Content

Then, TurboTax will use the information to help you complete your tax return, including any deductions or tax credits you may qualify for so you can get every dollar you deserve. Hello, I’m Sara from TurboTax, with some information about IRS tax forms. It’s unlikely you enjoy filling out tax forms, but if you have to pay income tax every year, you should be glad you don’t have to come up with one yourself. For tax years prior to 2018, Forms 1040EZ and 1040A were available but have been phased out beginning with the 2018 tax year by a redesigned Form 1040 and a new 1040-SR for those 65 and older. The 1040 family of forms serves as the center of your tax return. This primer will help you decode the alphabet soup of IRS forms and understand your tax return.

Here’s a primer on some of the documents you’ll want to be familiar with as you use TurboTax to prepare your tax return. The Internal Revenue Service Web site includes all the IRS Forms & Publicationsfor Federal income tax returns. For tax years beginning 2018, the 1040A and EZ forms are no longer available. For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017. Once you receive any necessary 1098 forms, you can input them into TurboTax.

Use the app ItsDeductible™ to calculate the value of items you donate, and know exactly what qualifies as a charitable donation on your taxes. When you buy health insurance from the Marketplace, you provide information about your income, and the government uses that information to calculate how much it will pay your insurer.

Our software is designed to take away the burden of understanding tax laws and forms. TurboTax software programs include the tax forms you’re likely to need to file your federal and state taxes. And the great thing is they guide you through your tax return so you don’t need to know which tax forms to file.

You’ll get this version if you bought health coverage through the “Marketplace”—the web-based insurance markets that the federal government and states set up under the ACA. In addition to qualified tuition, the IRS defines related expenses for this form as fees and course materials required to be enrolled at or attend an eligible educational institution. Form 1098-E Student Loan Interest Statement reports student loan interest received from you by a lender throughout the year. Lenders are required to fill out this form if you paid them $600 or more in interest over the year. This interest may be deductible as an adjustment when calculating your Adjusted Gross Income . Lenders do not have to provide a Form 1098 if they received less than $600 in interest, mortgage insurance premiums, or points during the year. Additionally, interest received from a corporation, partnership, trust, estate, association, or company does not require filing a Form 1098.

Tax Forms For Federal And State Taxes

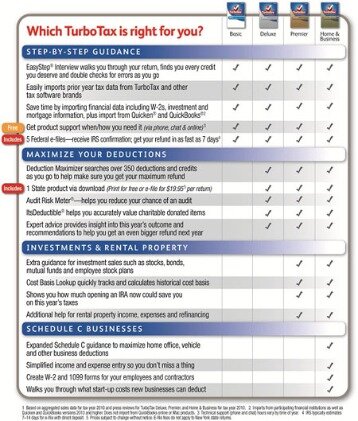

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. There have been a few recent changes to the federal form 1040. We’ll review the differences and show you how file 1040 form when it comes to tax time. TurboTax Free Edition, for simple tax returnsonly, has all the forms you need to complete your return. If you own a home, made donations, or have child care or medical expenses, TurboTax Deluxe will guide you through all your deductions and fill in the proper forms. TurboTax Premier offers extra help with investments and rental property and the forms required by the IRS, while Home & Business helps you with self-employment income.

If you bought a property with owner financing, the seller might not file a Form 1098. Regardless of why you may not have received a Form 1098, you typically can still deduct qualifying mortgage interest. Intuit, the Intuit logo, checkmark design, TurboTax, EasyStep, QuickBooks, and ItsDeductible among others, are registered trademarks or service marks of Intuit Inc. in the United States and other countries. Other parties’ trademarks or service marks are the property of their respective owners.

- Generally, the charity must provide this form within 30 days from the date of the sale of the vehicle if box 4a is checked or 30 days from the date of the contribution if box 5a or 5b is checked.

- There have been a few recent changes to the federal form 1040.

- Remember, with TurboTax, we’ll ask you simple questions and fill out the right forms for you.

- Student loan interest taxation has not changed from tax year 2019 to tax year 2020.

- Properly documenting the taxes you’ve already paid can keep you from overpaying.

If you answered yes to any of those questions, then you’ll need to file a standard 1040. You may also need to file a 1040 if you claim certain credits or deductions. For example, if you itemize your deductions you’ll need to fill out a 1040, as you can’t attach the Schedule A form needed for itemized deductions to either a 1040EZ or 1040A. If you’re wondering if you need to file with the full standard 1040 form, ask yourself these questions.

Well Help You File Both Your State And Federal Taxes For Free, If You Qualify

We’ll tell you how and make sure you get any new deductions you qualify for. Just answer some basic questions about yourself, your life, and your family, and we’ll fill out the right tax forms for you. When you receive one from the Marketplace, though, you’ll receive an “Exemption Certificate Number.” You must provide this number to avoid the penalty. Deductions and credits related to qualified tuition payments has not changed for tax year 2020 other than standard inflation adjustments, where applicable.

