Content

Because CC is leasing property from EC, economic performance on the contract occurs ratably over the five-year period from January 1 of year 1 through December 31 of year 5. CC is not allowed to deduct any of the expenditure in year 0 and is allowed to deduct one-fifth of the contract price in year 1 .

All your personal information is handled with confidentiality and is not shared with third parties. Additionally, we ensure that we provide original content with accompanying plagiarism reports to show originality.

103 In January of year 0, Justin paid $4,800 for an insurance policy that covers his business property for accidents and casualties. Assume Justin paid $6,000 for a 24-month policy that covers from April 1, year 0 through March 31, year 2. 102 In January of year 0, Justin paid $4,800 for an insurance policy that covers his business property for accidents and casualties. The policy begins on February 1 of year 1 and extends through January 31 of year 2. 101 In January of year 0, Justin paid $4,800 for an insurance policy that covers his business property for accidents and casualties. The policy covers the business property from April 1 of year 0 through March 31 of year 1. On December 1, 20×1, ABC enters into a $100,000 snow removal contract with Snow Movers Co.

D What Amount Can Ralph Deduct If The Potential

He also paid $3,200 to construct a new driveway for access to the property. 19 Indicate the amount that Josh can deduct as ordinary and necessary business deductions in each of the following expenditures and explain your solution. Josh borrowed $50,000 from the First State Bank using his business assets as collateral. Over the course of a year, Josh paid interest of $4,200 on the borrowed funds, but he received $3,500 of interest on the bonds.

- $235 (50% of cost of the dinner and theater) is deductible.

- the december 31, 2017, physical count showed $300 of supplies available.

- The more information you give to our writers, the better.

- It is important to take advantage of as many tax deductions as one legally can.

- As such, we are constantly changing our policies to ensure maximum customer and writer satisfaction.

In this lesson, we’ll define the function of the Internal Revenue Service and discuss the process of tax preparation. We’ll also explore two methods of filing taxes and learn how tax audits are completed. Grandpaperwriters.com has the best professional essay writers for quality services.

Recent Questions In Financial Accounting

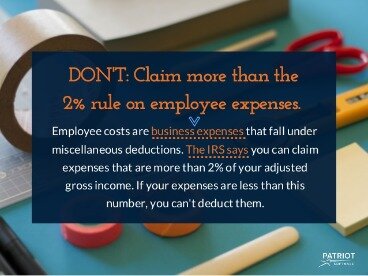

Business associates include anyone the taxpayer reasonably expects to do business with, such as customers, suppliers, employees, or advisors. $235 (50% of the cost of the dinner and theater) is deductible. Entertainment is directly related to business if there is an active discussion aimed at generating revenue and the discussion occurs in a business setting. A restaurant is an acceptable business setting.

He recorded the following receipts this year. Indicate the extent to which these payments are taxable income to Jeremy this year if Jeremy is a cash-method taxpayer and he is an accrual-method taxpayer. This year Josh paid $23,400 to employ the mayor’s son in the business.

Hence, no amount ($0) of the costs that were associated with sightseeing can be deducted as a business expense. You can only deduct meals if you stayed away from home and spend the night on a hotel or other type of lodging place. Since she bought her meals on the road they are not deductible. Renee manufactured and sold a “gadget,” a specialized asset used by auto manufacturers that qualifies for the domestic production activities deduction.

Small Business Tax Deductions To Use Now (+11 You Should Never Try)

Tackling an order may be challenging but we always offer the best. Once the editors are satisfied with the assignment, they will forward the assignment to your account and a copy to your email. Brief explanations of how our services work 1. Provide us with the necessary instructions. Go to the Order Now page and click the order now button.

Most of the times when a personnel is sent for an official business trip, transportation and lodging, and sometimes even meals are shouldered by the company. $1,500 for an accountant to evaluate the accounting system of Rebecca’s business. The accountant spent three weeks in January of year 1 working on the evaluation. Because the liability is contingent on a future event occurring after the end of the year, the liability is not fixed. Because her travel did not require her to be away from home overnight, meals are not deductible. 35 Ralph invited a potential client to dinner and the theater.

He used the money to buy City of Blanksville bonds. Over the course of a year, Josh paid interest of $13,300 on the borrowed funds, but he received $12,000 of interest on the bonds. Under the cash-method, Elizabeth can only deduct amounts paid to the consultants by the end of the year. Since she has not paid the consultants anything by year-end, so she could not deduct any expense associated with the contract. The 12-month rule for capitalizing expenditures applies to rent payments for a cash method taxpayer.

Acct323 Homework 5

The entire premium is deductible under the 12-month rule because the insurance coverage does not exceed 12 months and does not extend beyond the end of next year. As such, economic performance occurs as XYZ performs the services. ABC can deduct $50,000 for services in the current year. As such, economic performance occurs as XYZ performs the services and XYZ can deduct the cost of the services in the current year. Thus, it can only deduct $7,500 next year because that is when all of the repair services will be received.

The contract provides that the snow removal service will begin January 1, 20×2 and end March 15, 20×2. Both ABC and Snow Movers are accrual method taxpayers. ABC has prepaid for services it is to receive from another. As such, economic performance occurs when paid if the other is reasonably expected to provide all of the services within 3.5 months after payment. March 15, 20×2 is 3 months after the payment date of December 15, 20×1. The trip does not appear to be motived primarily for business (2 days business v. 8 days personal). Sightseeing was done purely for her leisure and entertainment and had nothing to contribute towards the business.

Tax Chapt 9

an analysis of the company’s insurance policies showed that $1,100 of unexpired insurance coverage remains. the office supplies account had a $700 debit balance on december 31, 2016; and $3,480 of office supplies were purchased during the year. the december 31, 2017, physical count showed $300 of supplies available. two-thirds of the work related to $15,000 of cash received in advance was performed this period. the prepaid insurance account had a $6,800 debit balance at december 31, 2017, before adjusting for the costs of any expired coverage. an analysis of insurance policies showed that $5,800 of coverage had expired. wage expenses of $3,200 have been incurred but are not paid as of december 31, 2017.

Note that in order to use any of these deductions, you will need to prove the fees and cost. This means you need to keep receipts – all of them, and in an organized fashion. Taxes are business as usual, but so are a lot of other things. Small business in the U.S. are fortunate to have plenty of possible deductions to save money where they can. Discounts We offer the best prices in the industry. We currently have a 20 percent discount for all of our customers.