Content

screen, check the box next toI/we got a letter/notice from the IRS telling me/us to fill out an 8862 form to claim the Earned Income Credit. You can use the steps below to help you get to where to fill out information for Form 8862to add it to your tax return. Try TurboTax software. If you’re not satisfied, return it within 60 days of shipment with your dated receipt for a full refund (excluding shipping & handling). If you’re not satisfied, return it to Intuit within 60 days of purchase with your dated receipt for a full refund. Jen will receive $1,645 in EITC and $2,000 in Child Tax Credit.

Find out more from the tax experts at H&R Block. 1 TaxSlayer Pro through SurveyMonkey surveyed 757 users of TaxSlayer Pro online tax preparation software 4/1/19 through 4/17/19. 93% of TaxSlayer Pro respondents reported that they continue to use TaxSlayer Pro software after switching. Answer the questions and eventually you’ll be askedDo any of these uncommon situations apply? Check the box that says,I/we got a letter/notice from the IRS telling me/us to fill out an 8862 form to claim the Earned Income Credit. On theDo any of these uncommon situations apply?

You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Schedule EIC, which is used to claim the Earned Income Credit with a qualifying child, must be completed prior to filling out Form 8862. The IRS defines a qualifying child as the child, an eligible foster child, brother, sister or descendant of the taxpayer’s child, brother or sister. The child must be younger than the taxpayer and, under age 19 or a full-time student under age 24 or, any age if totally and permanently disabled. Additionally, the child must have lived with the taxpayer for more than half the year and not file a joint return.

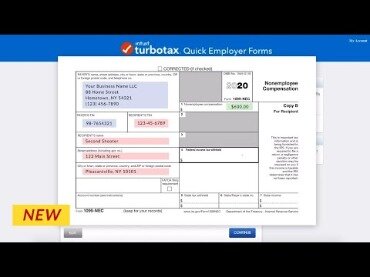

The first page of form 1040 TurboTax is where you calculate your Adjusted Gross Income and Taxable income. Foreign partnerships with more than $20,000 annual income in the United States, or those who earn more than 1 percent of their income in the US, need to file Form 1065. For more detailed instructions on how to fill out form 2106 on TurboTax, you can visit TurboTax’s official website. If the car is being used for business and is claiming business expenses, you will have to disclose your vehicle’s information in Section A. It is the part of the form where you input the business expenses you had throughout the year. It is whether or not you were reimbursed for those expenses. You can fill TurboTax form 2106 by entering your details in the two given parts of the form.

It is meant for tax filers who cannot get the full amount of credit using the CTC. There are two major forms that you need to fill out to determine whether you qualify for this credit. The first form is the Child Tax Credit and Credit for Other Dependents worksheet, and the second form is Schedule 8812.

Financial Services

And because of its multi-platform nature, signNow works well on any gadget, PC or mobile phone, irrespective of the operating system. Forget about scanning and printing out forms. Use our detailed instructions to fill out and e-sign your documents online. If you were previously disallowed from taking the EIC, claiming the credit this year will result in your return being rejected with IRS error code IND-046.

- In all cases, the dependent being claimed must be a U.S. citizen, national or resident.

- This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block.

- You may claim up to three qualifying children for the EIC.

- Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

- An exception applies but the box labeled ‘Distribution Code’ does not show a distribution code of 2, 3, or 4.

Free ITIN application services available only at participating H&R Block offices, and applies only when completing an original federal tax return . CAA service not available at all locations. Available only at participating H&R Block offices.

The credit can then be used to pay 100 percent of the first $2,000 of certain education expenses. If your AOTC claim for the previous tax year was disallowed, you must file tax form 8862 to qualify for the AOTC in the current tax year. The Additional Child Tax Credit is the second kind of tax credit you can apply for.

That goes for agreements and contracts, tax forms and almost any other document that requires a signature. The question arises ‘How can I e-sign the form I received right from my Gmail without any third-party platforms? ’ The answer is simple – use the signNow Chrome extension.

