Content

Mr. Trump’s move came after two weeks of negotiations with House Speaker Nancy Pelosi of California and Senate Minority Leader Charles E. Schumer of New York failed to produce a deal. Democrats were seeking a package of aid totaling about $3.5 trillion; the White House and Senate Republicans were proposing relief totaling about $1.5 trillion. “Through these four actions, my administration will provide immediate and vital relief to Americans struggling at this difficult time,” the president said at his golf club in Bedminster, New Jersey. Information reporting is required for tax-exempt interest paid on tax-exempt bonds after December 31, 2005.

Effective for tax years beginning after 2005, the bill increases the age of minors from 14 to 18 for purposes of subjecting the minor’s unearned income to tax at the parents’ tax rate (the so-called “kiddie tax). An exception applies for a child who is married and files a joint return for the tax year, and for distributions from certain qualified disability trusts. For 2006, the AMT exemption amount for married taxpayers would increase to $62,550 and for unmarried individuals to $42,500 (instead of dropping to $45,000 and $33,750, respectively).

U.S. companies’ effective tax rate defined as the tax paid on investments earning the market rate of return after taxes—was 18.6% in 2012, according to the Congressional Budget Office . The law created a single corporate tax rate of 21% and repealed the corporate alternative minimum tax. The law temporarily raised theestate taxexemption for single filers to $11.2 million from $5.6 million in 2018, indexed for inflation. This provision did not cap itemized deductions but gradually reduced their value when adjusted gross income exceeds a certain threshold—$266,700 for single filers in 2018. The reduction was limited to 80% of the deductions’ combined value. The law temporarily raised the exemption amount and exemption phase-out threshold for thealternative minimum tax , a device intended to curbtax avoidanceamong high earners by making them estimate their liability twice and pay the higher amount. For married couples filing jointly, the exemption rose to $109,400 and phaseout increases to $1,000,000—both amounts are indexed to inflation.

The IRS released new withholding brackets reflecting changes to the personal income tax schedule, which employers began using on Feb. 15, 2018. Having passed the legislation on Dec. 19, 2017, they were forced to amend it after the Senate parliamentarian struck down three of its provisions. For most people, tax season comes to a close on April 15 each year.

After four years, it will be capped at 30% of earnings before interest and taxes . The law allows full expensing of short-lived capital investments rather than requiring them to be depreciated over time—for five years—but phase the change out by 20 percentage points per year thereafter. The section 179 deduction cap doubles to $1 million, and phaseout begins after $2.5 million of equipment spending, up from $2 million.

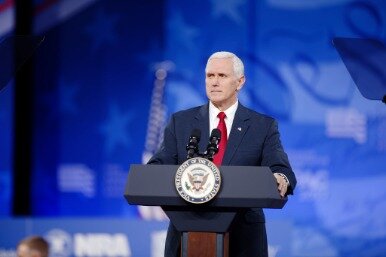

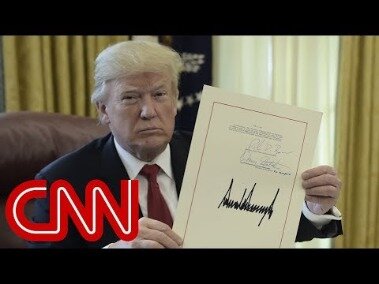

President Donald Trump Signs Tax Bill Into Law, Saying It’s ‘selling Itself’

This defense bill is a big win for servicemembers and their families. MOAA thanks Congress for its bipartisan work, and President Trump for endorsing the legislation and extending our nation’s streak of producing a defense bill to 59 years. The bill also expands spouse employment resources, such as an increase to $1,000 for licensure reimbursement as well as expansions to the My Career Advancement Account program for any degree area and to include Coast Guard spouses.

The Act allows health and dependent care FSA participants to carry over unused balances from a plan year ending in 2020 to a plan year ending in 2021 and from a plan year ending in 2021 to plan year ending in 2022. Health care providers must provide good faith estimates of expected charges. For uninsured individuals, the Department of Health and Human Services (“HHS”) will establish a dispute resolution process for instances where the actual charges substantially exceed the estimated charges.

The highest earners were expected to benefit most from the law, while the lowest earners were believed to pay more in taxes once most individual tax provisions expire after 2025. It lowers individual tax rates, including trimming the top bracket to 37 percent from 39.6, while doubling the standard deduction and replacing personal exemptions with a $2,000 partly refundable child tax credit. The law eliminates various deductions while limiting others on state and local taxes and mortgage interest.

Deferring payroll taxes would require workers and employers to repay the money at some point. Employers pay half the tax, up to 15.3%, and withhold the other half from employees’ wages.

Health Transparency

Group health plans and health insurance issuers must provide an advance explanation of benefits (“EOBs”) for scheduled services. Similarly, air ambulance services are prohibited from balance billing individuals covered by a group health plan or individual/group health insurance. The Act has parallel provisions that address surprise bills from certain non-network providers, air ambulances and for emergency services. Another provision imposes prohibitions and requirements on providers.

