Content

Trickle-Up Economics, available as an ebook or paperback, describes the best tax policy for any economy, based on 3 simple economic principles that anyone can understand. We read almost daily that the rich are getting richer and that inequality continually increases. Although there are several reasons for this, a major factor is an unfair tax system that places most of the tax burden on work.

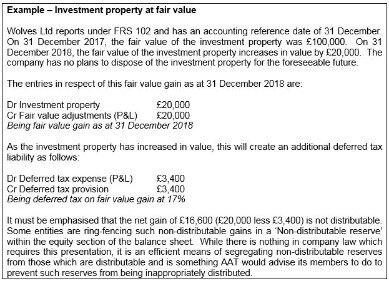

If the debt on business real estate is restructured, then a solvent taxpayer may delay taxes on the restructuring by electing to reduce the basis of the depreciable property by the amount of the debt discharge. This election is made on Form 982, Reduction of Tax Attributes Due to Discharge of Indebtedness.

A foreclosure is the legal process by which the lender takes collateral property to satisfy an outstanding debt. A deed in lieu of foreclosure (i.e., conveyance) is a transaction in which the borrower merely transfers title to the lender in full satisfaction of the debt. Both transactions are treated as a sale or exchange of property for tax purposes. In either case, the tax treatment depends largely on the type of debt involved (i.e., nonrecourse or recourse). The basic tax consequences associated with foreclosures are discussed in detail below, but for quick reference, Exhibit 1 summarizes the rules, and Exhibit 2 on p. 824 illustrates how those rules work. Discharged principal may, in part or in whole, be excluded from gross income under the exclusion rules of Sec. 108.

If the lender then forgives part of all of the deficiency , the forgiven amount constitutes cancellation of debt income for tax purposes. Any COD income must be reported as income on your Form 1040 for the year the debt forgiveness occurs, unless you qualify for a tax-law exception. This article was originally published byWithumSmith+Brown.Eric Wilsonis a senior accountant at WithumSmith+Brown, PC with three years of public accounting experience. He services clients needing both auditing and attestation services as well as taxation services. His industries of focus include real estate, mortgage banking, technology, and non-for profits. If this property was Jimmy’s principal residence he may be able to exclude the gain under Section 121. Section 121 is a common exclusion for homeowners who sell their principal residences in which they have lived in for at least two out of the past five years.

ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers. MetaBank® does not charge a fee for this service; please see your bank for details on its fees. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules.

Figuring Gain Or Loss On Repossession Of Personal Property Sold As Installments

Since foreclosure is a sale, all this prior depreciation becomes taxable. As a result, you may have a capital gain even if your defaulted mortgage was less than what you paid for the property. To add insult to injury, this nasty “depreciation recapture” is taxed at a higher rate than capital gain. If the property is a principal residence, and if it can be excluded under the home sale exclusion rules, then the foreclosure or voluntary conveyance does not have to be reported. Foreclosures and reconveyances of business property are reported on Form 4797, Sales of Business Property.

This is usually the total amount of debt owed right before the foreclosure, minus the property’s FMV. There is a good chance that a person who is dealing with foreclosure will qualify as “insolvent” under the IRS definition. If you do – then your “debt cancellation” income is not taxable, whether it is from your own home or from investment properties. You will only need to attach an extra form to your tax return to explain your situation. The new law does not cover “cash-out” refinances.

The seller receives statements showing how much the home sold for. There’s no escrow period with foreclosures, however. The lending bank simply takes possession of the home. COD income is a typical example of phantom income–an occurrence in which a taxpayer incurs a tax even though no cash is received from the capital transaction.

How To Report A Foreclosed Rental House On Your Taxes

This income exclusion does not apply to ordinary or capital gain recognized on a sale of property. Thus, if the borrower is facing significant gains because the size of the nonrecourse loan exceeds the borrower’s tax basis in the property , the borrower could be facing a large tax bill! Jimmy would recognize a capital gain of $100,000.

The business property is valued at the lower of its fair market value on the date the repossession is completed or at the loan balance immediately before the property transfers back to the bank. If the property value is higher than the loan balance, you have a taxable gain. If its value is less than the loan balance, the amount you write off in your business accounting books depends on whether you have a capital loss or ordinary loss. The amount of any debt your banker forgives is included with your gross income.

- So, when is a modification or amendment of a loan enough to trigger a “significant modification”?

- As previously stated, the requirement to include discharged principal in gross income is a general rule under Sec. 61.