Easily find the app in the Play Market and install it for e-signing your form . If you own an iOS device like an iPhone or iPad, easily create electronic signatures for signing a form in PDF format. signNow has paid close attention to iOS users and developed an application just for them. To find it, go to the AppStore and type signNow in the search field. After that, your form is ready. All you have to do is download it or send it via email. signNow makes e-signing easier and more convenient since it provides users with a number of additional features like Add Fields, Merge Documents, Invite to Sign, and so on.

Get The Free Form 8862 2018

IRS defines a ‘partnership’ as any relationship between two or more persons who join to carry on a trade or business. Partnership Tax Return is also known as ‘Tax Form 1065’ is how business partnership reports their financial information to the IRS. Section B and C cover the mileage rate that applies to the miles of business travel you are deducting and expenses like gas and insurance for your car and rental car expenses. This part of the form is all about vehicle expenses. If you don’t incur any vehicle expenses, you can skip this section of the form.

To continue to fill TurboTax form 8949, log into your TurboTax account or register for a new account. To fill TurboTax tax form 8962, simply answer the questions as asked in the form. On line 4, check Yes and check No if you could be claimed as a qualifying child. Ensure that you aren’t a qualifying child on another return. If you need to share the form with other parties, you can easily send it by electronic mail. With signNow, it is possible to e-sign as many papers daily as you require at an affordable price.

From the search results, click on 1095-a link that will redirect you to the entry screen of the form. In the second line, check the boxes that are relevant to your credit , if any. In the first line, enter the year for which you are filing the form. Log in to your signNow account. If you haven’t made one yet, you can, through Google or Facebook. Create your e-signature, and apply it to the page. Type signnow.com in your phone’s browser and log in to your account.

To know how to fill out form 8379 on TurboTax, you need to first log in to your TurboTax account. If you don’t have an account, then you can create a new one.

Description of benefits and details at hrblock.com/guarantees. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. The IRS has the authority to take or hold your tax refund if they think your return isn’t accurate and in other situations as well.

Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. At participating offices. Only available for returns not prepared by H&R Block.

Small Business

The AOTC is a credit offered for certain education expenses. Eligible students during their first four years of higher education can receive a maximum annual credit of $2,500 per eligible student.

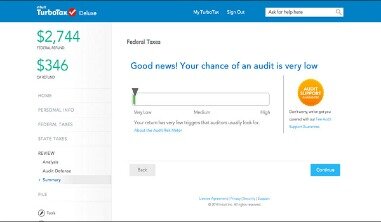

That qualified her to file as the Head of Household, which gives her a larger standard deduction. Because Jen only has one child, this is the end of entering dependents. If you have more than one child, repeat and enter the information about your other children. Jen gives the name, date of birth, citizenship, and the relationship about her child. 97% of people who receive EITC have children. Here Jen answers Yes because she has a child. After you sign up with TurboTax and you enter the software, you will be asked for your name, address, Social Security Number, and your marriage status.

You must to fill out this form if you previously received a disallowance and are reapplying in a subsequent year. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. State restrictions may apply. Additional training or testing may be required in CA, MD, OR, and other states.

What Is The 8862 Tax Form?

Starting price for state returns will vary by state filed and complexity. Enrolled Agents do not provide legal representation; signed Power of Attorney required. Audit services constitute tax advice only. Consult an attorney for legal advice.

All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. All tax situations are different. Fees apply if you have us file a corrected or amended return.

If your distribution is fixed or subject to the tax, and a distribution code of 1 shows in the appropriate box, you don’t need to file a 5329 Form then. When you use TurboTax to fill TurboTax tax form 1040, the Tax will automatically be calculated for you.

When you use the summary method of reporting, in some cases, the IRS still wants the supporting details sent to them. So with these steps, you will know how to fill out form 982 on TurboTax quickly. An exception applies but the box labeled ‘Distribution Code’ does not show a distribution code of 2, 3, or 4.

H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

One theory given for the surprisingly high number of people who use a tax preparation service is the Earned Income Tax Credit . EITC is a refundable tax credit available to eligible workers earning relatively low wages. To those who qualify, EITC represents a substantial amount of money they will receive from the government. The 2018 maximum EITC for a tax filer with one child is $3,461; for two children, $5,716; and for three or more children, $6,431. When you are receiving that much from filing the tax return, paying $200 can be seen as a necessary and acceptable cost.