Content

A partner who is allocated QPAI from an eligible 861 partnership must report that QPAI on line 7. For this purpose, your average annual gross receipts are your average annual gross receipts for the preceding 3 tax years. If your business hasn’t been in existence for 3 tax years, base your average on the period it has existed. Include any short tax years by annualizing the short tax year’s gross receipts by multiplying the gross receipts for the short period by 12, and dividing the result by the number of months in the short period. Making qualifying production property out of scrap, salvage, or junk material, or from new or raw material by processing, manipulating, refining, or changing the form of an article, or by combining or assembling two or more articles. See Regulations section 1.199-3 for more information, exceptions, and other rules. QPAI and Form W-2 wages are figured by only taking into account items that are attributable to the actual conduct of a trade or business.

1.199-8 concerning application of proposed or final regulations. Engineering or architectural services performed in the United States for construction in the United States. These activities must be performed for construction projects in the United States. Domestic construction or substantial renovation of U.S. real property. This includes residential and commercial buildings and infrastructure, such as roads, power lines, water systems and communications facilities. However, transmission or distribution of these commodities are specifically excluded from DPGR. © 2021 KPMG LLP, a Delaware limited liability partnership and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee.

Instructions For Form 8903

Since the logger has an economic interest in the timber under the contract right to cut agreement, receipts from the sale of the logs also qualifies as DPGR for purposes of the logger’s tax return. In addition to the multitude of possible contractual terms and variations in state law, the issue of when an economic interest is retained may again come into play . There is a continuum of possible contractual relationships between an owner of timber in fee and a second party. At one end a grantor severs all interest in the timber while retaining the land, creating a separate estate in the timber. At the other end of the continuum the fee holder contracts for logging services and sells the logs produced by the contractor.

This deduction also applies to the calculation of the alternative minimum tax. The dollar amount of the domestic production activities deduction is limited. The deduction can’t exceed adjusted gross income for sole proprietors, partnerships, S-corporations, or limited liability corporations. Under the simplified deduction method, your other trade or business deductions, expenses, or losses are ratably apportioned between DPGR and non-DPGR based on relative gross receipts.

Final Regulations Pending Oira Review

There are several other categories of receipts that qualify, but they don’t apply to tree farms. You may qualify for a deduction or adjustment to gross income equal to the lesser of 3 percent of your taxable income, or your so-called qualified production activities income . The rate of the deduction increases to 6 percent for the 2007 to 2009 tax years, and 9 percent thereafter. However, the amount of the deduction cannot exceed 50 percent of the W-2 wages you paid to employees or company officers.

You generally must allocate your gross receipts between DPGR and non-DPGR. Allocate gross receipts using a reasonable method that accurately identifies gross receipts that are DPGR. However, if less than 5% of your gross receipts are non-DPGR, you can treat all of your gross receipts as DPGR. Also, if less than 5% of your gross receipts are DPGR, you can treat all of your gross receipts as non-DPGR.

Qualified payments are the patronage dividends and per-unit retain allocations paid to patrons on which the cooperative computed its DPAD. A patron who receives a qualified payment can be allocated any portion of the DPAD allowed with respect to the portion of the QPAI to which such payment is attributable. The cooperative must identify the portion of its DPAD allocated to a patron in a written notice mailed to the patron no later than the 15th day of the 9th month following the close of the cooperative’s tax year. The qualified payments and allocated DPAD will also be reported to patrons that aren’t corporations on Form 1099-PATR, Taxable Distributions Received From Cooperatives.

The Basics Of The Section 199 Deduction

Treasury Department, final regulations relating to application of the domestic production activities deduction for specified agricultural or horticultural cooperatives. If you use the small business simplified overall method to calculate the cost of goods sold and other deductions, expenses, and losses reported on line 4, column , you must make an additional calculation to determine the amount to report on line 4, column . Multiply the amount reported on line 4, column , by the ratio of oil-related DPGR reported on line 1, column , divided by DPGR from all activities reported on line 1, column . Don’t reduce the amount reported on line 4, column , by this amount. An S corporation can’t use the section 861 method to figure QPAI. You generally can use the small business simplified overall method to apportion cost of goods sold and other deductions, expenses, and losses between DPGR and non-DPGR if you meet any of the following tests.

In general, gross receipts derived from the following activities aren’t DPGR. Engineering or architectural services you perform in the United States in your engineering or architectural services trade or business for the construction of real property in the United States. Generally, your gross receipts derived from the following activities are DPGR. Adjusted gross income for an individual, estate, or trust figured without the DPAD.

Enters the portion of the deduction allocated to the other members of the EAG (including non-computing members) as a negative number on line 24. Beneficiaries of estates and trusts, partners, and S corporation shareholders report the QPAI distributed from estates or trusts, and certain partnerships or S corporations on line 7.

- This may be possible in the case of section 631 since the same party is involved on both sides of the accounting transaction.