- The amount of COD excluded from income is limited to the amount by which the taxpayer is insolvent.

- Under this rule, most of your debt cancellation income can avoid taxes – as long as you do not do a “cash-out” refinance.

- To better understand how gain or loss is calculated when repossessing personal property, it helps to remember how gain or loss calculated on the sale of property, which equals the sale price minus your tax basis in the property.

However, if the FMV exceeds the debt plus the accrued interest, then the lender realizes a taxable gain, which is reported for the tax year when the lender receives the property. When your rental property gets foreclosed on, and you’re responsible for your loan, your lender may forgive your remaining balance. If the lender does this, it won’t affect your capital loss write-off. However, the IRS may treat the loan forgiveness as regular income.

Foreclosure Sales At A Loss

COD excluded in excess of the taxpayer’s tax attributes is disregarded with no resulting tax consequences. As an alternative to reducing tax attributes, a taxpayer may elect to reduce first the adjusted basis of their depreciable property to the extent of the excluded COD. The type of debt that is preferable depends on the debtor’s circumstances.

Other consequences could arise from such an exchange. The “new” loan will have a deemed issue price equal to its fair market value on the date of the modification, but the face amount might be significantly higher. As such, the “new” loan could have significant OID, triggering substantial additional interest inclusion to the lenders. And, the loan may have so much OID that special tax rules applicable to high-yield high-OID notes could trigger, which can force the borrower to defer interest deductions on a portion of the interest paid or accrued on the note.

If you aren’t, then the amount you realize is equal to the remaining mortgage balance that exists when the bank forecloses. But if you are responsible for paying the remaining balance, then the amount you realize is equal to the fair market value of the house when it’s foreclosed on. In some cases the lender will not be allowed to recognize the loss. For instance, if the borrower is a corporation for tax purposes, and the loan had an original term of longer than 10 years, then even if there is a deemed exchange for tax purposes the lender may still have a loss disallowed. Instead, the tax basis in the “old” debt would be rolled over into the “new” debt, and the lender would only recognize a loss at a later date, if ever. The above discussion only touches on many of the most relevant tax issues facing borrowers, owners, lenders, investors, and others facing distressed real property investments.

If you have questions about your situation, click here to contact one of EHTC’s tax advisors. It is wise to consider the tax implications of a foreclosure before it takes place. For both personal and investment properties, a plan may help reduce the tax burden. As you can see, the tax treatment of properties in foreclosure can get a little complicated. I will briefly summarize the key points I want you to take away from all of this. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

See Online and Mobile Banking Agreement for details. H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details.

Tax can be forgotten when one is watching one’s formerly valuable real estate crash in value, or one is deciding whether to seize real property to try to recover as much of one’s loan as one can, but the consequences of ignoring the tax rules can be severe. The value that careful tax advice and tax planning can create in distressed real property scenarios is real, and can mean the difference between financial disaster and financial recovery. Whenever assets reprice, opportunity can be presented to opportunistic investors with available capital. These investors looking to play offense will be seeking to acquire real property at its new, lower price, or to buy debt secured by real estate from distressed lenders.

If the debt is cancelled and the debtor is not insolvent, bankrupt or subject to other COD income exclusions, nonrecourse debt is generally preferable. The debtor will have no COD income, and the gain if any will be long-term (IRC Sec. 1231) capital gain if the asset was held for more than one year. Like any business, cash flow is imperative for real estate ownership to continue. Without the ability to collect rent on tenant leases, the real estate lessor is in danger of borrower default on its debt obligations and potential foreclosure or debt restructuring on its properties. The following will discuss the tax implications of foreclosure and debt restructuring and potential exclusions taxpayers may be able to utilize. Under the purchase price adjustment exception, the debtor does not report COD income. Instead, the debtor reduces the adjusted basis of the purchased property (Sec. 108).

Since the tax basis is less than the FMV of the property, gain is recognized to that extent. As of tax year 2020, the tax return you’d file in 2021, the rate on long-term capital gains for properties owned one year or longer depends on your overall taxable income and filing status. You can still qualify for an exclusion from capital gains tax under the modified rules for calculating your gain or loss if the foreclosed property was mixed-use—it was your primary residence at one time and a secondary residence at another time. The rules are also relaxed somewhat for members of the Armed Forces. You can have canceled debt incomefrom the foreclosure with this type of loan as well, in addition to a capital gain. In a normal sale transaction, the amount you realize is just another name for the sales price. However, in a foreclosure, the amount depends on whether you are responsible for the remaining mortgage debt or not.