Content

Constitution was ratified, legalizing the government’s right to collect a federal income tax. That same year, Congress passed legislation that made income tax a part of American life. The federal Coronavirus Aid, Relief and Economic Security Act provided $600 weekly supplemental unemployment benefits for individuals out of work for reasons related to the pandemic. The Coronavirus Response and Relief Supplemental Appropriations Act, passed as part of the Consolidated Appropriations Act of 2021, provides up to $300 in weekly supplemental unemployment benefits. Louisiana taxpayers should be aware of the state tax implications of federal COVID-19 relief measures implemented in 2020.

Punch cartoon ; illustrates the unpopularity amongst Punch readers of a proposed 1907 income tax by the Labour Party in the United Kingdom. Pitt’s income tax was levied from 1799 to 1802, when it was abolished by Henry Addington during the Peace of Amiens.

The first federal income tax was imposed in the 1860s when the government was in desperate need of money to fund the Civil War. Years later, in response to various court rulings declaring the income tax unconstitutional, Congress passed the 16th Amendment to the U.S. The amendment, which took effect in 1913, specifically authorizes direct taxes on income and is the basis for the federal income tax system as we know it today. Part of the 16th Amendment, income taxes are a part of our lives. To find the places with the lowest tax burdens, SmartAsset calculated the amount of money a specific person would pay in income, sales, property and fuel taxes in each county in the country.

State And Local Finance Initiative Subscribe To Rss

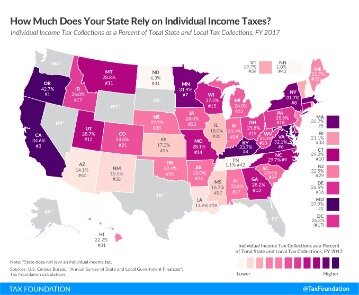

Corporate income taxes contributed an additional $324 billion, or 9 percent of federal revenue. Income tax is also levied by most U.S. states and many localities on individuals, corporations, estates, and trusts. These taxes are in addition to federal income tax and are deductible for federal tax purposes. State and local income tax rates vary from 1% to 16% of taxable income.

- Generally, nonresident individuals are taxed on wages earned in the state based on the portion of days worked in the state.

- Partnerships are not taxed, but their partners are taxed on their shares of partnership income.

- Anyone who receives a 1099-G tax form from LWC that documents unemployment benefits they did not receive, or overstates benefits they did receive, should report the possibility of fraud.

- All taxpayers must file those forms for credits, depreciation, AMT, and other items that apply to them.

- They are also subject to tax on capital gains upon sale or exchange of their shares for money or property.

The Internal Revenue Code states that “gross income means all income from whatever source derived,” and gives specific examples. The amount included is the amount the taxpayer is entitled to receive. Gains on property are the gross proceeds less amounts returned, cost of goods sold, or tax basis of property sold.

If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling). If the standard deduction is larger than the sum of your itemized deductions , you’ll receive the standard deduction. Many taxpayers claim the standard deduction, which varies depending on filing status, as shown in the table below. Your location will determine whether you owe local and / or state taxes. A tax table is a chart that displays the amount of tax due based on income received as a discrete amount, a percentage rate, or a combination of both. State and IRS Tax Refund & Stimulus Tracking Guide by Tina Orem Everything you need to track your stimulus check, federal tax refund and state tax refund — plus tips about timing. Your state might have different brackets, a flat income tax or no income tax at all.

What Are The Different Types Of Income Tax?

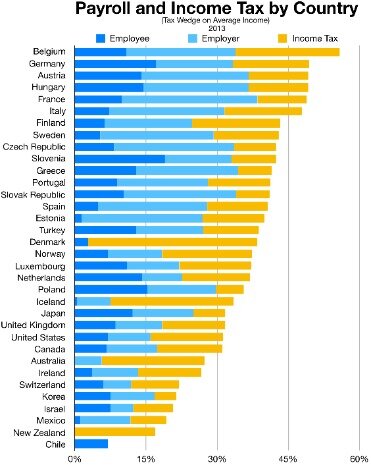

Comparison of tax rates around the world is a difficult and somewhat subjective enterprise. Tax laws in most countries are extremely complex, and tax burden falls differently on different groups in each country and sub-national unit.

When it comes to taxes, all the record keeping and paperwork to keep track of can be exhausting. But hey, depending on where you live, you might have to deal with federal, stateandlocal taxes . If you’re feeling overwhelmed this tax season, work with one of ourtax Endorsed Local Providers in your area. That way, you can rest easy knowing you have a tax advisor on your side to help you get your taxes done right. The Department previously submitted the following proposed rule to the Iowa Legislature, Collection of Court Debt, which has been adopted and filed, effective January 1, 2021. On December 27, 2020, President Donald Trump signed Public Law , the Consolidated Appropriations Act, 2021. This federal law includes a number of federal tax changes, some with retroactive effect.

Please help us keep our site clean and safe by following our posting guidelines, and avoid disclosing personal or sensitive information such as bank account or phone numbers. Any comments posted under NerdWallet’s official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you. Here’s a quick look at some of our top-rated tax-software providers. directly reduce the amount of tax you owe; they don’t affect what bracket you’re in. Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992.

What’s Wrong With The American Tax System

All other taxes are commonly referred to as “indirect taxes,” because they tax an event, rather than a person or property per se. Persons paying wages or making certain payments to foreign persons are required to withhold income tax from such payments. Income tax withholding on wages is based on declarations by employees and tables provided by the IRS. Persons paying interest, dividends, royalties, and certain other amounts to foreign persons must also withhold income tax at a flat rate of 30%.

It has been argued that head taxes and property taxes were likely to be abused, and that they bore no relation to the activities in which the federal government had a legitimate interest. The fourth clause of section 9 therefore specifies that, “No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken.” President Abraham Lincoln and the United States Congress introduced in 1861 the first personal income tax in the United States. Employers and employees must also pay Social Security tax, the employee portion of which is also to be withheld from wages. Withholding of income and Social Security taxes are often referred to as payroll tax.

Income Tax In The United States

According to the Congressional Budget Office, individual income taxes are the federal government’s top source of revenue. In 2017, for example, individuals are expected to have paid about $1.66 trillion in income taxes, amounting to 48 percent of federal revenue.

Top individual tax rates were lowered in 2004 to 35% and tax rates on dividends and capital gains lowered to 15%, with the Bush administration claiming lower rates would spur economic growth. From 1964 to 2013, the threshold for paying top income tax rate has generally been between $200,000 and $400,000 . The one exception is the period from 1982 to 1992 when the topmost income tax brackets were removed.

But it also means you might have to pay quarterly takes to the IRS. Let’s take a look at Kentucky, which has a flat 5% tax on income. If you made $50,000 last year and your neighbor brought in $500,000, both of you will be taxed 5% by the state of Kentucky. There are nine states that keep things simple.Really simple.They have aflat tax rate.That means it doesn’t matter how much or how little you earn—you’re taxed at the same rate as everyone else.

A possible solution to this problem will be to cut the marginal taxes on the income as suggested by Carrol et al . Although this is a potential solution it should be carried out with a grain of salt to ensure that there is an even playing field for both entrepreneurs and incumbent innovative businesses.