Content

If you can’t find the information or it’s not there — sometimes companies write a prospectus as if you inherently know such stuff — check with the company’s investor relations department. On the day you purchase shares of preferred stock, there’s no taxation, but your basis in the stock is established at this time. Your tax basis is the total cost to acquire the preferred shares, which is usually the fair market value of the stock plus associated costs, such as the commission you’re charged to make the trade. Tax basis is important because it reflects the maximum amount you can receive tax free if you ever sell the shares.

While both preferred stocks and common stocks represent ownership in a company, they differ along several important criteria. Holders of common stocks typically have voting rights whereas investors in preferred stocks may not.

Because preferred stock usually has a high dividend rate relative to the interest rate on bonds, investors respond favorably. A advantage of preferred shares over bonds is that a company can retire them at any time — a disadvantage for investors, but often overlooked.

Livian recommends that you buy or sell only with a limit order, spelling out the worst price at which you are willing to transact. Don’t put in a stop-loss order, causing an automatic sale when the price dips. In a thinly traded stock, he says, that’s an invitation to get whipsawed. Certain financial information included in Dividend.com is proprietary to Mergent, Inc. (“Mergent”) Copyright © 2014. All stock quotes on this website should be considered as having a 24-hour delay. For example, the 401 contribution limit for 2017 was $18,000, with workers aged 50 and older allowed to contribute an additional $6,000.

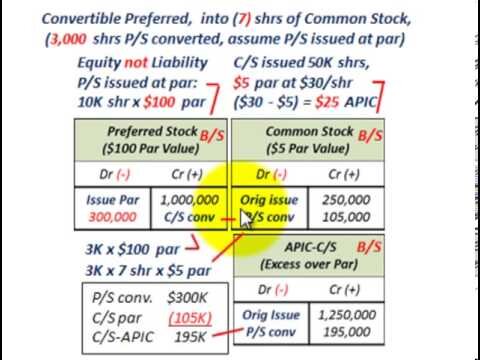

Most convertible stock can be converted after a set date at a specific share price. If you own convertible hybrid stock, you may be able to reduce your taxes by converting it into common stock, because common dividends are taxed at a lower rate for most people. If your stock portfolio includes preferred shares, they probably pay out dividends more frequently than the shares of common stock you hold.

Since 1986 it has nearly tripled the S&P 500 with an average gain of +26% per year. These returns cover a period from and were examined and attested by Baker Tilly, an independent accounting firm. Preferred stock has fewer benefits than common stock for most investors. Ordinary income is any type of income earned by an organization or individual that is subject to standard tax rates. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty.

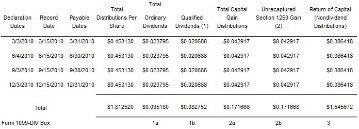

Separate from the taxation on sales of preferred stock, the dividend payments you receive during your holding period must be reported on your tax return each year. The general rule is that dividends are taxed at ordinary income rates. If the dividends are qualified, meaning the preferred shares satisfy a number of eligibility requirements, they’re taxed at those lower long-term capital gains rates.

How To Find Outstanding Shares After The Dividend

When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. You also need to report dividends from investments you sold during the year. The use of the H&R Block tax preparation software and web-based products is governed by their applicable license agreements. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. H&R Block is not affiliated with Fidelity Brokerage Services or their affiliates. H&R Block is solely responsible for the information, content and software products provided by it.

- Rather, in an extraordinarily successful enterprise, as long as things go well year after year, you collect your preferred dividends while the common stockholders earn significantly more.

- However, withdrawing any of the funds before retirement age would lead to stiff penalties.

- All financial products, shopping products and services are presented without warranty.

- Preferred stock dividends can generate tremendous growth in a tax-sheltered account, especially if they are reinvested regularly.

- This means that their dividends are taxed at the dividend tax rate, not as ordinary income.

- Certain financial information included in Dividend.com is proprietary to Mergent, Inc. (“Mergent”) Copyright © 2014.

