Content

Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Fees apply if you have us file a corrected or amended return. What if I receive another tax form after I’ve filed my return?

If you were to sell your investments and donate the cash, you’d be on the hook for capital gains. Taxpayers in search of last-minute savings can give directly to the organization or use a tax-advantaged account known as a donor-advised fund. Southern New Hampshire University is a registered trademark in the United State and/or other countries. H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit. Additional feed may apply from SNHU.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Did you make a tax-deductible donation to Goodwill and need to fill out a tax receipt?

Do Charitible Contributions Affect Income Taxes?

H&R Block employees, including Tax Professionals, are excluded from participating. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund.

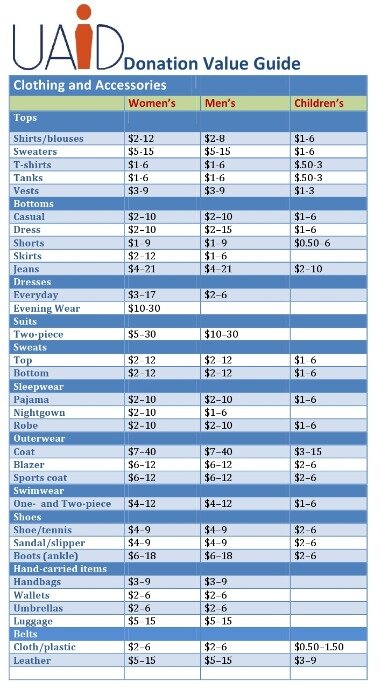

To write off any cash contributions, no matter how small, you need a canceled check, bank record or a receipt with the charity’s name and donation amount. That means that putting cash in the church collection plate or the Salvation Army bucket is a no-no if you want to be able to take a deduction for it. If you’re not sure whether the group you want to help is approved by the IRS to receive tax-deductible donations, check online at IRS Exempt Organizations Select Check. If you end up donating items worth more than $500, you have to file IRS Form 8283, to which you can attach your itemized lists for the year. To itemize your clothing donation, you’ll first determine the fair market value and then use IRS Form 8283.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services.

If you’ve already e-filed or mailed your return to the IRS or state taxing authority, you’ll need to complete an amended return. You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. If you donate property to a nonprofit such as clothing, electronics, or furniture, you need to determine how much it is worth when you donate it. You can only deduct this amount on your taxes as a charitable donation. You can’t come up with this value out of thin air. Moreover, because of past valuation abuses by taxpayers, the IRS has imposed special rules for valuing some types of property. Clothing donations are taxable as long as you itemize on your taxes.

Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers. Bird served as a paralegal on areas of tax law, bankruptcy, and family law. She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published author of over 30 books.

Talk To A Tax Attorney

Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. If you’re thinking of getting a new vehicle and donating your old one to get the deduction, check outauto loan ratesat Bankrate.com. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

Check cashing fees may also apply. Check cashing not available in NJ, NY, RI, VT and WY. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator .

We are an independent, advertising-supported comparison service. If you are a member, the form will manage your subscription. We can provide donation receipts to document the value of your donation. When making a donation to Goodwill, ask the sales associate for a receipt. Use the slider to estimate the fair market value of an item. To determine the fair market value of an item not on this list below, use this calculator or 30% of the item’s original price. Some software programs will help you calculate values, but make sure the version you’re using isn’t out of date.

Donation Valuation Guide

I would suggest making several trips if you are going over the $250 threshold. IRS Publication 561, Determining the Value of Donated Property, gives a good explanation of how these factors should be used to determine an item’s fair market value.

- The IRS defines fair market value as what a consumer would willingly pay for an item if neither the seller nor the buyer was under any duress to make the sale.

- You need to combine all deductions for similar items you donated to all organizations in the year.

- In addition to money you give to nonprofit causes you support throughout the year, you can also claim items you donate.

- If you aren’t sure, the IRS maintains a database called the Tax Exempt Organization Search.

Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings®account. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. US Mastercard Zero Liability does not apply to commercial accounts . Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions.

OBTP# B13696 ©2018 HRB Tax Group, Inc. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax®offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities.

Turbo Tax Itsdeductible – Lists values of thousands of household items, clothing, games, etc. as either Medium or High value. They based their values on survey of thousands of thrift stores across the country. You can use it separately or as part of doing your taxes using Turbo Tax. As you check off items online, it adds up your charitable deductions and creates a record you can download. • Don’t overestimate the value of your donations. When coming up with a value, consider the item’s age and quality.

You might be contributing less than the entire interest in the donation. If so, you must show the amount you’re claiming as a deduction for the year as a result of the donation. The organization gives out free, unordered items with a donation request. Goodwill Industries – Offers a printed form that lists values of 66 items showing one value or a range of values for each item. Special rules apply to donations of automobiles and other vehicles.

How To Donate Books For Tax Deductions

CharityDeductions.com also allows you to create donation lists with valuations. Unfortunately, not every charitable donation is tax deductible. If you gave your unused clothing to a friend, for instance, you can’t claim it on your taxes, even if your friend lost all her clothing in a disaster.