Content

In August and September, your son lived with you. For the rest of the year, your son lived with your husband, the boy’s father. Your son is a qualifying child of both you and your husband because your son lived with each of you for more than half the year and because he met the relationship, age, support, and joint return tests for both of you. At the end of the year, you and your husband still weren’t divorced, legally separated, or separated under a written separation agreement, so the rule for children of divorced or separated parents doesn’t apply. If the child lived with each parent for the same amount of time, the IRS will treat the child as the qualifying child of the parent who had the higher adjusted gross income for the year. The custodial parent must use either Form 8332 or a similar statement to make a written declaration to release a claim to an exemption for a child to the noncustodial parent.

- For example, if your spouse dies at the end of the 10th year, you must pay the estate $150,000 ($450,000 − $300,000).

- The custodial parent must sign either a Form 8332 or a similar statement.

- Taxpayer A has AGI of $80,000; Taxpayer B has AGI of $70,000.

- If you are a U.S. citizen or resident alien and you pay alimony to a nonresident alien spouse, you may have to withhold income tax at a rate of 30% on each payment.

- Once you’ve actually filed your return as married filing jointly though, you can’t amend that return to file two separate returns using the married filing separately status.

- We collect the best resources in the state to help taxpayers file and pay taxes, get help they need, and work with the department to stay in compliance.

Treat social security and equivalent railroad retirement benefits as the income of the spouse who receives the benefits. Treat income or loss from a trade or business carried on by a partnership as the income or loss of the spouse who is the partner. Under all facts and circumstances, it wouldn’t be fair to include the item of community income in your gross income. You establish that you didn’t know of, and had no reason to know of, that community income.

They each report on their returns only their own earnings and other income, and their share of the interest income from community property. George reports $26,500 and Sharon reports $34,500. In some states, spouses may enter into an agreement that affects the status of property or income as community or separate property. Check your state law to determine how it affects you. The income tax liability from which you seek relief is attributable to an item of your spouse or an unpaid tax resulting from your spouse’s (or former spouse’s) income. If the liability is partially attributable to you, then relief can only be considered for the part of the liability attributable to your spouse .

Eligibility Requirements For Married Filing Separately

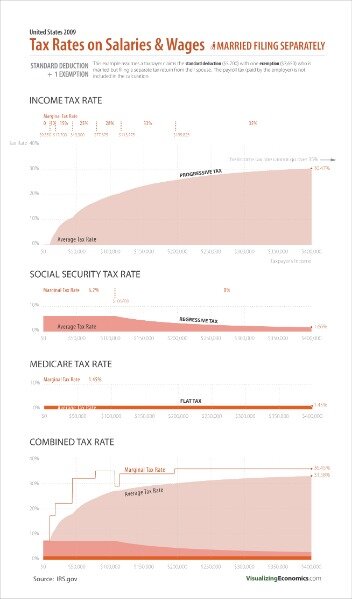

Conversely, for those filing separately, the tax break is just $12,200, which is the same as for single people. The filing statuses we know today — single, head of household, qualifying widow, married filing jointly and married filing separately — first appeared on the federal Form 1040 in 1961. The married filing separately status could be beneficial if you want to separate your tax liability from your spouse’s.

971 explains these kinds of relief and who may qualify for them. You can also find information on our website at IRS.gov. Under the health care law, you must have qualifying health care coverage. near the end of this publication for information about getting publications and forms. Go to IRS.gov/OrderForms to order current forms, instructions, and publications; call to order prior-year forms and instructions.

Your spouse receives no other community income. Under your state law, earnings of a spouse living separately and apart from the other spouse continue as community property. When you become divorced or separated, you will ususallyhave to file a new Form W-4 with your employer to claim your proper withholding.

It also applies even if the property’s liabilities are more than its adjusted basis. If you make a transfer of property in trust for the benefit of your spouse , you generally don’t recognize any gain or loss. You don’t recognize gain or loss on the first transfer.

Youre Our First Priority Every Time.

For example, if your spouse dies at the end of the 10th year, you must pay the estate $150,000 ($450,000 − $300,000). These facts indicate that the payments to be made after your former spouse’s death are a substitute for $10,000 of the $30,000 annual payments. Of each of the $30,000 annual payments, $10,000 isn’t alimony. Your former spouse has custody of your minor children. The decree provides that if any child is still a minor at your spouse’s death, you must pay $10,000 annually to a trust until the youngest child reaches the age of majority.

This might cause your refund to be applied to your spouse’s increased tax. To avoid this, file your returns on separate forms. Although you’re submitting returns on the same form, you are submitting two separate tax returns.

What Tax Breaks Are Afforded To A Qualifying Widow?