This is less of a concern to individual investors, who tend to have little impact on the voting outcomes because of the relatively tiny proportion of shares they own. Preferred stock lists separately and trades at a different price from common stock. That is because, in nearly every instance, corporation bylaws forbid the payment of any dividend on the common stock unless the dividend on the preferred stock has been paid.

How To Calculate The Implied Value Per Share Of Common Equity

Of that $900, only $720 should be taxable at one of the more favorable rates. The remaining $1,080 of dividends reported would be taxed at your ordinary income tax rate. If you earn dividends on hybrid preferred stock, your dividends will be taxed at your normal tax rate. If you own traditional preferred stock, your dividends will be taxed at the reduced dividend tax rate, as long as you meet the holding requirements. In order to qualify for the lower dividend tax rate, you must hold your stock for at least 90 days after receiving a dividend. One of the quirks of tax law is that while generally a company cannot expense payments of dividends on preferred shares, a utility may pass this expense on to its customers. From the utility company’s point of view, this has a cost advantage of comparable magnitude to the deduction of the interest payment on a bond.

In the 35 percent bracket, for example, an unqualified dividend would need to be $1.30 to match a buck’s worth of qualified dividend. Preferred stock payments are called dividends, even though they have a fixed payment rate. Like common stock dividends, preferred share dividends are distributions of profits, not interest payments. The IRS does not consider distributions of profits tax-deductible. Corporations issue preferred stock for valid reasons, but a tax advantage isn’t one of them. Preferred stocks may offer potential tax advantages for investors, with high current income both before and after taxes. Preferreds can offer this due to the fact that many of them qualify as being QDI1-eligible.

These shares don’t usually carry voting rights, but their dividends are generally paid ahead of those paid to common stock holders. Knowing how taxes affect preferred shares can help you make smart investment decisions. Preferred stock, whether hybrid or traditional, can contain one or more attributes. If you issue preferred shares that are convertible, you give investors the right to convert shares into common stock.

You can’t completely rely on reported net income as it appears at this point, though due to the nature of preferred stock and preferred stock dividends. Regular cash dividends paid on ordinary common stock arenotdeducted from the income statement.

Recent changes to the tax law give income investors more savings than before. For example, dividend and capital gains are taxed at 20% for investors making over $425,800 and households earning more than $479,901. On the lower end of the spectrum, individuals earning between $38,601 and $425,800 are taxed at 15% for long-term capital gains.

Preferred Stock: No Tax Advantage

Intuit is solely responsible for the information, content and software products provided by Intuit. Fidelity disclaims any liability arising out of your use of these Intuit software products or the information or content furnished by Intuit. You must have held the applicable share of the fund for at least 61 days out of the 121-day period that began 60 days before the fund’s ex-dividend date. 1 Assumes a marginal income tax rate of 37% a 3.8% Medicare surtax on investment income and a QDI rate of 20%. When you take the example one step further and look at preferreds from a “taxable equivalent yield basis”, QDI eligible preferred stock yields are even more attractive, with a taxable equivalent yield of 6.44%. Net of damage to principal when a premium-priced stock is called in or your utility inadvertently torches the countryside, you can expect a return of 5%.

Allow for a 15% federal tax plus a 3.8% surcharge (for the ones with income over $250,000) and you’re left with 4% and a fraction. That beats the not quite 3% you can get on the Vanguard Long-Term Tax-Exempt Fund.

You could pay a lower dividend tax rate by holding your investments for the 61-day minimum. Just be sure that doing so aligns with your other investment objectives. If you don’t hold the shares long enough, the IRS might deem them nonqualified, and you’ll pay tax at the higher, nonqualified rate. Again, remember that there are many exceptions and unusual scenarios with special rules — seeIRS Publication 550for the details. If your Ford shares paid a dividend on Sept. 1 and the ex-dividend date was July 20, you would need to have owned your shares for at least 61 days between May 21 and Sept. 19. And when you count the days, include the day you sold the shares but not the day you bought them.

