Content

Now that you know your projected withholding, the next step is to estimate how much you’ll owe in taxes for this year. Thenadd the two togetherto get your total household tax withholding. Ready to get your tax withholding back on track? And besides, it’s always a good idea to do a “paycheck checkup” once in a while just to make sure your employer isn’t withholding too much on payday. Many employers have an automated system for submitting an employee’s changes for Form W-4. Please be sure to check with your employer to see if they have this option available.

The employee has a relatively simple tax situation. When they filled out Form W-4, they wrote that they did not have another job or a working spouse.

Even though tax returns are due in April, you pay your tax bill a little at a time all year long through a process called tax withholding. Some employees receive tips but don’t report them to their employers, so no tax is withheld from this money. You should use Form 4137 to calculate the amount of Social Security and Medicare tax due on unreported tips and report this additional amount on your tax return. One employer might not know about earnings from another that can push your overall wages over the wage base limit, so they continue withholding even though they no longer have to.

Your W-4 can either increase or decrease your take home pay. If you want a bigger refund or smaller balance due at tax time, you’ll have more money withheld and see less take home pay in your paycheck. If you want a bigger paycheck, you’ll have less withheld and have a smaller refund or larger balance due at tax time.

Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating. If your state has an income tax, you will probably have state income taxes withheld from your paycheck. Your employer will use information provided on the state version of Form W-4 and your income to determine how much to withhold. Your employer sends the federal income tax withholding to the IRS on your behalf. Your goal is to have at least enough FITW during the year to cover your expected federal income tax liability.

How To Calculate Your Tax Withholding

If your payroll reporting amounts change drastically, the IRS may change your reporting frequency. Register on the Electronic Federal Tax Payment System website to link your company bank account and make federal tax deposits. The 2020 federal tax withholding tables can be found in the IRS’ current Publication 15-T. These tables are essential to calculating how much to withhold. NerdWallet writes that there are seven tax rates for 2020. IRS Form W-4 has been changed effective January 1, 2020. This form is used to record employee information for calculating withholding and deductions.

Save the last paycheck stub to compare with your W-2. The amounts on the last stub and the W-2 amounts usually should match. However, your employer might have added other amounts for additional benefits offered. These could be taxable income for you. Contact your payroll department if there are any differences. All paycheck stubs show your gross pay — the total amount you earned before any taxes were withheld for the pay period.

This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. By subscribing, you agree to receive communications from FreshBooks and acknowledge and agree to FreshBook’s Privacy Policy.

How To Calculate Employer Federal Withholding

When it’s time to file taxes, this amount applies to what you owe. Employee paychecks start out as gross pay. Gross pay is the total amount of pay before any deductions or withholding.

- Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

- Valid for 2017 personal income tax return only.

- For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas.

- We work with the Regions and UCPath to ensure employees are accurately paid in a timely manner.

- Each employer withholds 6.2% of your gross income for Social Security up to income of $132,900 for 2019.

Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice. H&R Block prices are ultimately determined at the time of print or e-file. Description of benefits and details at hrblock.com/guarantees. Small Business Small business tax prep File yourself or with a small business certified tax professional.

Step Seven: Take State Income Tax Deductions

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product.

A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation.

Starting price for simple federal return. Starting price for state returns will vary by state filed and complexity. Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns.

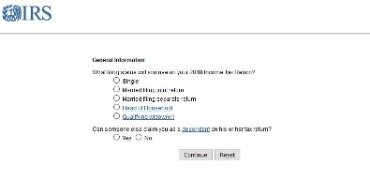

The IRS requires that all workers in the U.S. sign IRS FormW-4 at hire. This form includes important information you will need to pay the employee and to make sure withholding and deductions are correctly calculated on the employee’s pay.

Ready To Try Turbotax?

Available at participating offices and if your employer participate in the W-2 Early AccessSM program. The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. One state program can be downloaded at no additional cost from within the program. Emerald Cash RewardsTMare credited on a monthly basis.