Content

Writing off your real estate taxes could save you a significant amount of money on your taxes, depending on how much you pay in property tax, state and local taxes and personal property taxes each year. The key, though, is to determine whether you can save more money by itemizing your taxes instead of claiming the standard deduction. Because the standard deduction is now higher, fewer taxpayers will benefit from itemizing.

A local compensatory initiative under Proposition 218 is an alternative option when contract impairment problems are present. Proposition 218 was an initiative constitutional amendment approved by California voters on November 5, 1996. Called the “Right to Vote on Taxes Act,” Proposition 218 was a constitutional follow-up to Proposition 13.

This statement lists the amount of mortgage interest you pay during the year. But it also lists the property tax payments your lender has made on your behalf. Personal property taxes are those levied on all property that doesn’t fit into the “real property” category. These taxes are on movable assets such as cars, boats, livestock and other items that you own.

Property Tax In San Diego

In instances where the number of registered voters within a Community Facilities District is very small, the required election is held as a property owner election. Sometimes a real estate developer is the only “voter” in such property owner elections that approve a Mello-Roos tax. The Mello-Roos tax calculation often takes into account property characteristics, such as square footage of the home and lot/parcel size. The tax is included with your general property tax bill as a special tax lien and is recorded as a “Notice of Special Tax Lien.” If the Mello-Roos is delinquent for more than 90 days, then the CFD has a right to foreclose on the property. Mello-Roos taxes are a special type of tax that impacts some properties in California. Properties that are subject to it can have an additional levy of 1 percent to 1.5 percent at initial assessment, plus an increase of as much as 2 percent per year.

After Proposition 13, property tax values were frozen at 1976 assessed values and property tax increases could not be greater than 2% per year as long as a home was not sold. Once it was sold, the property was reassessed at 1% of the sale price and the 2% annual cap was reinstated.

What Is Property Tax Assessment?

The GCM concludes that, even though not based on the value of the property, these “special taxes” are still determined by a “like-rate” against all property in the jurisdiction. The GCM concludes that an analysis of the facts and circumstances of these special taxes may be necessary. California income taxes represent only a percentage of a taxpayer’s overall tax burden. However, many taxpayers’ community facilities district special taxes can be as much as nearly one-half of the taxpayers’ overall property tax bill. In the current economic climate, the loss of the deduction should prove to be significant for a large number of taxpayers. The impact on affected taxpayers will likely cause many to scour disclosure materials used in connection with the purchase of their homes to determine how the special taxes were treated.

- To determine if your home’s Mello-Roos tax can be paid off, you can contact the County of San Diego Auditor & Controller, Property Tax Services department.

- The Tax Cuts and Jobs Act also increased the standard deductions that homeowners can take.

- You can also enter the state and local taxes you paid during the year on line 5a, your state and local real estate taxes on line 5b and your state and local personal property taxes on line 5c.

- Many older communities have imposed Mello-Roos taxes on areas that include older homes not previously subject to Mello-Roos taxes.

Mello-Roos taxes generally are not deductible from federal taxes as they do not satisfy IRS requirements for the deduction. A Mello-Roos allows a local county or city government or school district to sell bonds in order to finance a specific project or service. Projects permitted under California law range from infrastructure improvements to police and fire services, schools, parks, and childcare facilities. A Mello-Roos tax or charge levied to finance a service is generally subject to reduction or repeal using the local initiative power under Proposition 218, including the significantly reduced petition signature requirement thereunder.

Districts And Taxes

This is advantageous to the buyer because the Mello-Roos tax portion of the tax bill is not a tax deduction. If a buyer were to take out a mortgage, the interest on the entire mortgage is a tax deduction.

Homeowners are able to calculate the amount of Mello-Roos that they have to pay. Owners who commit to living in the district for a long term see the benefits of paying off the Mello-Roos early so that they do not face the maximum 2% Mello-Roos increase.

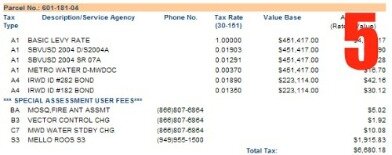

Although Proposition 13 tax limits are on the value of real property, Mello-Roos taxes are equally and uniformly applied to all properties. if you don’t pay it on time, then the facilities district that obtained the lien can withdraw the assessment from the tax roll and commence judicial foreclosure. Historically, the Franchise Tax Board (“FTB”) has not often audited property tax deductions claimed on taxpayers’ returns. Most taxpayers know that property taxes and mortgage interest are tax deductible, but until you move into a Community Facilities District in California, you probably haven’t heard of Mello-Roos before. For most counties, these amounts are identified on the tax bills as amounts that do not include a tax rate percentage.

Community Facilities Districts , more commonly known as Mello-Roos, are special districts established by local governments in California as a means of obtaining additional public funding. Counties, cities, special districts, joint powers authority, and schools districts in California use these financing districts to pay for public works and some public services. If you review your property tax bill, one clear indicator that a tax is deductible is if there is a tax rate shown. That means the tax was assessed based on the value of the home, which makes it tax deductible. Mello-Roos taxes can be tax deductible if it meets all of those conditions, but Mello-Roos taxes are often used for a variety of local purposes. They can be used for public services, like police and fire protection, as well as maintenance and repair, like fixing schools, libraries, sidewalks, and electrical lines.

When Proposition 13 was passed in 1978, it limited how local governments could tax real estate. Before Proposition 13, real estate property taxes averaged a little under 3% of market value.

If you own your home, your bill for Mello-Roos will be sent to you with your other property taxes each year. If you’re paying Alhambra property tax, for instance, you’ll see it in the bill Los Angeles County sends to your house which builds this tax in to what you owe. A portion of such assessments for local benefits may be deductible if they are made for the purpose of maintenance or repair, or for the purpose of meeting interest charges with respect to those local benefits. The burden is on the taxpayer, however, to show that a portion of the amount assessed is allocable to these purposes and should be deductible. I do my taxes with turbo tax.I am looking into solar and have a question.

The bonds must be paid off within 40 years, ending the special tax – although many Mello-Roos districts expire sooner. Mello-Roos taxes pay for the construction of new community improvements and services by shifting the cost to the community’s residents. Many communities with Mello-Roos taxes have new schools and generous packages of amenities. Mello-Roos communities are also frequently growing and may enjoy relatively low crime rates thanks to the availability of money to pay for additional policing.

Tax Pro Or File Your Own?

To determine if your home’s Mello-Roos tax can be paid off, you can contact the County of San Diego Auditor & Controller, Property Tax Services department. For a fee, the department will determine the amount of pay off based on the Rate and Method of Apportionment of Special Tax, also known as the taxing formula. The special Mello-Roos tax stays in effect as long as needed to repay the principal and interest on the special bond along with any reasonable administrative costs. Mello-Roos bonds carry a typical time frame of twenty five to forty years for repayment. Santaluz Mello-Roos tax is projected to be paid off between 2030 and 2033. The Black Mountain Ranch Villages are determined to be paid off between 2036 and 2037. There are instances where the builder on a new home enclave absorbs the costs of infrastructure on a new home and passes on the fees in the form of a price increase.