Content

Whether you are offering an off-the-beaten path bike tour or an Indian cooking class, Vayable allows you to show others what you love about where you’re from while making money. When you refer a friend, they receive $25 in credit towards their first massage. After that, you will receive $25 credit towards your next massage. When you refer a patient, their first visit is free, and you’ll receive $10 towards your next visit. CrowdFlower distributes companies’ “microtasks” to millions of contributors online.

The new shopper will add the code to their application, once that person completes 40 hours of work, you will be paid $25. When you refer a new member, you receive a $5 credit, while they get $10 off their first order and free delivery. Become a Saucey Courier to make great money, set your own schedule & be part of a great community. Saucey makes it easy for you to make money off of your mode of transportation. Thankfully, there is no shortage of food delivery services. Grubhub also allows you to make money with your car as you deliver people food from their favorite Grubhub restaurants.

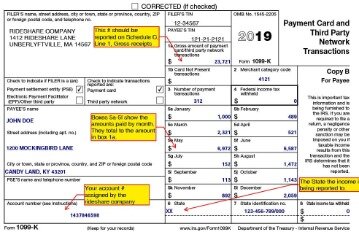

You want to be honest in your reporting to avoid costly fines or penalties down the road. If you’ve just started your business, you will need to estimate your net earnings in order to determine the self-employment tax and to make quarterly payments. If you’ve been in business, you will have a good sense of annual income to determine the quarterly payments. It’s very important to understand that you will always pay self-employment taxes as long as you make more than $400 in a given tax year. You may also pay income taxes, which are figured out differently for different earning brackets.

Refer someone and they receive $10 off their first reservation. DogVacay is a network of more than 20,000 pet sitters across the US and Canada who offer in-home dog-sitting, grooming, boarding, and walking. DogVacay offers 24/7 customer service and premium pet service for every reservation.

Why Generate Forms With Form Pros?

Don’t feel so intimidated by your tax liability after using our free 1099 taxes calculator. In the next section, we’ll show you how you can reduce your tax bill with deductible expenses. It is convenient to submit the paper electronically in PDF format.

Taskers get paid after the completion of a task via TaskRabbit’s online payment system. As an independent contractor, driving for an on demand economy company gives you the ability make money with your extra time. Drive during your lunch break, at night, or during busy weekends – it’s up to you. However, these companies don’t only provide taxi-style services; companies like HopSkipDrive enable the driver to chauffeur kids to their activities around town, similar to a nanny.

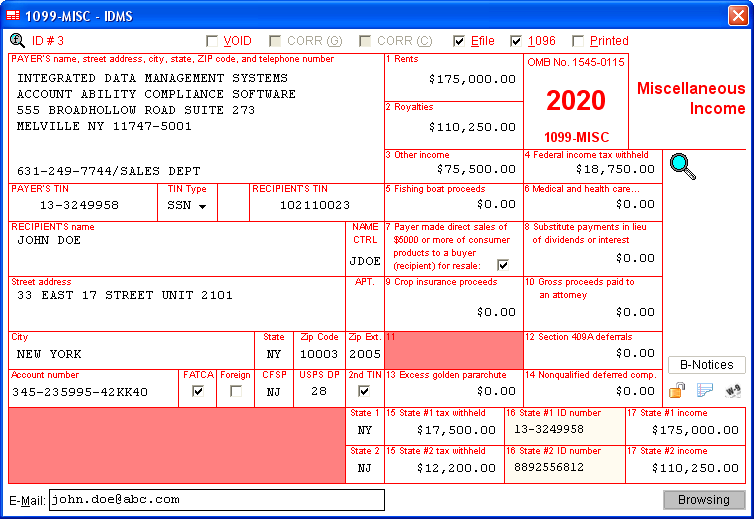

You use the IRS Schedule C to calculate net earnings, and then IRS Schedule SE to calculate how much self-employment tax you owe. If you’re a freelancer, the taxes you pay contribute toward Social Security and Medicare, just as any other taxable U.S. citizen. Here’s all you need to know about completing your 1099-MISC tax return. If you are self-employed as a sole proprietorship, an independent contractor or freelancer and earn $400 or more, you may need to pay SE tax. This is true even if you are paid in cash and do not receive a 1099-MISC. Keep in mind, you may be able to offset this income if you have qualifying expenses.

What Education Expenses Are Tax Deductible 2020

Once you win and complete an assignment, get paid via direct deposit, PayPal, wire transfer, Local Funds Transfer , Payoneer or Skrill. At YourMechanic, you can make money with your mechanic skills by working on your own schedule, performing services right at a user’s own home or office. With SpareHire, you can browse project opportunities privately, so companies will not see your contact information until the final stage of the matching process.