- The question is when, if ever, receipts from the disposal of standing timber are included.

- For Form 1040 returns filed after tax year 2017, include the result from line 25 of Form 8903 on Schedule 1 , line 36.

- The challenge is to define domestic production gross receipts DPGR).

- For example, if you have a one-person business and do all the work yourself or use independent contractors to do the work you don’t do, you get no deduction because you have no employees.

- Patrons of certain agricultural or horticultural cooperatives may be allocated a share of the cooperative’s DPAD to include on Form 8903.

In a nutshell, businesses that engaged in manufacturing and other qualified production activities had to implement cost accounting mechanisms to make sure their tax deductions were accurately calculated. Rules were changed and a handful of tax breaks were added, but many were repealed, as well.

For purposes of section 199, a qualifying in-kind partnership is a partnership engaged in any of the following activities. Activities related to manufacturing, producing, growing, extracting, installing, developing, improving, and creating qualifying production property.

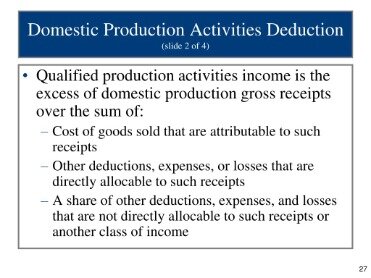

Income means your gross receipts from a production activity reduced by the cost of goods sold and related expenses, including the cost of production and a portion of your indirect expenses such as rent. Under the small business simplified overall method, your total cost of goods sold and other deductions, expenses, and losses are ratably apportioned between DPGR and non-DPGR based on relative gross receipts. If any of the losses or deductions disallowed for tax years beginning after 2004 are allowed in a later tax year, a proportionate share of the expenses reflected in those losses or deductions is taken into account in figuring the DPAD in the later tax year. This newer version of the deduction is closely related to the deduction for Qualified Production Activities Income , which is the portion of income derived from domestic manufacturing and production that qualifies for reduced taxation. More specifically, qualified production activities income is the difference between the manufacturer’s domestic gross receipts and the aggregate cost of goods and services related to producing domestic goods. The tax-deductibility of QPAI is intended to reward manufacturers for producing goods domestically instead of overseas. Also known as the Section 199 deduction, the domestic production activities deduction was in effect from 2005 through 2017.

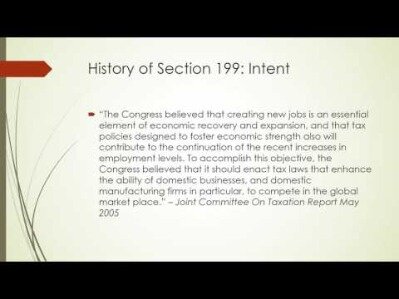

This deduction applied to both small and large businesses that manufactured, grew, extracted, produced, developed, or improved goods inside the U.S. Using Form 8903, qualifying companies were able to claim the domestic production activities deduction based on a complex formula and set of rules. Passed by Congress in 2004, the domestic production activities deduction was intended to offer tax relief for businesses that produce most of their goods or work inside the U.S. rather than overseas. This deduction is no longer in use as it was replaced in 2017 by the qualified business income deduction that was introduced via the Tax Cuts and Jobs Act of 2017. The challenge is to define domestic production gross receipts DPGR). These are receipts derived from the lease, rental, license, sale exchange or other disposition of qualifying production property that was manufactured, produced, grown, or extracted by the taxpayer in whole or in significant part within the United States. Qualifying production property is tangible personal property, computer software, and sound recordings.

This deduction, called the Domestic Production Activities Deduction , passed in 2004 for the benefit of companies who manufactured goods inside the United States. Qualifying companies were able to take a deduction based on a complex formula. With the passing of the TCJA, this deduction is no longer available for 2018.

The Dpad Is Available For Previous Tax Years And For Some Businesses

The QPAI should be reported to you on Schedule K-1 for Forms 1041, 1065, or 1120S. If you use the section 861 method, apply the rules of section 861 to determine the amount to report on line 3, column .

A retail establishment is defined as tangible property at which retail sales are made that the taxpayer owns, leases, occupies or otherwise uses to sell food or beverages to the public. Furthermore, a facility that prepares food and beverages for take-out service or delivery is considered a retail establishment for purposes of section 199. Accordingly, a restaurant that prepares food onsite from start to finish or a caterer may not qualify for the benefit. If no wages are paid during the year, no deduction is allowed.

For Form 1040 returns filed after tax year 2017, include the result from line 25 of Form 8903 on Schedule 1 , line 36. For Form 1120 returns filed after tax year 2017, enter the result from line 25 of Form 8903 on line 26, Other deductions. Under section 199, a consolidated group is treated as a single member of the EAG. The consolidated group will generally file only one Form 8903. The EAG’s DPAD is allocated among members of the EAG based on the ratio of each member’s QPAI to the total QPAI of the EAG.