Property you receive from your spouse is treated as acquired by gift for income tax purposes. When you transfer property to your spouse , you must give your spouse sufficient records to determine the adjusted basis and holding period of the property on the date of the transfer. If you transfer investment credit property with recapture potential, you must also provide sufficient records to determine the amount and period of the recapture.

Married filing separately is a tax status for married couples who choose to record their respective incomes, exemptions, and deductions on separate tax returns. There is a potential tax advantage to filing separately when one spouse has significant medical expenses or miscellaneous itemized deductions or when both spouses have about the same amount of income. If you’re not sure which filing status to use and you’re eligible for either married filing jointly or married filing separately, calculate your tax liability for both to see which makes sense for your tax situation. Credit Karma Tax®, which is always free to e-file, can help you decide which tax status is best for you. In the eyes of the IRS, signing a joint return means both spouses are equally liable for all taxes and penalties for that tax year — even if you later divorce. The married-filing-separately status allows you to claim responsibility only for your own return. For example, two spouses may choose to file separately if they’re planning to divorce and wish to keep their finances separate.

If your spouse was a nonresident alien at any time during the tax year, and you haven’t chosen to treat your spouse as a resident alien, you are considered unmarried for head of household purposes. However, your spouse isn’t a qualifying person for head of household purposes. You must have another qualifying person and meet the other requirements to file as head of household.

, earlier.) If you have no legal responsibility arising from the divorce settlement or decree to pay your spouse’s legal fees, your payments are gifts and may be subject to the gift tax. Direct payments of tuition to an educational organization or to any person or organization that provides medical care aren’t subject to federal gift tax. Therefore, such payments made for the benefit of a spouse or former spouse won’t be subject to federal gift tax. The tax treatment of items of property transferred from you to your spouse or former spouse pursuant to your divorce is shown below. The term “property” includes all property whether real or personal, tangible or intangible, or separate or community.

A separation agreement may divide the community property between you and your spouse. It may provide that this property, along with future earnings and property acquired, will be separate property. A decree of legal separation or of separate maintenance may or may not end the marital community. The court issuing the decree may terminate the marital community and divide the property between the spouses.

How Married Filing Separately Works

But keep in mind that using this status means you may pay more tax and miss out on a number of tax breaks. A separate return includes a return claiming married filing separately, single, or head of household filing status. Taxpayer A has AGI of $25,000; Taxpayer B has AGI of $26,000.

After the IRS accepts your Married Filing Separately tax return, if you need, you still can amend your return to a Married Filing Joint filing status return for up to 3 years after the original tax deadline . If you suspect that your spouse may be evading taxes or has cheated on any previous tax return, you can keep yourself safe from an IRS audit by filing a separate return. You will not be liable for your spouse’s fines, penalties, interest, and back taxes. Please note the source of funds is highly important in this type of situation. Even if, in a normal year it would make more sense for this couple to file jointly, in the year of the expense, filing separately might make sense. But if the couple filed separately, the cost would easily exceed the teacher’s threshold for medical deductions, which would be $3,375 ($45,000 x 7.5%), based only on the teacher’s AGI. This would leave an eligible deduction of $8,625 for the teaching spouse to claim on Schedule A of the 1040.

There are a number of reasons why it’s usually better to file jointly if you’re married. Still, if you don’t want to file jointly, you might wonder what the disadvantages of married filing separately are. If your spouse has a delinquent federal income tax, student loan, child support obligation or other debt, the Treasury Offset Program allows the Department of the Treasury to seize any tax refund your spouse may be due. If you file a joint return, your refund will also be considered shared. That means if your spouse owes and you file jointly, you and your refund could be on the hook for their debt.

The community property states are California, Arizona, New Mexico, Texas, Louisiana, Nevada, Idaho, Washington, and Wisconsin as of 2020. You or your spouse—or perhaps both of you—might qualify for the head of household filing status if you’re living apart. This is much more advantageous than filing a separate married return, but it comes with a lot of qualifying rules.

There are rules to follow for filing separately, though. Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services.

After the due date of your return, you and your spouse can’t file separate returns if you previously filed a joint return. If your spouse itemizes deductions, you can’t claim the standard deduction. If you can claim the standard deduction, your basic standard deduction is half the amount allowed on a joint return. The following credits and deductions are reduced at income levels that are half those for a joint return. If you and your spouse file separate returns and one of you itemizes deductions, the other spouse can’t use the standard deduction and should also itemize deductions. You are an injured spouse if you file a joint return and all or part of your share of the overpayment was, or is expected to be, applied against your spouse’s past-due debts. An injured spouse can get a refund for his or her share of the overpayment that would otherwise be used to pay the past-due amount.