Content

Dave Du Val, EA, is Chief Compliance Officer for TRI Holdco. Inc., the parent company of TaxAudit, and Centenal Tax Group. A nationally recognized speaker and educator, Dave is well known for his high energy and dynamic presentation style. He is a frequent and popular guest speaker for the California Society of Tax Consultants, the California Society of Enrolled Agents and the National Association of Tax Professionals. Dave frequently contributes tax tips and information to news publications, including US News and World Report, USA Today, and CPA Practice Advisor.

John can claim all reasonable travel expenses for himself while en route, to and from Germany and for the one week period of medical services in Germany. Maria can claim all reasonable travel expenses for herself and her son while en route, to and from Halifax and for the two-week period of medical services in Halifax. If a medical practitioner certifies in writing that you were not able to travel alone to get medical services, you can also claim the transportation and travel expenses of an attendant. Travel expenses – travel expenses cannot be claimed as a medical expense if you traveled less than 40 kilometres from your home to get medical services. While these costs to renovate or alter a home to accommodate the use of a wheelchair may qualify as medical expenses under the conditions described above, these types of expenses related to other types of impairment may also qualify. In all cases, you must keep receipts and any other related documents to support your claim.

Liver extract injections for a person with pernicious anaemia– prescription needed. Laser eye surgery– the amount paid to a medical practitioner or a public or licensed private hospital. Hospital services– public or private, that are licensed as hospitals by the province, territory or jurisdiction where they are located in. Drugs and medical devices bought under Health Canada’s Special Access Program– the amounts paid for drugs and medical devices that have not been approved for use in Canada, if they were bought under this program. Driveway access– reasonable amounts paid to alter the driveway of the main place of residence of a person who has a severe and prolonged mobility impairment, to ease access to a bus. and paid to a medical practitioner or a public or licensed private hospital.

If a doctor can confirm that your current weight is a threat to your health, any weight-loss program that is prescribed is deductible. However, programs for maintaining general good health are not deductible. Sex-reassignment surgery and hormone therapy to treat gender identity disorder . However, the cost of breast augmentation surgery, even as part of a gender transition, may not be deductible.

Are Medicines Deductible?

Dave is an Enrolled Agent who has prepared thousands of returns during his career and has trained and mentored hundreds of tax professionals. He is a member of the National Association of Tax Professionals, the National Association of Enrolled Agents and the California Society of Enrolled Agents. Dave also holds a Master of Arts in Education and has been educating people since 1972. We would recommend that if you choose to deduct the cost you obtain a letter from the physician detailing what vitamins are recommended and what medical condition is being treated. You might also ask your physician to write a prescription for them, even if they are over-the-counter, as this may eventually bolster your case.

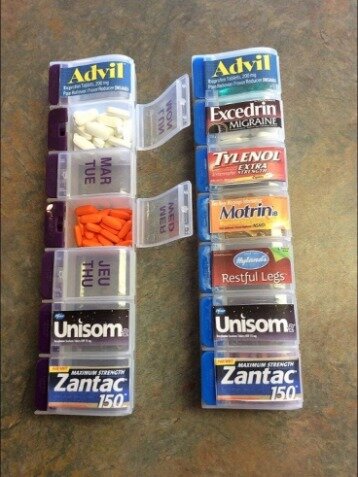

- Examples of common eligible medications include pain relievers, allergy medication, cough medicine and drops, sleep aids, eye drops, stomach/intestinal remedies, medicinal creams, nasal sprays, and decongestants.

- Medical expenses are any costs incurred in the prevention or treatment of injury or disease.

- Please note that an expense is only considered eligible for FSA reimbursement if it is deemed medically necessary to treat a specific medical condition, disease or diagnosis.

- If you pay part and your insurer pays part, the portion you pay is deductible.

At least for a little while, you may need to pay out-of-pocket for these items and keep your receipt to expense or claim the purchases with your HSA, FSA, or HRA provider and have them reimburse you, versus simply using your related account’s debit card. This is because the merchants you purchase from must update their point-of-sale system to recognize these products as qualified medical expenses. Examples of common eligible medications include pain relievers, allergy medication, cough medicine and drops, sleep aids, eye drops, stomach/intestinal remedies, medicinal creams, nasal sprays, and decongestants.

