Content

However, if you filed after the tax filing deadline for that year, the period begins on the date you actually file. So, once you file a joint return you can not change it to a separate return if the filing deadline has already passed. The IRS allows you to change your filing status for a tax return you’ve already filed if no more than three years have passed since the original tax filing deadline. For example, if you filed as a single taxpayer last year, but now realize you qualified for head of household, you need to make the change on an IRS Form 1040X.

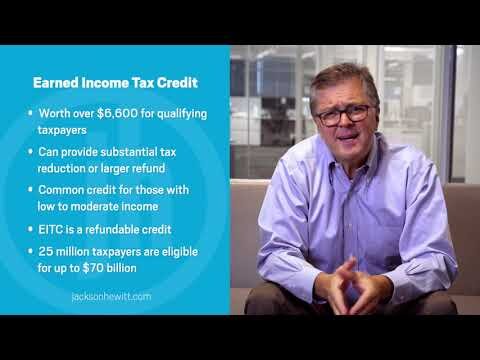

“You generally give up a lot and pay a lot more in taxes to file separately,” says Joe Orsolini, president of College Aid Planners. Your filing status determines important factors, such as your tax rates and standard deduction, which is the amount of income that’s not subject to federal income tax. Therefore, having the right filing status can help you get the biggest refund. After the IRS accepts your Married Filing Separately tax return, if you need, you still can amend your return to a Married Filing Joint filing status return for up to 3 years after the original tax deadline . Eligible couples filing jointly can make contributions to two separate IRA accounts – one for each spouse – and receive substantial tax benefits. Another great benefit of filing jointly is the raised limit to charitable contributions that may be deducted in a year.

Adjusted gross income also determines if a couple can use un-reimbursed health care costs and casualty losses on Schedule A to save taxes. Spouses with union dues, job-search costs, tax-preparation fees and un-reimbursed business expenses may find their miscellaneous deductions don’t qualify when their higher combined income raises their AGI. Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ). A senior product specialist with Credit Karma Tax®, Janet Murphy is a CPA with more than a decade in the tax industry. She’s worked as a tax analyst, tax product development manager and tax accountant. She has accounting degrees and certifications from Clemson University and the U.S. In 2020, the standard deduction is $12,400 for separate filers.

Just be sure to use the name shown on your Social Security card. Many married couples find it best to file jointly since that usually provides the larger refund and you don’t have as much due in taxes. Yes, you may file as Married Filing Separately even if you filed jointly with your spouse in previous years. However, Married Filing Separately is generally the least advantageous filing status if you are married. You can only choose “married filing jointly” or “married filing separately” status.

You can click My Account in top right and then Save & Sign Out to save your return. If your spouse passes away, you may use either the married filing jointly or filing separately status for the tax year of your spouse’s death.

“You are allowed to choose the status that most benefits you, and you can choose a different status each year by making the same assessment each time.” For example, if you and your spouse file jointly and earn a combined AGI of $100,000, you would have to rack up more than $7,500 in doctors bills before you could begin deducting any of these expenses. Conversely, if you chose to file separately with an AGI of $40,000, your medical bill total would only have to exceed $3,000, which is 7.5% of $40,000.

What Is Your Filing Status?

If you’re legally married as of December 31 of the tax year, the IRS considers you to be married for the full year. Usually, your only options are to file as either married filing jointly or married filing separately. Married Filing Jointly is usually better, even if one spouse had little or no income. When you file a joint return, you and your spouse will each receive the $4050 personal exemption, plus the married filing jointly standard deduction of $12,600 (add $1250 for each spouse over the age of 65).

Maybe you’ve heard of the so-called marriage tax penalty, a quirk in the tax law that sometimes causes married couples to pay more income tax than they would if they had remained single. Marriage penalties occur when the tax brackets, standard deductions, and other aspects of the tax code available to married couples aren’t double those available to single taxpayers. Unfortunately, court costs and legal fees related to a divorce are not tax deductible. For tax years prior to 2018, however, you may be able to deduct any portions of those fees related to tax advice and alimony. These can include expert counsel on how your separation or pending divorce affects all types of taxes, such as income, property and estate, at all levels of taxation. Ending a marriage puts both partners on a federal tax path requiring forethought and planning to navigate.

