Content

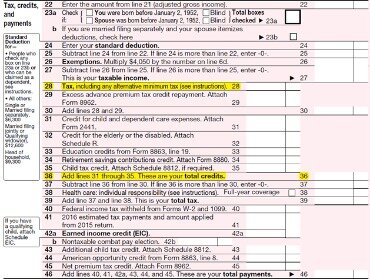

You still can’t itemize deductions, but can claim individual retirement account deductions and adjustments for student loans and other educational expenses. You also can claim certain credits for child and dependent care. Also, if you’re not a sole proprietor, you may need to file a separate tax return for the business. Page 2 is also where you claim tax credits and list the tax payments you’ve already made for the year. Some tax credits, such as the Child Tax Credit, the Earned Income Credit, and the additional child tax credit, go right on Form 1040. If you own a business, you may also benefit from the qualified business income deduction.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein. If you want to file a paper return, the address to which you’ll send your return depends on the state in which you live. You can find that address in the IRS Instructions for Form 1040. There are a handful of other taxes that will require you to also complete Schedule 2.

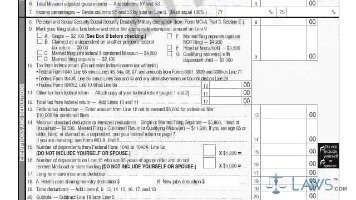

If you filed taxes last year but never received your state tax refund, what should you do? Get the answer from the tax experts at H&R Block. If you arerequired to file a tax return, but do not qualify to file either Form 1040EZ or Form 1040A, you must file the full version of Form 1040. One big limiting factor with Form 1040A is that you cannot claim itemized deductions.

About H&r Block

Additional fees and restrictions may apply. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns.

- Joe finished college last year and got his first full-time job making $40,000.

- To make it even easier for you, we’ve listed the necessary information to help you through the tax filing process.

- You cannot claim any children, or any other person, as your dependent.

- January’s drop compares to a 15.5pc fall in imports from Germany over 2020 but the latest slump in trade was still not as severe as the worst months of the first lockdown.

- Schedule F. Schedule F is used to report profits or losses from farming, allowing you to break down income and expenses in full detail.

For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited. Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. Only available for returns not prepared by H&R Block.

Form 1040 Filing Deadline

But if you’re preparing all of your tax stuff, you should know that the IRS has done away with the 1040A and 1040EZ forms, instead of creating a more streamlined Form 1040. Prior to the 2018 tax season, the 1040A and 1040EZ were options in lieu of 1040 for those with less than $100,000 of taxable income and fewer specifics to deal with. They were each much shorter than the 1040. You can use the more detailed forms for a simple return, however if you have information that requires you to use the more detailed forms, then you cannot use the simpler forms.

View your filing options with H&R Block now. Unless you meet each of these conditions, you cannot use Form 1040EZ. Even if you do meet these conditions, you cannot use Form 1040EZ and claim any dependents or itemized deductions. You also cannot claim tax credits other than the earned income tax credit, or claim adjustments to income such as contributions to an IRA. To benefit from claiming dependents, deductions or adjustments and credits, you must use Form 1040A or 1040. Therefore, here is some information comparing them. Each form served the same purpose—to report your income and determine if you owe additional taxes or, better yet, get a refund—but the forms varied in complexity.

These allow you to reduce your gross income, thereby reducing the amount of income that’s ultimately taxed. The adjustments include, among other things, breaks for alimony payments you made, self-employment taxes you paid or moving expenses you incurred. You also need to look at those other two individual tax returns to take advantage of additional income adjustments and tax credits. So, opting to file Form 1040A instead of 1040EZ saves Joe a bundle.

Year-round access may require an Emerald Savings®account. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.

In those circumstances, the returns are due on the next business day. An automatic extension until October 15 to file Form 1040 can be obtained by filing Form 4868. However, if you’re able, e-filing is the preferred way to file IRS Form 1040. The IRS recommends that all eligible taxpayers file their returns electronically because it’s easier, more convenient, and more secure than paper filing. It can also help you get your tax refund faster. You can e-file your return using IRS Free File if your adjusted gross income is $66,000 or less. Otherwise, most tax prep software and tax professionals are authorized to electronically file Form 1040.

Here Are The Deductions That Disappeared Due To Tax Law Changes

Although some of the merchandise did not reach the shelves on time, the upscale department store chain reported a smaller-than-expected fall in quarterly revenue powered by online sales and its off-price business. Nordstrom’s focus on e-commerce, as consumers shift to shopping online in the wake of the health crisis, and the growth of its off price channel helped it bring in sales even amid restrictions. Nordstrom expects some pressure in gross margin as it aligns inventory in its first quarter, the time it expects its off-price Rack stores to return to normal inventory levels. Form 1040-NR-EZ is a simplified version of the IRS return for nonresident aliens, if their only U.S. income is from wages or other eligible sources. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling).

Schedule 1 lets you add additional sources of or adjustments to income that aren’t on Form 1040. Income sources on Schedule 1 include taxable refunds, alimony received, unemployment, business income and rental real estate. Gains from prizes or gambling winnings can also be filed here. Adjustments to income can include paid alimony, self-employed qualified plans like a SEP or SIMPLE IRA, student loan interest deductions, tuition and fees, educator expenses and health savings account deductions. The 1040EZ form was even shorter than the 1040A. You were not able to claim any tax deductions or tax credits . The types of taxable income one could have been far more limited, and you could only use it if your filing status was single or married filing jointly.

This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services.

TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only.

However the form 1040A is a gradual step-up from the 1040EZ, and a step below the traditional 1040. estern Governors University is a registered trademark in the United States and/or other countries.

For tax years beginning 2018 , the 1040A and EZ forms are no longer available. They have been replaced with new 1040 and 1040-SR forms. For those who are filing prior year returns, you can continue to use form 1040A or EZ for tax years through 2017. The tax return deadline was original set at March 1. This was changed to March 15 in the Revenue Act of 1918, and in the Internal Revenue Code of 1954, the tax return deadline was changed to April 15 from March 15, as part of a large-scale overhaul of the tax code.

And there are even more tax-saving opportunities found on the long Form 1040. They might not apply to Joe, but they could cut your tax bill — if you take the time to look over each of the forms. Here are the basic guidelines for the three individual tax returns. Near the bottom of form 1040, you’ll write down how much income tax you’re responsible for.

All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Fees apply if you have us file a corrected or amended return.