Under this provision, known as full expensing, companies can immediately write off the full cost of equipment they buy. I suspect that as the act is studied by tax professionals that traps for the unwary, unexpected planning opportunities and technical glitches will be identified.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy. Nearly three-quarters of respondents told Pew four years ago, that they were bothered “some” or “a lot” by the complexity of the tax system. The department’s website continues to host other papers dating back to the 1970s. The next day, the Wall Street Journal reported that the Treasury Department deleted a paper saying the exact opposite from its site. The law does not eliminate the carried interest loophole, though Trump promised as far back as 2015 to close it, calling the hedge fund managers who benefit from it “pencil pushers” who “are getting away with murder.”

Mortgage Interest Deduction

President Trump signed the Act into law on December 27 after initially criticizing the amount of direct payments to individuals and other aspects of the Act late last week. A deduction is an expense that a taxpayer can subtract from his or her gross income to reduce the total that is subject to income tax.

Additionally, take a closer look at the capacity of child care centers on post and streamline hiring to ensure they are properly staffed. Ensures a proper work order system and complaint database are in place along with a number of other provisions correcting gaps and negligence in the Military Housing Privatization Initiative system. MOAA will monitor implementation and ensure our members and prospects understand the procedures and policies to be written in support of this legislation. To address non-combat related military medical malpractice, the NDAA directs DoD to develop a regulation for negligent malpractice to be addressed through the military legal system.

The Act provides $600 per individual ($1,200 for taxpayers filing jointly) payments directly to Americans, as well as $600 for each child dependent under the age of 17. The payments begin to phase out at an adjusted gross income of $75,000 for an individual and $150,000 for joint filers. The package does not include relief for multiemployer pension plans facing insolvency or the single-employer defined benefit plan funding relief provisions previously included in the House-passed HEROES Act. It also does not include relief for states and local governments or the business liability protections that were primary areas of contention throughout the COVID-19 legislative negotiations since last spring. President-Elect Biden and Congressional Democrats have called for an additional COVID-19 relief and stimulus package next year.

- The establishment of outreach plans for affected beneficiaries, including transition plans for continuity of health care services.

- You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

- Perhaps most concerningly for Democrats, the legislation repeals Obamacare’s individual insurance mandate.

- The New York Times reported on Nov. 30, 2017, that a Treasury employee, speaking anonymously, said no such analysis exists, prompting a request from Sen. Elizabeth Warren (D-Mass.) that the Treasury’s inspector general investigate.

- MOAA will continue to work to identify and correct inequities in service and benefits borne by servicemembers and their families in the Guard and Reserve.

Mr Trump emphasised the size of the tax cuts during the bill signing, calling the legislation “a bill for the middle class and a bill for jobs”. Although report language is not binding, DOL and other agencies typically try to comply with such requests. This applies to distributions made through 180 days after enactment. The Act allows a health and dependent care FSA grace period for a plan year ending in 2020 or 2021 to be extended 12 months after the end of such plan year.

The most pessimistic estimate of the legislation’s budget effects came from the Committee for a Responsible Federal Budget , which argued on Dec. 18, 2017, that Congress is using a flawed baseline to measure the law’s budget effects . By shifting cash from foreign subsidiaries, Shay stated, multinationals with offset fiscal years have the chance to shift cash to the U.S. through tax-free dividends, paying the 8% rate on remaining overseas assets—as opposed to the 15.5% cash rate. The law enacts a deemed repatriation of overseas profits at a rate of 15.5% for cash and equivalents and 8% for reinvested earnings. The law eliminates the section 199 deduction for businesses that engage in domestic manufacturing and certain other production work. This is also known as the domestic manufacturing deduction, U.S. production activities deduction, and domestic production deduction.

The European Union has accused the U.S. of subsidizing exports through this preferential rate, a violation of World Trade Organization rules. Note that the 2020 CARES Act, in response to the economic fallout of the COVID19 pandemic, temporarily reinstated a carryback period for all net operating losses generated in years beginning after Dec. 31, 2017, and before Jan. 1, 2021 (i.e., for tax years 2018, 2019, and 2020). Businesses with up to $25 million in average annual gross receipts over the preceding three years will be eligible to use cash accounting—up from $5 million from the old tax code. According to the Congressional Budget Office , repealing the measure is likely to reduce federal deficits by around $338 billion from 2018 to 2027, but lead 13 million more people to live without insurance at the end of that period, pushing premiums up by an average of around 10%. The additional standard deduction, which the House bill would have repealed, has not been affected. In 2019, the inflation gauge used to index the standard deduction changed in a way that is likely to acceleratebracket creep. The Tax Cuts and Jobs Act was the largest overhaul of the tax code in three decades.

