Content

Enter your filing status, income, deductions and credits into the income tax calculator below and we will estimate your total taxes for 2016. Based on your projected withholdings for the year, we can also estimate your tax refund or amount you may owe the IRS for 2017. Typically, you receive a tax refund after filing your federal tax return if you pay more tax during the year than you actually owe.

For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

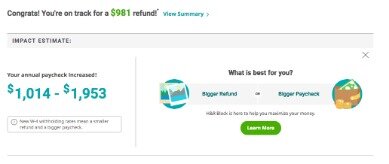

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. and situation, helping to reduce the amount of income tax you owe to the federal and state governments. In most cases, tax credits cover expenses you paid thought the year and come with requirements you must satisfy before you can claim them. Quickly estimate your 2020 tax refund amount with TaxCaster, the convenient tax return calculator that’s always up-to-date on the latest tax laws. This interactive, free tax calculator provides accurate insight into how much you may get back this year or what you may owe before you file.

What Education Expenses Are Tax Deductible 2020

Using these calculators should provide a close estimate of your expected refund or liability, but it may vary a bit from what you ultimately pay or receive. Doing your taxes through a tax software or an accountant will ultimately be the only way to see your true tax refund and liability. You may reduce taxable income by either claiming the standard deduction or itemize deductions. Our tax calculator will consider both as it determines your refund estimate or estimate of how much you may owe. Your tax bracket is determined by your taxable income and filing status. When you use our tax refund estimator, we’ll ask you questions about these details to let you better calculate your estimated taxes.

Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Description of benefits and details at hrblock.com/guarantees. Small Business Small business tax prep File yourself or with a small business certified tax professional.

Do I Have To File Taxes If I Made Less Than $10,000?

All prices are subject to change without notice. Our free tax calculator is a great way to learn about your tax situation and plan ahead. But we can also help you understand some of the key factors that affect your tax return estimate in 2021. Once you’ve gathered the necessary documents, you’re nearly set to file.

You and TaxSlayer agree to submit to the personal and exclusive jurisdiction of the courts located within the state of Georgia. TaxSlayer is taking reasonable and appropriate measures, including encryption, to ensure that your personal information is disclosed only to those specified by you.

MethodologyEach tax season millions of U.S. taxpayers are issued refunds for the amount of money they overpaid within that tax year. Meanwhile, some taxpayers end up owing money to the IRS after filing their taxes because they underpaid throughout the year. SmartAsset analyzed data from the IRS to determine the counties where people received the highest average tax refunds and the counties where people owed the most money after filing their taxes. Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due.

ATL deductions lower AGI, which means less income to pay taxes on. They include expenses that are claimed on Schedules C, D, E, and F, and “Adjustments to Income.” One advantage of ATL deductions is that they are allowed under the alternative minimum tax. ATL deductions have no effect on the BTL decision of whether to take the standard deduction or to itemize instead.

There are many stringent measures in place for dividends to be legally defined as qualified. The range of taxation can be as high as 23.8% for the highest tax bracket to tax-free for the lowest tax bracket. Bankrate.com is an independent, advertising-supported publisher and comparison service. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. At the higher end in price but also in terms of features and easiness to use.

Find A Reputable Tax Refund Calculator

H&R Block does not automatically register hour with SNHU. Students will need to contact SNHU to request matriculation of credit.

You can use the quarterly vouchers included in IRS Form 1040-ES to make these payments. Credit Karma is committed to ensuring digital accessibility for people with disabilities.

But you may still want to file if you worked during 2020 and your employer withheld tax from your paycheck. Filing a tax return — even if you’re not required to do so — is the only way to get any tax you’re owed refunded to you. Adjusted gross income is your gross income minus above-the-line adjustments . These can include certain business expenses, contributions to health savings accounts, educator expenses, student loan interest and other adjustments.

The maximum credit is paid until earnings reach a specified level, after which it declines with each additional dollar of income until no credit is available. Families with children receive a much larger credit than those without qualifying children. For the most part, this credit is refundable. BTL deductions refer to the Standard Deduction or Itemized Deductions from Schedule A and personal exemptions.

Technically, you can start filing as soon as you receive your W-2s from your employer. This usually happens around the end of January, but varies depending on your employer. available and you can also see how much you’d get by calculating your refund. Here are some tools to help calculate your refund. See IRS Form 1040-ES for copies of vouchers and details on these and other payment methods.

The rest of us will owe the government money. Owners of partnerships, LLCs, and S corporations are not employees of the business. They receive payments periodically from the business, and these payments are added to their personal tax returns. Be sure your tax preparation software is the small business or self-employed version. Before you buy, check to be sure it includes Schedule C and Schedule SE (for self-employment taxes). Business tax return versions are usually for a specific business type, like partnerships, corporations, and S corporations.

The merchants and information and service providers offering merchandise, information and services through the Site set their own prices and may change prices or institute new prices at any time. You agree to pay all charges incurred by users of your account and credit card or other payment mechanism at the prices in effect when such charges are incurred. You also will be responsible for paying any applicable taxes relating to purchases through the Site. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return.

How To Estimate Your 2021 Tax Refund: Tips, Calculators And More

H&R Block Emerald Prepaid Mastercard® is issued by MetaBank®, N.A., Member FDIC, pursuant to license by Mastercard International Incorporated. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Additional fees, terms and conditions apply; consult your Cardholder Agreement for details.

We are continually improving the user experience for everyone, and applying the relevant accessibility guidelines. iPhone is a trademark of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

- You and TaxSlayer agree to submit to the personal and exclusive jurisdiction of the courts located within the state of Georgia.

- Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services.

- Use tax preparation software to run a rough calculation of estimated taxes for the next year.

- Nonrefundable credits can reduce total tax liability to $0, but not beyond $0.

- You can use Form W-4 to reduce your withholding easily right now so you don’t have to wait for the government to give you your money back later.

Corporations usually use Form 1120-W to calculate their estimated tax. You can use the estimated taxcalculation worksheet provided by the IRS on Form 1040-ES or using the worksheets included in Publication 505. An estimate of business expenses for the year, using previous years as a guideline or using year-to-date expenses and projecting them through the end of the year.

Income

As a result, a tax credit is generally more effective at reducing the overall tax bill when compared to a dollar-equivalent deduction. Broadly speaking, tax exemptions are monetary exemptions with the aim of reducing, or even entirely eliminating taxable income. They do not only apply to personal income tax; for instance, charities and religious organizations are generally exempt from taxation. In some international airports, tax exempt shopping in the form of duty free international shops is available. Other examples include state and local governments not being subject to federal income taxes. In order to find an estimated tax refund or due, it is first necessary to determine a proper taxable income.