Content

“The Ultra-Millionaire Tax Act will help level the playing field, narrow the racial wealth gap, ensure the wealthiest finally begin to pay their fair share, and invest trillions of dollars into our communities so we can make a real difference in the lives of people across America.” However, Alexander Hamilton, who supported the carriage tax, told the Supreme Court that it was constitutional because it was an “excise tax”, not a direct tax. Hamilton’s brief defines direct taxes as “Capitation or poll taxes, taxes on lands and buildings, general assessments, whether on the whole property of individuals or on their whole real or personal estate” which would include the wealth tax.

If millionaires are voting with their feet—and moving to the tax systems that they want—what kinds of tax plans can survive this pressure? If there is a great deal of millionaire tax migration, perhaps questions of fairness really are just idle discussions of unworkable aspirations. Moving after achieving high success or at a late career stage can mean giving up a home-field advantage that may not make much business or economic sense. These views are based on the strength of people’s convictions rather than actual evidence. Until very recently, there has been remarkably little data and analysis on the migration patterns of top income earners.

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. While millionaires have available a number of tax perks, they are excluded from many others because of their higher tax bracket. In California, high earners are taxed 9.3 percent plus an additional 1 percent surcharge on income over $1 million . The rich are able to get much bigger tax breaks for the same tax deductions taken by the middle class. For example, a wealthy family living in a McMansion gets a much bigger tax deduction on the interest on their large mortgage than a middle-class family gets on the interest on their small mortgage on a two-bedroom house.

Get More With These Free Tax Calculators And Money

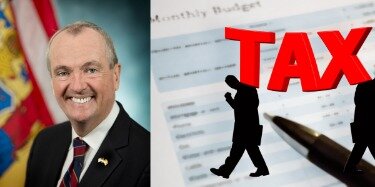

The proposed budget Mr. Murphy released last month also included about $1.2 billion in spending cuts and $4 billion in new bonding debt. A 2014 study by Stanford University that evaluated a 2004 tax increase on high-income New Jersey residents concluded, however, that it had not chased the affluent out of state. That was also true in California, which enacted a millionaires tax in 2005, the study found.

- Unlike federal wealth taxes, states and localities are not bound by Article 1, Section 9, which is why they are able to levy taxes on real estate.

- A wealth tax serves as a negative reinforcer (“use it or lose it”), which incentivizes the productive use of assets .

- I also examine—along states’ narrow border regions and in cities that cross state lines—whether millionaires cluster on the lower tax side of the border.

- The Ultra-Millionaire Tax Act would level the playing field and narrow the racial wealth gap by asking the wealthiest 100,000 households in America, or the top 0.05%, to pay their fair share.

- We should close this loophole so that they pay the same rate as others at their income level who receive their compensation as salary.

Only 17% planned to sell stocks in 2021 as a result of potential tax changes. With Biden advocating for an increased estate tax, 16% plan to make changes to their giving or estate planning. If you happen be among this country’s 1 percent of wealthiest Americans, you are in the highest tax bracket. A number of tax benefits—such as Roth IRAs, for one—are not available to those in this high-earning category. Still, you should be aware of a few tax rules that are helpful to those with your level of income.

Implications Of A Wealth Tax In The United States

This information includes 45 million tax records from anyone who ever filed a tax return with annual income of at least $1 million between the years 1999 and 2011. Access to these data is provided through collaboration with researchers at the Office for Tax Analysis at the U.S. Department of the Treasury.24 These big administrative data provide, in essence, a census of top income earners in the United States, with data on how much they make, where they live, and where they move. This is an extraordinary database from which to probe central questions about the mobility of the rich. This is a story of middle-class wage stagnation, combined with dramatic gains in income at the top. The top 1 percent today capture more than 20 percent of all income created in the U.S. economy. Since the early 1990s, roughly half of all income growth in the United States has accrued to the top 1 percent, with the other half going to the rest of the population—the 99 percent.8 Corporate CEO salaries illustrate the extremes of the growing divergence in economic fortunes.