In its finalized form, however, the Tax Cuts and Jobs Act cuts the corporate tax rate, benefiting shareholders, who tend to be higher earners. It scales back the alternative minimum tax andestate tax, as well as reducing the taxes levied on pass-through income (70% of which goes to the highest-earning 1%). It does not close the carried interest loophole, which benefits professional investors. It scraps the individual mandate, likely driving up premiums and making health insurance unaffordable for millions. Owners ofpass-through businesses—which include sole proprietorships, partnerships, and S-corporations—now have a 20% deduction for pass-through income. Certain industries, including health, law, and financial services, were excluded from the preferential rate unless taxable income is below $157,500 for single filers. To discourage high earners from recharacterizing regular wages as pass-through income, the deduction is capped at 50% of wage income or 25% of wage income plus 2.5% of the cost of qualifying property.

User Clip: Tax Bill

Following an adverse benefit determination, the current external review process will be available to determine whether the surprise billing and surprise air ambulance provisions apply. The Act increases an employer’s deduction for the cost of food and beverage expenses related to its trade or business from 50% to 100% if the food and beverages are provided by a restaurant. This applies to expenses incurred after December 31, 2020 and before January 1, 2023. The Act extends the paid sick and family leave credits enacted in the Families First Coronavirus Response Act (“FFCRA”) and CARES Act for three additional months to March 31, 2021. Some 55 percent of Americans oppose the tax bill, while 33 percent are in favor according to a CNN poll released Tuesday. Trump thanked Senate Majority Leader Mitch McConnell and House Speaker Paul Ryan, among other Republican lawmakers for their efforts to get the bill passed. The measure, known as the the Tax Cuts and Jobs Act, is being hailed by the GOP as the biggest legislative achievement for Trump and congressional Republicans.

The law achieves that by allowing oil and gas drilling in the Arctic National Wildlife Refuge, which is located in committee chair Sen. Lisa Murkowski’s (R-Alaska) home state. Murkowski voted against multiple Obamacare repeal bills over the summer, making it important for Republicans to secure her support for tax reform. The continuing resolution that authorized the use of reconciliation to reform the tax code permitted the Senate Finance Committee to pass legislation increasing the federal budget by up to $1.5 trillion over 10 years. The idea that cutting taxes boosts growth to the extent that government revenue actually increases is almost universally rejected by economists, and for a long time, the Treasury did not release the analysis Mnuchin bases his predictions on.

Additional COVID-19 related measures are included in Division EE of the legislation—the “Taxpayer Certainty and Disaster Tax Relief Act.” Division EE also addresses expiring provisions unrelated to COVID, miscellaneous tax matters, and tax relief for disasters other than COVID-19. For tax years beginning after May 17, 2006, the bill modifies the wage limitation rule for purposes of the manufacturer’s deduction (I.R.C. §199) that was created as part of the 2004 Jobs Bill. As originally enacted the manufacturing deduction was limited to 50 percent of a business’ employee wages reported on Form W-2. In other words, the limitation had been 50 percent of those wages that were deducted in arriving at qualified production activity income. As modified, taxpayers are only able to include amounts which are properly allocable to domestic production gross receipts.

The analysis revealed that the tax break would hit 93.7% of taxpayers in the highest-earning quintile, and only 53.9% of those in the lowest quintile. The idea of a fiscal “trigger,” a mechanism to enact automatic tax hikes or spending cuts that some senators pushed for in case optimistic growth forecasts did not come to fruition, was rejected on procedural grounds. However, as a result of the 2010 Statutory Pay-As-You-Go Act, that law requires cuts to federal programs if Congress passes legislation increasing the deficit. Trump’s revised campaign plan, released in 2016, would have scrapped the head of household filing status, potentially raising taxes on millions of single-parent households, according to an estimate by the Tax Policy Center . The law temporarily raises the child tax credit to $2,000, with the first $1,400 refundable, and creates a non-refundable $500 credit for non-child dependents. The law raised the standard deduction to $24,000 for married couples filing jointlyin 2018 (from $12,700), $12,000 for single filers (from $6,350), and to $18,000 for heads of household (from $9,350). Taxpayers who itemize in these high-tax states were likely to be hurt by the legislation’s cuts to the state and local tax deduction.

There are some, Garrett also said, who regret that the president didn’t choose to push infrastructure spending first, suggesting that if he had started with infrastructure, it would have attracted Democratic votes and paved the way for more bipartisan legislation. Now, in an election year, with legislation passed that is entirely Republican, this could be more challenging. CBS News Chief White House correspondent Major Garrett points out that everything the president has achieved so far legislatively involves special rules that allowed the Senate to rely on a simple majority, rather than the higher threshold of 60 votes that is usually the rule. The rollback of Obama-era regulations, this tax bill, the Supreme Court nomination of Neil Gorsuch have all been passed with only Republican votes.