themselves in the mission and program descriptions required on the Form 990.”