Additional training or testing may be required in CA, MD, OR, and other states. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable.

Learn about the different options when you can’t pay or still owe money from a past return from the tax experts at H&R Block. When the IRS issues a levy, it will send a notice to your employer (IRS Form 668-W) requiring the business to send part of your paycheck to the IRS.

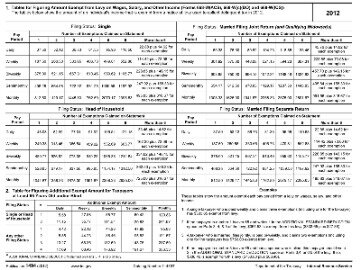

The IRS can only take your paycheck if you have an overdue tax balance and the IRS has sent you a series of notices asking you to pay. Wage levies are continuous and a portion of your wages is exempt from levy. If support is allowed, the same child cannot be claimed as an exemption for figuring the exempt amount. There are methods you can employ to limit the chance of having a tax levy placed on your assets. If you can’t prove that the levy is unfair, you may still be able to prevent a levy by using the approaches below. If the levy would create an extreme financial hardship for you, the IRS may hold off on collecting.

Bankruptcy is a powerful tool for dealing with IRS wage garnishments. Bankruptcy may completely eliminate your tax debts without the need to pay anything. Or, if you do have to pay money to the IRS, bankruptcy can make the payments much more manageable. If you do owe the money to the IRS, you have several alternatives. Generally, the IRS will want extensive financial information to verify your need for relief from their collections activity. You can work out an installment agreement with the IRS.

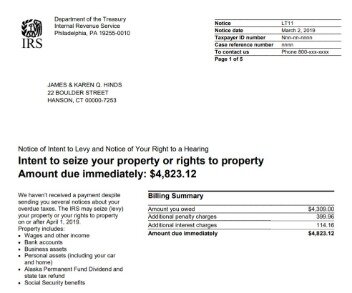

Our qualified tax experts at Community Tax have the finesse to go through every detail and we will help you determine if this is the best option for you. A tax resolution plan allows you to pay to the capacity of your ability-it can mean a halt to a wage garnishment and a negotiation for a payment plan that will keep you financially stable. The IRS has the authority to enforce a wage garnishment if a taxpayer has failed to respond to the IRS with a full repayment of debt or an appeal for a payment negotiation. If the 3/2/240 requirement is not met, then the tax must be paid in full because it is considered a priority debt. If you file a Chapter 7 bankruptcy, you will have to set up a payment plan with the IRS after your Chapter 7 bankruptcy discharge is granted. You still may be able to pay less than the full amount if you can negotiate an offer in compromise with the IRS. The IRS can notify you of the amount they have determined you owe and issue a demand for payment.

One of our experienced tax professionals can guide you through the process for removing the garnishment. To serve as proof that the wage garnishment notice was delivered, the IRS must send the Final Notice of Intent to you by either certified or registered mail. However, the letter doesn’t have to be delivered to you personally, so it’s important that you check your mail and make sure that you receive the notice on the day it’s delivered.

The Head Of Household Exemption And State Wage Garnishments

There can be any number of legitimate reasons why a taxpayer may be given an offer in compromise by the IRS. Most people who qualify in this category are currently in a financial situation where they cannot afford the payment, indicating a severe financial hardship. The IRS is willing to take into consideration many financial factors, including your income, asset equity, ability to pay, and your required expenses in order to live. Income taxes are dischargeable in bankruptcy if the tax return was due over three years before filing bankruptcy and was filed over two years before the bankruptcy case was filed. The last requirement is that the tax authorities assessed the tax at least 240 days ago. If these conditions are met, the tax is a general unsecured debt.

One way this happens is when the Internal Revenue Service uses a tax levy to take property. This can happen without the need to take you to court and win a judgment against you. A bank or credit card company, on the other hand, would have to successfully bring a lawsuit against you and meet other requirements. During your appointment, a licensed tax professional will answer your initial questions and determine if we can help based on your financial situation. Your exempt amount takes into consideration all sources of income.