They would not normally be incurred by persons who have normal physical development or who do not have a severe and prolonged mobility impairment. Rehabilitative therapy including lip reading and sign language training to adjust to a person’s hearing or speech loss. Phototherapy equipment for treating psoriasis or other skin disorders. You can claim the amount paid to buy, use, and maintain this equipment. Laryngeal speaking aids – can be claimed without any certification or prescription. Diapers or disposable briefs for a person who is incontinent because of an illness, injury, or affliction.

Easily Overlooked Expenses

Jennifer’s doctor gave her a letter certifying that she was not able to travel without an attendant. Maria had to travel with her son Michael from Sydney to Halifax to get medical services for herself. Maria’s doctor gave her a letter certifying that she was not able to travel without an attendant. Paul lives in St-Hyacinthe and had to travel over 40 kilometres one way to Montréal to get medical services because similar services were not available within 40 kilometres of his home. He had to use his vehicle because no public transportation was readily available. Teletypewriters or similar devices that allows a person who is deaf or unable to speak to make and receive phone calls – prescription needed.

You may be able to claim the public transportation expenses you paid as medical expenses. Where public transportation is not readily available, you may be able to claim vehicle expenses. Sign language interpretation services used by a person with a speech or hearing impairment and paid to someone in the business of providing these services. Reasonable travel expenses for the person to go to a school, institution, or other place that trains them in the handling such an animal (including reasonable board and lodging for full-time attendance at the school) are eligible expenses.

For Simple Tax Returns Only

You can include the cost of a prescribed drug you purchase and consume in another country if the drug is legal in both the other country and the United States. What legally “is and isn’t” tax-deductible can often be confusing, especially when dealing with medical expenses for items that can be bought over-the-counter or without a prescription. It’s important to know the IRS rules pertaining to medical expenses—and to check each year for changes or updates to the rules. Payments for inpatient hospital care or residential nursing home care, if the availability of medical care is the principal reason for being in the nursing home, including the cost of meals and lodging charged by the hospital or nursing home. If the availability of medical care isn’t the principal reason for residence in the nursing home, the deduction is limited to that part of the cost that’s for medical care.

At IRS, I participated in the review and audit of federal estate tax returns. At one such audit, opposing counsel read my report, looked at his file and said, “Gentlemen, she’s exactly right.” I nearly fainted. It was a short jump from there to practicing, teaching, writing and breathing tax.

These products are defined as tampons, pads, liners, cups, sponges or other similar products. In addition, over-the-counter products and medications are now reimbursable without a prescription. Taxpayers should save receipts of their purchases for their records and so that they are able to submit claims for reimbursements. You can only include the medical expenses you paid during the year. You must reduce your total deductible medical expenses for the year by any reimbursement of deductible medical expenses, and by expenses used when figuring other credits or deductions. This is true whether you receive the reimbursement directly or it’s paid on your behalf to the doctor, hospital, or other medical provider. If you itemize your deductions for a taxable year on Schedule A , Itemized Deductions, you may be able to deduct expenses you paid that year for medical and dental care for yourself, your spouse, and your dependents.

Irs Outlines Changes To Health Care Spending Available Under Cares Act

In other words, if your insurance company pays for your expense , such expenses are not deductible. It must be genuinely “out of pocket” in order for you to have a tax deductible medical expense. If you pay part and your insurer pays part, the portion you pay is deductible. Did you spend a lot of money on your medical care last year?

Nevertheless, medical expenses can be considerable as you get older, and the medical tax deduction can come in handy for when you have large, unreimbursed medical expenses. For example, suppose you were married and your spouse used a wheelchair.

Medical services outside of Canada– if you travel outside Canada to get medical services, you can claim the amounts you paid to a medical practitioner and a public or licensed private hospital. A “licensed private hospital” is a hospital licensed by the jurisdiction that it operates in.

You can only include the cost of a drug that was imported legally. For example, you can include the cost of a prescribed drug the Food and Drug Administration announces can be legally imported by individuals.