Instead of cutting education funding for our children, we should ask millionaires to pay a tax rate at least as high their secretary’s. 30 percent of income inequality is due to unfair taxes and budget cuts to services and benefits. But the idea of a wealth tax overall does have broad support in the United States. A Reuters/Ipsos poll last year found nearly two-thirds of Americans strongly or somewhat agree that the very rich should be contributing more. Bunn also notes that a wealth tax could cause foreign investors to replace home-grown billionaires as owners of capital. At the same time, passage of a wealth tax would prove difficult in the Senate. The Ultra-Millionaire Tax Act is cosponsored by Democratic Senators Bernie Sanders, Sheldon Whitehouse, Jeff Merkley, Kirsten Gillibrand, Brian Schatz, Ed Markey and Mazie Hirono.

When a majority of the income for high earning taxpayers comes from wages, the “ordinary,” i.e. higher, income tax rates come into play, which means that compensation and other “ordinary” income over certain levels is subject to the highest federal tax rate of 37 percent in 2019. However, Reed adds that if income is mainly from long-term investments, as is the case for many millionaires, the highest rate at which it is taxed is only 20 percent in 2019. However, these investments can also be subject to the Net Investment Income Tax depending on your particular situation. While not a true millionaire’s tax, Hawaii taxes its rich 11% percent on all income over $200,000 for single filers, and Rhode Island imposes a 5.99 percent tax rate on income over $145,600 regardless of filing status. Connecticut, Maryland, New Jersey, North Dakota, Oregon, Vermont and Wisconsin round out the high tax states, each with varying rates and income caps. “The hyper concentration of wealth among a tiny number of multimillionaires and billionaires is a crisis for American capitalism and the American Dream,” said Congressman Boyle.

If a jet-setting millionaire class can easily dodge taxes by moving away, these people can effectively dictate tax policy to states and nations by threatening to leave. Places and nations can alleviate inequality, at least in part, by taxing the well-off and investing in education, infrastructure, and public services that make life better for most people. But globalization renders the rich more mobile and less connected to places that might tax them. The potential flight of the rich leaves places, states, and countries wondering about the future.

“Calling on the state’s wealthiest residents to help fund New Jersey’s pandemic recovery is both smart and just policy, especially now during an economic downturn that has disproportionately harmed low-paid workers and communities of color,” Mr. McKoy said in a statement. Facing a fiscal crisis brought on by the urgent health needs of the pandemic and the monthslong shutdown of businesses, lawmakers agreed to raise the tax rate on earnings over $1 million to 10.75 percent, up from 8.97 percent. Individuals earning more than $5 million were already taxed at the higher rate. But Mr. Murphy, a self-avowed progressive who arrived in Trenton with few legislative allies, had been unable to win support for a millionaires tax from fellow Democrats who control the Legislature — the powerful Senate president, Stephen M. Sweeney, a political rival, or the Assembly leader, Craig J. Coughlin. In New Jersey, the millionaires tax was an initiative the Democrat-led legislature had symbolically approved for years before Mr. Murphy took office in 2018, knowing that it would never be signed into law by Chris Christie, then the Republican governor. Joseph R. Biden Jr., the Democratic nominee, has proposed raising taxes on people earning more than $400,000 to finance a slate of programs, including expanded day care.

President Obama proposes to restore the exemptions to their 2009 levels — $3.5 million for an individual ($7 million for a couple) taxed at a 45% top rate. In the 1950s and 1960s, when the economy was booming, the wealthiest Americans paid a top income tax rate of 91%.

Elizabeth Warren

Additionally, the Tax Foundation estimates 2020 presidential candidate Senator Bernie Sanders’ wealth tax plan would collect $3.2 trillion between 2020 and 2029. I’m confident lawmakers will catch up to the overwhelming majority of Americans who are demanding more fairness, more change, and who believe it’s time for a wealth tax.”