While “it’s almost always better to file jointly because of a lower tax responsibility overall,” there are “very specific situations” when it pays to submit separate returns, Guglielmetti says. Choosing your filing status is one of the first things you do when you start preparing your tax return online. Once you select your filing statuseFile.com will then apply the correct tax rates and standard deduction amounts to your return. For example, numbers 8-10 make the Married Filing Separately status not a good choice, tax-wise, for students. In any case, it is a good idea to estimate your tax refund or liability using both Married filing statuses so you know which one would be most beneficial to you. If you and your spouse file separate returns, your access to certain tax benefits will be severely limited. Because of this, the combined tax calculated on separate returns is generally higher than the tax calculated on a joint return.

Guide To Filing A North Carolina State Tax Return

If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

This will make your tax refund smaller but it will put more money in your paychecks throughout the year. If you are unmarried, see if you qualify as head of household. Filing as head of household rather than single allows you to claim a much larger standard deduction.

For example, two spouses may choose to file separately if they’re planning to divorce and wish to keep their finances separate. Some people aren’t required to file a federal income tax return if they meet certain age and income requirements for their filing status. But most separate filers will have to file a federal income tax return.

However, this tax filing status requires that you pay more than half the costs to maintain your home and to have a dependent who lives with you for more than half the tax year. To avoid paying taxes on up to $250,000 profit from selling a home, one spouse must have lived in and owned the house for at least two of the last five years. Speaking of your jobs, being married could open up some new opportunities to save through your employer. Draw up a list of the tax-favored fringe benefits at each workplace. If you can be covered by your spouse’s medical plan, for example, maybe you can trade your coverage for another benefit. For married couples filing jointly, that threshold is just $622,051 — far from double that available to single taxpayers.

In California, Nevada or Washington, community property law extends to same-sex registered domestic partners—RDPs. But they do not have the option of filing a joint federal return unless they are married. The IRS does not recognize their relationship unless they are married under state law. They must file separate federal income tax returns as “head of household” or “single” and include their separate and community income. Californian RDPs must also prepare a mock “married filing jointly” 1040 return in order to complete the California state tax return.

In addition to decisions about assets and child custody, separated couples have choices that affect how much they pay Uncle Sam. Some of these choices can be made independently; others require you to communicate with each other. When they compare the tax due amount under both joint and separate filing statuses, they may discover that combining their earnings puts them into a higher tax bracket. That means it’s possible for your income to fall into multiple tax brackets. If that’s the case, then you’ll pay the rate for each bracket only on the portion of your income that falls within the thresholds of that bracket. And for most brackets, there’s an additional amount of tax you’ll pay besides the percentage of income.

Of the 150.3 million tax returns filed in 2016, the latest year for which the IRS has published statistics , 3.07 million belonged to twosomes who filed separately. If you’re married, there are circumstances where filing separately can save you money on your income taxes. For example, a married couple filing a separate return in 2020 and who has taxable income of $35,000 would pay 10% on the first $9,875 of taxable income and 12% on the remaining $25,125. For example, “if one spouse earns $1 million a year, and the other earns $80,000, that might be an instance where you would use married filing separately,” says Ingram. If you have a dependent living at home and you’re considered unmarried by the IRS, you may qualify for the head-of-household filing status, which is typically more beneficial than married filing separately.

Tip 3: Figure Your Tax Both Ways

Casualty losses must also total more than 10% of AGI and occur in a federally declared disaster area.

- Once you’re back from the honeymoon, you and your spouse may need to adjust the withholding from your paychecks.

- For example, a married couple filing a separate return in 2020 and who has taxable income of $35,000 would pay 10% on the first $9,875 of taxable income and 12% on the remaining $25,125.

- The more unequal two spouses’ incomes, the more likely that combining those incomes on a joint return will pull some of the higher earner’s income into a lower bracket.

