We also have a W-4 Calculator that allows you to see the effect that changing your withholding or filing status will have on your paychecks AND your tax refund. Try it out by clicking the “Tax Calculators and Tips” tab.

An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status.

You Get Marriedor Divorced

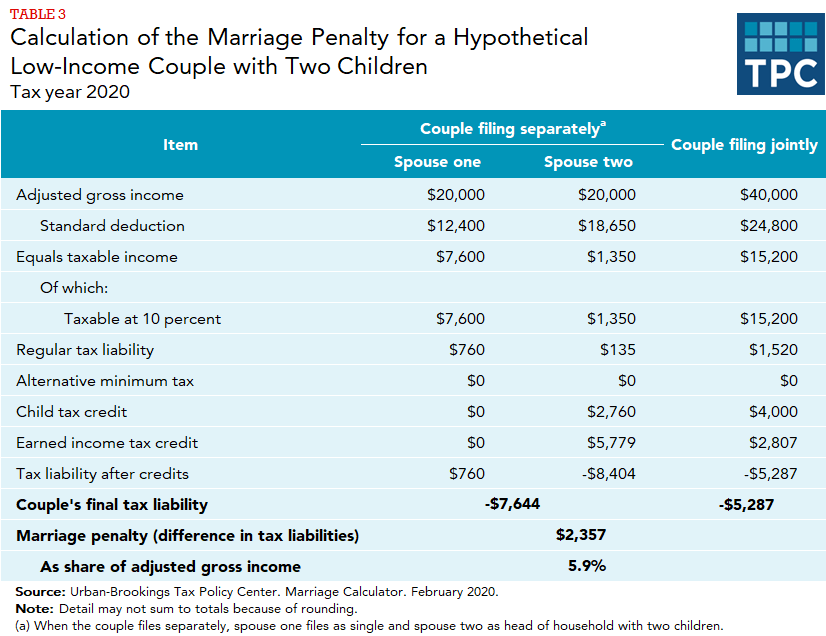

Tying or untying the knot will most likely change your tax rate, especially if both spouses work. Married persons filing jointly qualify for a lower tax rate and other deductions than filing as single. Getting a divorce can take you back to single or head of household status and reverse many tax benefits. If you fail to account for these events on your W-4, your withholdings could be inaccurate.

Each may have a different affect on your withholding status, depending on your situation. How long do you keep my filed tax information on file? Bear in mind that if you have more money than necessary withheld from your paycheck you’ve lost the use of that money throughout the year, although you should get it back later as a tax refund. If you have too little withheld, you may face a big tax bill and also an underpayment penalty. Using that information, plus your filing status, your employer will calculate how much to withhold from your pay. Another way is to calculate your minimum withholding amount based on your prior year’s tax liability.

- Additionally, the IRS offers spouses who file jointly one of the biggest standard deductions each year, according to TurboTax.

- Limited time offer at participating locations.

- Referring client will receive a $20 gift card for each valid new client referred, limit two.

- The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis.

- Fees apply if you have us file an amended return.

- Spouse A can shave twice as much off her taxable income simply because she’s married.

In addition, your spouse must not have lived in the home during the last six months of the year. For example, you can use $3,000 of capital losses to offset ordinary income, such as wages, every year. A single person can deduct up to $3,000 against ordinary income and a married couple together can only deduct up to $3,000 against ordinary income. If the married couple files separately, they can each only deduct $1,500 of capital loss against ordinary income. Receive unearned income such as dividends, interest, annuities, alimony, or a distribution from an IRA , 401 or a trust.” You will then be given an opportunity on Step 2 to enter the amount you expect.

Once you file your taxes, you may learn that you have a big tax refund coming your way. Here’s a refund schedule we’ve created to give you an idea when you can expect your money. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment.

In contrast, if one withholds too much, they will receive a tax refund. Employees are, however, required to report their marital status. This can create confusion because, regardless of marital status, employees have a choice on the number of allowances they would like to claim. Determine the amount of tax you want withheld this year, which is the sum of your anticipated tax obligation and the amount of refund you prefer .

Information Menu

Any of these could allow you to reduce your withholding to account for the added tax benefits. When you have too much money withheld from your paychecks, you end up giving Uncle Sam an interest-free loan .

Gross payThis is your gross pay, before any deductions, for the pay period. Please enter a dollar amount from $1 to $1,000,000. If the result from the W-4 calculator is different from your current withholding, ask your employer for a fresh W-4 form to fill out. You can do it on paper or electronically.

Unlike the Social Security tax, there is no annual limit to the Medicare tax. Starting in 2013, an additional Medicare tax of 0.9% is withheld on all gross earnings paid in excess of $200,000 in a calendar year. If you enter an amount for the year-to-date gross earnings, this additional Medicare tax will be calculated based on the current period’s gross earnings that exceed the annual $200,000 threshold. If no year-to-date amount is entered, any additional Medicare tax withholding will be calculated only for any gross earnings in excess of $200,000 for the current payroll period. If year-to-date wages prior to the current payroll period have exceeded $200,000, the year-to-date wages must be entered to calculate an accurate additional Medicare tax. The net effect of having money withheld at the higher single rate will be either to reduce your eventual tax bill or to boost your refund. Especially when both spouses work, electing the higher single rate for withholding is worth a further look.

Marriage Tax Or Marriage Penalty

Some life events result in more taxes, while others entitle you to credits and deductions that lower your taxes. The list of these events is long, but here are 5 of the most common reasons to revisit your W-4 withholding. Every time you earn income, you’ll most likely owe income taxes. How much your employer sets aside to pay on your behalf is determined by the information you submit on your Form W-4. There are some important things you should know about filing jointly.

