Content

After completing her state tax return, she realized she actually only owed $2,500. In 2017, Maria’s state issued her a $500 refund on the amount of tax that was overpaid and sent her Form 1099-G to report the payment. If you have a tax return filing requirement, when it’s time to prepare your return, you’ll include the amount from Box 1 as part of your income on your 1040.Have questions about unemployment and taxes?

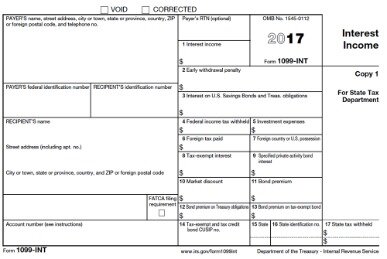

The payor was required to include Form 1096, a letter of transmittal and affidavit certifying the accuracy of each Form 1099. Form 1099 is also used to report interest (1099-INT), dividends (1099-DIV), sales proceeds (1099-B) and some kinds of miscellaneous income (1099-MISC).

No Matter How You File, Block Has Your Back

Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

Consult your own attorney for legal advice. See Peace of Mind® Terms for details. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice.

For whom a financial institution withheld and paid any foreign tax on interest. Brokerage firms, banks, mutual funds, and other financial institutions must file Form 1099-INT on interest over $10 paid during the year. Form 1099-DIV is an IRS form sent by banks and other financial institutions to investors who receive dividends and distributions from investments during a calendar year. Form 1099-MISC is intended to report the income of taxpayers who are not employees, such as independent contractors, freelancers, sole-proprietors, and self-employed individuals.

From whom a financial institution withheld any federal income tax under the backup withholding rules regardless of the amount of the payment. Brokerage firms, banks, mutual funds, and other financial institutions are required to file a 1099-INT on any interest over $10 paid during the year. The form must be reported to the IRS and sent to each interest recipient by Jan. 31st. Form 1099-INT is the IRS tax form used to report interest income. The form is issued by all payers of interest income to investors at year-end. It includes a breakdown of all types of interest income and related expenses.

Looking For More Information?

You may also get a penalty if you filed on paper when you were required to file electronically, if you failed to report a taxpayer ID or it was incorrect, or if you use a paper form that’s not machine-readable. Use Form 1099-MISC to report payments of $600 or more to a specific payee for the year .

- If you get a distribution code No. 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses.

- Once activated, you can view your card balance on the login screen with a tap of your finger.

- A 1099-INT is the tax form used to report interest income to investors and the IRS.

- You might qualify to exclude it, however, if the total of your debts exceeded the total value of your assets immediately before the time of foreclosure.

- This box applies to the FATCA reporting on foreign assets that may be subject to withholding.

Terms and conditions apply; seeAccurate Calculations Guaranteefor details. If you have questions about the taxability of the payments made to you on Form 1099-G or simply have questions about your return, our Tax Pros are here to help. They know the ins and outs of taxes and can help you better understand your return. Regardless of the type of payment, you may need to include some of the information from this form on your return.

Additional state programs extra. Emerald Cash RewardsTMare credited on a monthly basis.

Pay

If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. Your New York State Form 1099-G statement reflects the amount of state and local taxes you overpaid through withholding or estimated tax payments. For most people, the amount shown on their 2020 New York State Form 1099-G statement is the same as the 2019 New York State income tax refund they actually received.

He previously worked for the IRS and holds an enrolled agent certification. If you make contributions to one of these accounts, you stand to save a significant amount of money in taxes both in the short and long term. Not only can you deduct contributions you make to your account in the year made, but the unspent balances can rollover indefinitely from year to year. These balances can be invested and the earnings from these investments will never be taxed so long as withdrawals are spent on qualifying health expenses. Several tax incentives are available for you to save money on medical care costs. Form 1099-K shows the gross amount of income paid by your customers. Generally, you receive a smaller amount after bankcard processing fees are taken out.

To determine the taxable portion, she will refer to the Form 1040 Instructions, line 10. Small Business Small business tax prep File yourself or with a small business certified tax professional. Form 1099-A reports the “Acquisition or Abandonment of Secured Property” to the IRS when you lose a property to foreclosure. If you are experiencing financial difficulties, the CARES Act, enacted by Congress may offer you additional protections against foreclosure. Check with your lending institution to see if you qualify.

However, financial institutions must send Form 1099-K to all businesses with bank card revenue, regardless of whether they are incorporated. Non-profit organizations also receive Form 1099-K. Businesses send Form 1099-MISC, Miscellaneous Income, if you earn more than $600 in freelance work or contract labor during the year. The penalty is applied for each form and it’s based on when you file and if the information is correct.

How Do I Get Form 1099

In 2011 the requirement was extended by the Small Business Jobs Act of 2010 to payments made by persons who receive income from rental property. One notable use of Form 1099 is to report amounts paid by a business to a non-corporate US resident independent contractor for services . The ubiquity of the form has also led to use of the phrase “1099 workers” or “the 1099 economy” to refer to the independent contractors themselves. The form is used to report income, proceeds, etc., only on a calendar year basis, regardless of the fiscal year used by the payer or payee for other Federal tax purposes. For a variety of reasons some Form 1099 reports may include amounts that are not actually taxable to the payee. A typical example is Form 1099-S for reporting proceeds from real estate transactions. The Form 1099-S preparer will report the sales proceeds without regard to the amount of the taxpayer’s “basis” in the real estate sold.

The IRS takes the position that if you still owed $125,000 at the time the lender foreclosed and if you’re no longer liable for repaying it, that’s $125,000 in income to you. The amount reported on Form 1099-G is calculated as tax payments minus Illinois Income Tax liability. Payments may include all estimated payments, credit transfers, return payments, amended tax payments, extension payments, Illinois Withholding Income Tax credit, and pass-through payments. Tax liability refers to Illinois Income Tax liability before any penalty and interest is added.