- Read on to learn more about the Married Filing Separate status, its advantages and disadvantages, and how to file a Married Filing Separately tax return on eFile.com.

- Separated couples face choices that can have significant tax consequences.

- When Dr. Phil says marriage isn’t a 50/50 proposition, he’s not referring to spouses owning property in a community property state.

If both you and your spouse earn an income and you file jointly, your medical expenses would have to be higher in order to be able to make any deductions. But if you file separately — so your tax return reflects just one or your salaries — “you will reach the threshold faster and be able to deduct more of those expenses earlier on,” says Guglielmetti. When you prepare and e-File a tax return as Married Filing Separate, you and your spouse each file your own return, and report your own individual income, deductions, credits, on your separate tax returns. That way, you and your spouse are only responsible for your own individual tax liability. You will not be responsible for any tax, penalties, and interest that results from your spouse’s tax return. The first thing you and your spouse must decide on is whether to file as married filing jointly or married filing separately. If you do face a marriage penalty, don’t try to get around it by continuing to file as a single person.

For years, taxpayers complained about the marriage penalty, which used to happen when spouses who earned similar salaries, when combined, pushed the couple into a higher tax bracket than if they were single. Congress took steps to reduce that penalty, making the tax bill for married couples filing jointly closer to the combined total they would have owed as single taxpayers. Depending on the incomes, there still can be a marriage penalty. But if the taxpaying spouses have substantially different salaries, the lower one can pull the higher one down into a lower bracket, reducing their overall taxes.

Otherwise, if the name on your tax return doesn’t match the name the SSA has on file, it will likely cause problems at the IRS when your return is processed. If you’re expecting a tax refund, it might be delayed until the discrepancy is resolved. By filing separately, you lose the ability to claim earned income and higher education tax credits, among other breaks the IRS offers. But when filing separately, only one parent can claim a qualifying child — and many of the tax breaks that follow. Generally, the parent who provides the child’s housing for most of the tax year gets to claim the child and the tax breaks. If the child lived with both parents equally, then the IRS requires the parent with the highest adjusted gross income to claim the child.

That means if your spouse owes and you file jointly, you and your refund could be on the hook for their debt. One of the first boxes you’ll check on an income tax return is your filing status.

Filing Can Take Less Time And Expense

However, your new status can bring you lots of tax savings—perhaps even enough to pay for your recent honeymoon. Your filing status is very important because it determines the amount of your standard deduction and the tax rates and brackets your income is subject to. You can change your tax filing status each year as long as you satisfy its specific eligibility requirements. You may need to select a tax filing status, adjust your withholding and sell your home. You can see in more details hereIs it better for a married couple to file jointly or separately? And you will find more details on why you’d want to file separately on that page as well.

Newly married couples may have access to a variety of tax breaks depending on whether they file jointly or separately, as these tax tips will reveal. Enjoy your wedded bliss even more with the help of this video on tax basics. Evaluate whether you are eligible for a different filing status in one of the last three years. Choosing your filing status is an important first step for preparing your federal tax return. Your filing status determines your standard deduction, tax rates and brackets. If you’re up against the tax filing deadline and haven’t yet changed your name with the SSA, you can still file a joint return with your spouse.

Keeping track of separate assets also serves as a financial security blanket should your marriage fail. “Spouses with more at risk can use a prenuptial agreement to protect their separate assets,” adds Dentartigh, who finds that problems usually arise at divorce time. The good news is that once you’re married, the amount of tax-free profit you can receive from the sale of your home doubles from $250,000 to $500,000. Once you’re back from the honeymoon, you and your spouse may need to adjust the withholding from your paychecks. If one spouse itemizes deductions, both must itemize — even if the standard deduction would result in a lower tax bill for the other spouse. When two high-earning spouses have relatively equal incomes, the odds of getting hit with the marriage penalty go up.

Even if filing separately does make sense for your situation, there are still a few downsides you should know about. We think it’s important for you to understand how we make money. The offers for financial products you see on our platform come from companies who pay us.