That is a little more than the 19.3% rate paid by someone making an average of $75,000. And 1 out of 5 millionaires pays a lower rate than someone making $50,000 to $100,000. A wealth tax serves as a negative reinforcer (“use it or lose it”), which incentivizes the productive use of assets . The combination of declining federal taxes on the rich and rising incomes at the top has tempted a number of U.S. states to adopt so-called millionaire taxes on top incomes. States have been, in essence, going where the money is to find new revenues at the top of the income distribution.

This policy raised the marginal tax rate on incomes above $500,000 by 2.6 percentage points. There were widespread criticisms, however, that the tax was causing rich New Jerseyans to leave the state. Is this enough for top income earners to see progressive taxation as legitimate?

The new tax in New Jersey, the nation’s second wealthiest state, is expected to generate an estimated $390 million this fiscal year; 16,491 New Jersey residents and 19,128 nonresident taxpayers will now pay the higher rate, state officials said. As a separate, “add-on” provision, however, it can be easier to convince many legislators and to the larger public, that indeed, the surcharge will affect only higher-income households. Likewise, if part of the effort to raise additional revenue from higher-income households includes a plan to eliminate or reduce these increases at some specified point in the future, structuring the increase as an separate, “add-on” provision can make this claim more believable. It therefore can be easier to generate the support needed to enact a tax surcharge than to generate similar levels of support for adding income brackets and raising rates. For example, if a state’s current top bracket includes all income above $60,000 and the current top tax rate is set at 5 percent, each of these elements could be changed.

Wealth taxes can be limited to natural persons or they can be extended to also cover legal persons such as corporations. — Now that Democrats control the White House and Congress, President Joe Biden and other party leaders are pushing to spend big to revive the economy and address income inequality. Massachusetts Sen. Elizabeth Warren, Washington Rep. Pramila Jayapal and Pennsylvania Rep. Brendan Boyle want the ultra-wealthy to pay for it.

Those at the opposite end of the scale have been hit disproportionately by layoffs and have had a harder time find new jobs during the so-called “K-shaped” recovery. The three Democrats unveiled the Ultra-Millionaire Tax Act on Monday morning. It would levy a 2% annual tax on the net worth of households and trusts between $50 million and $1 billion as well as a 1% annual surtax on assets above $1 billion, for a 3% tax overall on billionaires. Now, let’s start exploring the evidence and see what mobility looks like for millionaires in the United States. So far, the coronavirus outbreak has sickened more than 106 million people globally. A timeline of the eventsthat led to these numbers may help you understand how we got here. At least eight other states — including California, Massachusetts and New York — have considered proposals to increase taxes on high-income residents, according to the National Conference of State Legislatures.

Reed noted, however, that there are limitations on itemized deductions for high-income taxpayers. And because you can afford to “give back” financially to your favorite causes and charities, Reed says there are ways you can almost “triple up” on tax benefits by donating appreciated stock through charitable contributions. CEOs of major corporations earn nearly 300 times more than an average worker.

Turbotax Cd

What should be the policy priorities of places that seek to address inequality and build a foundation for shared prosperity without setting off the migration of top income earners? The threat of millionaire migration does limit the ability of states to set higher tax rates for the rich but by less than one might think. I suggest a modest agenda for addressing individual tax evasion through offshore shell companies. And finally, I conclude by suggesting that it may be better for places to compete for young, highly educated individuals who are just beginning their careers, rather than trying to attract the late-career individuals who currently have the highest incomes. How does one study the geographic mobility patterns of the highest income earners? My initial entry point into this research area was in studying the effect of a so-called millionaire tax passed in New Jersey in 2004.

The bill is now one of her first moves as a new member of the Senate Finance Committee. “This is a wealth tax that has been needed for a long time. We need it to produce more revenue, to create more opportunity in American,” Warren said. “But it is a wealth tax that we particularly need because of the changes in this country under the pandemic. We have watched the wealth of the billionaire class in America increase by more than a trillion dollars over the last year.” See also Pollock v. Farmers’ Loan & Trust Co.; Sixteenth Amendment to the United States ConstitutionIn part because a wealth tax has never been implemented in the United States, there is no legal consensus about its constitutionality.