It lets you make certain adjustments to your taxable income, such as child tax credits or the deduction for student-loan interest, but doesn’t let you itemize deductions. You typically can use this form if you earn less than $100,000 and don’t have self-employment income. Remember the days of tromping off to the library or post office to pick up your tax forms? Back then, you had to sort through pages of IRS lingo to figure out if you had all the right forms, fill them out by hand, stuff them in an envelope—and hope for the best. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

The government offers a number of deductions and credits to help lower the tax burden on individuals, which means more money in your pocket. You’ll need the following documentation to make sure you get all the deductions and credits you deserve.

Student loan interest taxation has not changed from tax year 2019 to tax year 2020. In some years, the income limits for taking the deduction are adjusted for inflation. If a mortgage does not meet the $600 interest threshold, the form does not have to be filed. The information on this form may be used for certain tax deductions related to interest, mortgage insurance premiums, or points paid. The 1098 form and its variants are used to report certain contributions and other possible tax-deductible expenses to the IRS and taxpayers.

What Is Form 1098

Hi, I’m Arye from TurboTax with some important information about when to use a 1040 tax form. This video will help you decide which 1040 tax form is right for you, the 1040EZ, the 1040A or the full standard 1040 form. Properly documenting the taxes you’ve already paid can keep you from overpaying.

If you’ve ever claimed a tax credit then you are well aware that the IRS creates a separate form for each one. The biggest change to Federal Form 1040 is that a new Line 30 has been added for the Recovery Rebate Credit. This is for taxpayers who didn’t receive payments or could have received a larger payment from the government when economic impact payments went out in 2020.

TurboTax helps millions of taxpayers file their tax returns every year. Over the years, we’ve seen just about every tax scenario you can imagine.

Forget The Forms

These will be reported on Schedule A, Line 10b for taxpayers taking the standard deduction. Another change to Form 1040 is that there are now three lines to report withholdings. On Form 1040, Line 25a will be for W-2 withholdings, Line 25b will be for 1099 withholdings, and Line 25c will be for other withholdings. 1099-INT keeps track of interest income you earn on investments.

Find out about these forms with help from TurboTax in this video on tax tips. It’s filled out by your employer to document your earnings for the calendar year. This tax form supplies you with some of the most important information you’ll need when you fill out your 1040 including the wages you earned and the taxes your employer withheld. Form 1040A is more comprehensive than 1040EZ, but simpler than the regular 1040.

We find every tax deduction and credit you qualify for to get you the biggest tax refund, guaranteed. If the total of your itemized deductions does not exceed the standard deduction for your filing status, then your taxable income will usually be lower if you claim the standard deduction. Beginning in 2018, exemption deductions are replaced with higher child tax credits and a new dependent tax credit. This is also where you report income from a seller-financed mortgage. Schedule A is for itemizing deductions, such as mortgage interest, property taxes, medical or dental expenses, and charitable contributions. To print and view these forms you’ll need Adobe Reader on your computer.

Video: What Are Irs Forms?

These taxpayers can claim that amount as a refundable credit here. Taxpayers use the federal 1040 form to calculate their taxable income and tax on that income. One of the first steps is to calculate Adjusted Gross Income by first reporting your total income and then claiming any allowable adjustments, also known as above-the-line deductions. Your AGI is an important number since many deduction limitations are affected by it. Whether you choose to never see a tax form or print all the forms out at the end, you can take comfort in knowing that when you use TurboTax, your taxes are guaranteed to be accurate. If you’re ever unsure of whether a TurboTax product has the forms you need, just click the “Included Forms” link on the product description page for a full list of included forms.

In particular, they cover mortgage interest payments; contributions of motor vehicles, boats, or airplanes; student loan interest paid; and tuition and scholarship information. We update your federal and state tax refund amount as you work, so you always know where you stand. Get unlimited access to the helpful TurboTax community if you have questions about doing your taxes. ExplainWhy™ delivers personalized insights so you can truly understand your taxes. You can easily obtain all IRS forms on its website at and remember if you use TurboTax to prepare your return, we’ll ask you simple questions, guide you step-by-step and fill in all the right forms for you. IRS forms are filled out by taxpayers each year to indicate how much money that person owes to the government.

File your taxes for free with TurboTax and get your maximum refund, guaranteed. Prepare your return online and pay only when you’re ready to print or e-file. The purpose of IRS forms is to collect tax payer information in a uniform way. By issuing standard forms the IRS is able to operate much more efficiently. The most well known IRS form is probably your personal tax return, usually a 1040, 1040A or 1040EZ but there are many more that you may have to include with your tax return. If you used TurboTax to file electronically last year, you’ll receive no tax forms by mail from the IRS.

Estimated tax payments made during the year, prior year refund applied to current year, and any amount paid with an extension to file. “If you earn more than expected, you may need to adjust your subsidies midyear or else repay all or part of your subsidies,” she says. You must include this form with your tax return if you claim more than $500 as a deduction for the donation. Generally, the charity must provide this form within 30 days from the date of the sale of the vehicle if box 4a is checked or 30 days from the date of the contribution if box 5a or 5b is checked. Learn how they could impact your taxes and when you might be required to file one with the IRS. IRS Free File Program powered by TurboTax supports most federal forms and state forms.