They can also help you find deductions or exemptions that you might have missed. We broke down the two most popular tax filing services, H&R Block and TurboTax. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund. Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan.

IRS Form W-4, which you file with your employer when you start a job, is used to calculate how much money will be withheld from your paycheck to cover taxes. When you start a new job, you’ll usually be asked to fill out a W-4 Form, or Employee’s Withholding Certificate.

Other pre-tax deductionsEnter any other deductions made with pre-tax income. This amount will not be subject to income taxes, but is taxable in regards to require FICA and Medicare.

It can’t be a temporary court order, either, one that simply governs the situation until your divorce is finalized. You’re a single filer if you were never married unless you can qualify as head of household. In no case, however, can you file a married return. “This could be key to understanding what you should do or whether you should change your status since there are many variables in this decision.” To find out which status would benefit you the most, “you can run a side-by-side comparison — or have your tax preparer run it for you — with the outcomes of each filing status,” Guglielmetti says.

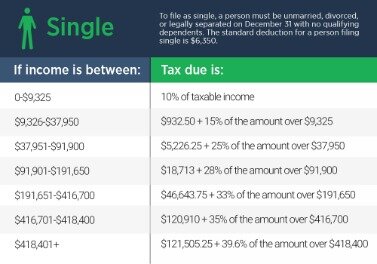

Standard Tax Deduction

For example, the standard deduction for the 2020 tax year is $12,400 for single filers. The deduction for taxpayers who are married and file jointly is $24,800.

Spouse A can shave twice as much off her taxable income simply because she’s married. This difference in brackets and rates can be particularly beneficial when one spouse is self-employed and has business losses. Those losses effectively subtract from the other spouse’s earnings when they file a joint return. For example, if you and your spouse file jointly and earn a combined AGI of $100,000, you would have to rack up more than $7,500 in doctors bills before you could begin deducting any of these expenses. Conversely, if you chose to file separately with an AGI of $40,000, your medical bill total would only have to exceed $3,000, which is 7.5% of $40,000. The American Opportunity and Lifetime Learning Education Tax Credits, which reduces the amount of taxes owed by those who are attending college, or have a spouse or child with college or graduate school tuition costs. Here’s what experts have to say about filing jointly versus separately, plus advice on how to decide what’s right for you.

The IRS does allow you to try to make a case that you weren’t personally aware of errors or omissions, however, and you can also make a claim for your share of the refund if you weren’t responsible for the debt in question. Otherwise, your choice is limited to filing a joint married return or a separate married return. The tax code treats you as a single filer in several ways if you file a separate return, but with some penalties. You’ll be prohibited from claiming a variety of tax credits and deductions.

Understanding the differences between single and married withholding will help you and your spouse plan appropriately for taxes so you don’t receive a nasty surprise when you file your return. If you’re employed rather than self-employed, you were asked to fill out Form W-4 for your employer when you began employment. You should submit a new, updated one whenever your marital status changes.

Withholding for these types of income differs from standard withholding and the estimator doesn’t currently have the ability to provide these sorts of recommendations. If you enter those types of income into the Tax Withholding Estimator, its recommendation will account for them in your wage withholding. The Tax Withholding Estimator uses your filing status, income, adjustments, deductions, and credits to estimate your anticipated tax obligation. Your actual tax obligation may differ from this if the amounts you entered are incorrect or if your situation involves tax requirements or benefits not included in this application. Use this to account for estimated payments that have already been paid. The application is designed to assist taxpayers adjust withholding on their regularly withheld income and limited to taxpayers with jobs or pensions that have regular federal income tax withholding. Medicare taxMedicare tax is calculated as your gross earnings times 1.45%.

And depending on your circumstances, it may save you money come tax season. McDonald’s is one of many major retailers that has stopped publicly fighting against a federal $15 minimum. If the result is negative, you need less than the baseline amount withheld for the balance of the year, so the Estimator recommends that you enter the annualized version of that on line 3. Double-check the income you have entered. If your job is for a partial year and not the full year, please make sure to adjust your income accordingly.

At the same income, and with the same number of allowances, the single withholding rate withholds more taxes than the married rate. However, single people who will owe more taxes, as well as married people with multiple sources of income and taxpayers who—for whatever reason—would like more money withheld, use the single withholding rate. If someone doesn’t submit any Form W-4 to their employer, the employer withholds a “baseline” amount from each paycheck. Submitting a W-4 to your employer indicates how to deviate from that baseline amount of withholding in order to achieve your desired refund amount. In your case, you will need a total of $X withheld from each paycheck for the balance of the year, which is $Y less than your current tax withholding. This means that your previous W-4 must have requested an additional amount to withhold from each paycheck that was larger than $Z.

You may need to have less income tax withheld to avoid having the IRS hold too much of your money all year. Remember, the higher the number of allowances one claims, the less money is withheld from their paycheck.

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. What if I receive another tax form after I’ve filed my return? Single filers are taxpayers who are unmarried and do not qualify for any other filing status. A joint return is a U.S. income tax return that reports the combined tax liability of married or recently widowed taxpayers. In particular, the form no longer asks you to calculate your number of withholding allowances. Instead, taxpayers whose income is under $400,000 or $200,000 are instructed to multiply their number of qualifying children under age 17 by $2,000 and any other dependents by $500 and enter those dollar figures on the form. If your marital status changes, you’ll want to submit a new W-4 Form so your employer can adjust your tax withholding.