Observers get paid $4-12 per job, which typically only take minutes to complete. Observa connects small businesses with independent ‘Observers’ who inspect and evaluate the quality and appearance of stores. Small business owners benefit from quick insights to improve and correct issues in their business. StyleSeat is your source for beauty and wellness professionals, from hair stylists to massage therapists to personal trainers. StyleSeat gives professionals everything they need to schedule online, as well as a free website to showcase their work.

If you work for an employer, your salary will be reported using Form W2, not 1099. You may think you need one, but it is not necessary to hire lawyer, accountant or notary to help you create the 1099-MISC Form.

Find Out What Your Self Employment Tax Will Be!

Either way, it’s a good idea to set aside some of your earnings throughout the year, so that you have money available when you do pay taxes. The Internal Revenue Service , the federal taxing authority, provides tools for you to use to file and pay taxes.

Each January, you should receive a 1099 MISC form in the mail from each company you did work for in the previous year. If you worked for more than one organization in a year, you can expect multiple 1099 MISC forms. Unlike for salaried jobs, with your filing status, taxes aren’t automatically withheld from your self-employment income pay stubs throughout the year. That means you’re probably not getting a tax refund, and will instead owe the government money when you file your tax return. When you include income from a 1099-MISC on Schedule C of your tax return, you may also need to file a Schedule SE to report the self-employment taxes you owe on your net profit.

Automate Business Interactions With Airslate Products

Form Pros uses advanced encryption standards and therefore ensures the confidentiality and security of your data. We offer a subscription plan so you can create unlimited Form 1099-MISC at a low cost. We also offer a money back guarantee and a free 14-day trial. You have a little extra time to mail the IRS their copy of the form. They must receive it by the last day of February if you are mailing in your taxes or by March 31 if you are filing electronically.

The 1099 Tax Calculator will come in handy if you’re self-employed. You mail 1099-MISC forms to one of three different IRS locations, depending on your principal business location. To find the correct address, see the IRS General Instructions for Informational Returns, Section D. The forms must reach the independent contractors who worked for you by January 31 of the year after they provided services.

Doing it this way you can save considerable money, particularly if you have to create many. If your state has income tax, you will also need to send Copy 1 to the appropriate state tax department. But “someone” is not justanyone.The following conditions must apply in order for you to need to send 1099-MISC forms out. Written by lawyers & paralegals, our forms create legally binding documents that can be emailed or saved to your device. Our advanced but easy to use tool generates your 1099-MISC form in just a few minutes. Eliminates common costly errors when using fillable PDF forms on other websites. Maximize deductions and minimize taxes with QuickBooks Self-Employed’s automated expense tracking.

- Gett is an on demand economy rideshare service that allows drivers to keep 100% of their tips and earn more during peak hours.

- However, it’s important to keep meticulous records of your expenses all through the year.

- Drivers can earn up to $25/hour and set their work schedules according to their particular needs.

- The first way requires each renter to sign a renter’s contract agreement, which lists what the renter is responsible for during the time of the rental.

On average, people discover write-offs worth $1,249 in 90 seconds. On the website when using the form, simply click Commence Now and move towards editor. Note that you must submit the completed document to the IRS by January 31st of the tax-filing year. Pay attention to the figures you prto avoid any misunderstanding. Automate multi-step workflows with ready-to-use Bots, from document routing and notifications to generating documents pre-filled with CRM data.

If you use it solely for your business, and not for personal use, it’s a good bet you can use it to lower your total income earned and pay fewer taxes. In the event that you don’t earn anything after expenses, you won’t owe either income or self-employment tax. Just be sure that you’re aware that consistently earning large amounts of money that has been reported on a 1099, but showing no profit, can cause a red flag for the IRS.

Zeel charges a fee for late cancellations that amounts up to and including the price of the massage itself. When you refer a friend to become a Thumbtack professional, after they make their first quote, you will receive 12 free credits. The Person you referred will get 30% off the first time they buy credit. Gigwalk is a database of quick jobs, or “Gigs” in your area that pay anywhere from $3-$100.

A 1099 form is a record of income you received from an entity or person other than your employer. A 1099-Misc form is a specific version of this that is used to report miscellaneous payments that a company made for the reporting tax year. Examples of income reported on a 1099-Misc include payments to an attorney, health care payments, royalty payments, and substitute payments a person receives instead of dividends. The easiest way to correctly complete and verify the Form 1099 MISC is to use special services like Form Pros. It does not require the installation of additional software, and it saves you time and money.