Backup withhold on any reportable payments made to the payee’s account, regardless of whether the payee makes any withdrawals, beginning no later than 7 business days after you receive the awaiting-TIN certificate. Backup withhold on any reportable payments if the payee makes a withdrawal from the account after the close of 7 business days after you receive the awaiting-TIN certificate. Treat as reportable payments all cash withdrawals in an amount up to the reportable payments made from the day after you receive the awaiting-TIN certificate to the day of withdrawal.

No, the W-9 is only used to record and file information for an independent contractor or freelancer and more often than not isn’t even seen by the IRS. A business does not deduct income tax from an independent contractor or freelance and neither does it pay Medicare or Social Security on their behalf.

Turbotax Cd

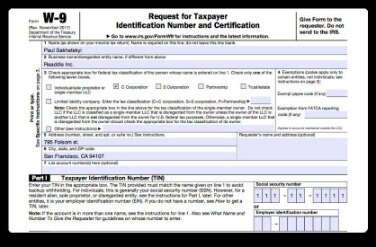

You should submit a new Form W-9 whenever any information you provided on the previous one has changed. Fill out a new form if your name, business name, address, Social Security number, or employer identification number has changed. You don’t know the person or business that’s asking you to fill out the W-9.You should always exercise caution when giving out sensitive information like your TIN. Make sure you know who’s asking you to fill out the form, why they’re doing so, and how the tax information you supply will be used.

Firstly, make sure you are filling in the W-9 requested for legitimate reasons. Secondly, fill in the information correctly so there are no comebacks. There are a few exceptions where you may be asked to fill in the W-9. A bank, brokerage firm or lending institution will request it if it has cancelled a debt that you owe.

- The only time you might be requested to fill in the W-9 as a permanent employee is if you’ve received compensation other than your monthly wages.

- If you need one, check out the IRS’s online application form for the EIN.

- This means that you may have to fill out multiple W-9 forms in the year.

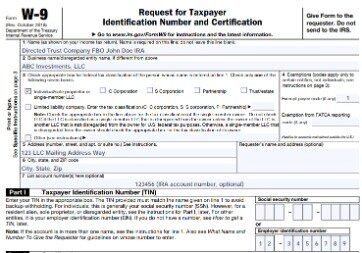

- If you’re an incorporated flow-through entity (i.e. you only pay taxes once, rather than twice like a C corp), you’re probably an S corp.

The person makes his or her own decisions and otherwise controls their professional services provided to a client. For example, a major financial institution could hire a freelance designer to create a new website for the price of $5,000. When the work is complete and the designer’s invoice is submitted, the financial institution pays the designer the full $5,000, without any taxes taken out.

The form is filled out by independent contractors who provide services to companies that have not hired them as full-time employees. If you are paid $600 or less in a single year by a company, you will not need to fill out the form for that company.

Am I Required To Fill Out A W9?

Independent contractors, freelancers and part-time employees responsible for their own tax returns are required to fill in the W-9. If you are fully employed and your employer asks you to fill in the W-9, you need to confirm whether the company sees you as permanent or temporary placement.

Self-employed persons don’t have income taxes or Social Security/Medicare taxes withheld. You and your employer can discuss the issue of your status, but it’s the IRS that ultimately decides whether a worker is an employee or an independent contractor (self-employed). Independent contractors fill out the W-9 to confirm their tax responsibilities and provide information to their employer.

Show the full name and address as provided on Form W-9 on the information return filed with the IRS and on the copy furnished to the payee. If the payee has marked their address “NEW”, you should update your records. If you made payments to more than one payee or the account is in more than one name, enter on the first name line of the information return only the name of the payee whose TIN is shown on Form W-9. You may show the names of any other individual payees in the area below the first name line on the information return. Forms W-9 showing an ITIN must have the name exactly as shown on line 1a of the Form W-7 application. If you are a PFFI reporting a U.S. account on Form 8966, FATCA Report, and the account is jointly held by U.S. persons, file a separate Form 8966 for each holder. Thus, for example, a U.S. financial institution maintaining an account in the United States does not need to collect an exemption code for FATCA reporting.

As a contractor or freelancer, you may have completed jobs for multiple businesses. This means that you may have to fill out multiple W-9 forms in the year. The W-9 form is an IRS tax form that is filled out by providing information about a freelancer or contractor including the name, address and taxpayer identification number .

If the LLC is owned by a single person, list the name of the owner on the “name” line and the name of the LLC on the “business name” line. The Internal Revenue Service would rather have the owner’s Social Security number instead of the LLC’s federal employer identification number. If the LLC is owned by another LLC, check the “limited liability company” box. The purpose of a W-9 request is unclear.If you’re not sure why the requestor wants a Form W-9 from you, ask them what tax documents they’ll use it to prepare for you. By law, you are only obligated to provide a W-9 to parties that intend to pay you interest, dividends, non-employee compensation, or any other type of reportable income.

Form W

It’s not necessary to fill out the W-9 to open up a customer account but financial institutions often use the form because it’s an useful facility for recording a customer’s details. It’s a way of letting the IRS know who carried out work for the company and how much they were paid. The accounting department might also find you a pain and tell your contact to refuse to do further business with you. Businesses have a heavy obligation from the IRS to obtain a completed Form W-9 from anyone they pay $600 or more to during the year. We use analytics cookies to ensure you get the best experience on our website. You can decline analytics cookies and navigate our website, however cookies must be consented to and enabled prior to using the FreshBooks platform. To learn about how we use your data, please Read our Privacy Policy.

If someone unexpected asks for a W-9, ask them why they need it. If their answer doesn’t align with any valid reason, you legally don’t have to provide one. Another quick way to tell is to determine whether the business aspects of the relationship are controlled by the payer.

If you are subject to backup withholding, cross out item two in part two of Form W-9 before submitting it. If you receive dividends or proceeds from stock sales, you will likely have to complete a W-9 form for the broker making the payment.

Expired ITINs must be renewed in order to avoid delays in processing the ITIN holder’s tax return. If the IRS deactivates the ITIN because it has expired, the ITIN may still be used on Form W-9. However, the ITIN holder will have to apply to renew the deactivated ITIN if there is a need to file a tax return. Advise foreign persons to use the appropriateForm W-8 or Form 8233, Exemption From Withholding on Compensation for Independent Personal Services of a Nonresident Alien Individual.

Potential Problems With The Form

Pearson obtained a bachelor’s degree in art from the University of Rio Grande in 1997. When you complete your W-9 form, sign your name and include the date. The IRS will note your signature and view it as a declaration that you’ve verified all the information included on your W-9 form.