TaxAct is not affiliated with Fidelity Brokerage Services or their affiliates. TaxAct is solely responsible for the information, content and software products provided by TaxAct. Fidelity cannot guarantee that the information and content supplied is accurate, complete, or timely, or that the software products provided produce accurate and/or complete results. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use. Fidelity disclaims any liability arising out of your use of these TaxAct software products or the information or content furnished by TaxAct. The use of the TurboTax branded tax preparation software and web-based products is governed by Intuit’s applicable license agreements.

Your brokerage firm can tell you whether a particular preferred stock generates qualified dividends. Preferred stocks are capital assets and are subject to the same taxation as common stocks when they’re sold at a gain or loss. Your preferred shares have additional tax implications, however, as they generally provide you with fixed dividend payments when the corporation is profitable. Dividends, as well as the profit you earn when selling preferred shares, are equally taxable, but this doesn’t necessarily mean you’ll owe tax on both types of income. While issuance of preferred stock is relatively expensive, it may be the best means of financing available.

On these shares, the issuer may defer the payment of dividends or interest for up to five, 10 or more years without triggering default. In this case, as an investor, you are liable for the taxes in the year the amounts were accrued and deferred. Although you haven’t received any dividend payments, you must still pay income taxes on the amounts you would have received if the issuer had paid out the funds. In the year you receive the payments, you would owe income taxes on that year’s accrued payments only. As a result, investors usually can’t sell their shares for much more, or much less, than they paid for them.

You are being referred to Facet Wealth, INC.’s website (“Facet Wealth”) by NerdWallet, Inc., a solicitor of Facet Wealth (“Solicitor”). The Solicitor that is directing you to this webpage will receive compensation from Facet Wealth if you enter into an advisory relationship or into a paying subscription for advisory services. You will not be charged any fee or incur any additional costs for being referred to Facet Wealth by the Solicitor. The Solicitor may promote and/or may advertise Facet Wealth’s investment adviser services and may offer independent analysis and reviews of Facet Wealth’s services. Facet Wealth and the Solicitor are not under common ownership or otherwise related entities.Additional information about Facet Wealth is contained in its Form ADV Part 2A available here. The use of the TaxAct branded tax preparation software and web-based products is governed by TaxAct’s applicable license agreements. TaxAct, the TaxAct logo, among others, are registered trademarks and/or service marks of TaxAct in the United States and other countries and are used with permission.

Intuit, the Intuit logo, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries and are used with permission. Intuit is not affiliated with Fidelity Brokerage Services or their affiliates.

Although real estate investment trusts – known as REITs – often issue traditional preferred stocks, those dividends are not qualified because of the companies’ special tax status. Trust-preferred stocks, which sometimes have TruPS in their identifying title, and third-party trust-preferred stocks pay unqualified dividends as well. Dividends from exchange-traded debt securities, sometimes lumped with preferred stocks on stock tables, also are unqualified. The search for fat dividends inevitably leads to preferred stocks, with their juicy yields that are almost guaranteed. However, “preferred” stocks come in a variety of flavors, only some of which pay dividends eligible for the qualified dividend tax rate of no more than 15 percent. The difference between a qualified and unqualified dividend can be substantial, depending on your tax bracket.

That, in turn, means that selling preferred stock is less likely to produce either a taxable capital gain or a capital loss than can be deducted against other income. Keep this in mind when considering when to sell preferred shares. Income statements include a company’s revenues, expenses, gains and losses, and net income. Net income represents the total after-tax profit the business made for the period before deducting the required dividends paid on the company’s outstanding preferred stock. Traditional preferred stocks – where the buyer gets a fixed, usually higher, dividend in exchange for giving up any stock ownership voting rights – typically pay qualified dividends. Banks, utilities and some large industrial companies are the primary issuers of traditional preferred stocks nowadays.