Make An Offer

The IRS and some state taxing agencies have the authority to garnish part or all of your paycheck in order to pay your overdue or back taxes. The IRS will send your employer, customer, or vendor Form 668-W or 668-WDO notifying them they are required to begin garnishing the wages/payments of the affected taxpayer. Upon receiving the order, employers generally have at least one full pay period to begin garnishment.

- Liens and levies are tools the IRS uses to collect back taxes.

- Upsolve provides an online web app that helps you file for bankruptcy for free on your own, if you have a simple case and pass our eligibility criteria.

- Those who have never worked with a tax professional before may wonder if they should hire one now.

- This is definitely something to take seriously, but as long as you pay quickly , you should be able to avoid major problems.

- A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents.

The value of the property is greater than what you owe and releasing the levy wouldn’t stop the IRS from collecting the amount owed. If you need additional help, ask a CPA, Enrolled Agent , or local tax attorney how to proceed.

If the Internal Revenue Service garnishes your wages for unpaid tax debts, you do have options to stop the IRS. There are a few different tax procedures you can use to stop a garnishment. In some cases, it may even be a good idea to file bankruptcy. You can stop IRS wage garnishment if you declare bankruptcy. When you file for bankruptcy, you get an automatic stay that stops all collection actions, including garnishment, repossession, and foreclosure. This can result in a big hit to your credit score, so don’t take this option lightly.

Promotional period 11/9/2020 – 1/9/2021. Mastercard is a registered trademark, and the circles design is a trademark of Mastercard International Incorporated. Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit.

These last two documents must be sent at least 30 days before the IRS begins to garnish your wages. Before it reaches this point, you should contact the IRS and attempt to resolve the issue, possibly by submitting a request to get on a payment plan. The tax code, however, limits only what the IRS is required to leave. The IRS will take as much as it can and leave you with an amount that the tax code says is necessary for you to pay for basic living necessities. The amount that you can keep corresponds to the number of exemptions you claim for tax purposes.

Payment Over Time

You don’t always have to pay your full tax bill in April. If you’ve fallen on hard times, it may be possible to set up a payment plan that allows you to pay taxes over a more extended period. Tax debts are among the most difficult debts to eliminate.

Students will need to contact WGU to request matriculation of credit. Timing is based on an e-filed return with direct deposit to your Card Account.

Personal state programs are $39.95 each (state e-file available for $19.95). Most personal state programs available in January; release dates vary by state. E-file fees do not apply to NY state returns.

A wage garnishment is nothing more than a means to collect a debt owed. It usually requires a court order that is served upon an employer and requires the employer to deduct a portion of an employee’s compensation and pay that portion to a creditor. Once the IRS garnishment is in place, it stays in effect until released according to the court order or is terminated through legal action. The IRS will usually grant an offer in compromise when they surmise that the total amount of tax debt cannot be collected within a realistic time frame. It is critical that a professional sit with you and carefully comb through all possible payment options before submitting the paperwork for an offer in compromise.

CAA service not available at all locations. By authorizing H&R Block to e-file your tax return, or by taking the completed return to file, you are accepting the return and are obligated to pay all fees when due.

How To Release A Tax Levy

Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.

For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. One state program can be downloaded at no additional cost from within the program.

Failure to return the Statement of Dependents and Filing Status to your employer in time could result in a lower exempt amount and larger per paycheck garnishment from the IRS. If you receive a bonus check from your employer, it is subject to full garnishment. The IRS can garnish your wages if you owe them back taxes. This can be nerve-racking if it happens to you. The big question is, can the garnishment be stopped? The answer is most likely “yes,” but it really depends on your specific situation.

Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. Only available for returns not prepared by H&R Block.

Discount is off course materials in states where applicable. Discount must be used on initial purchase only. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc.

You have the right to appeal the event and prevent a levy from moving forward. You can even request that creditors return levied assets to you after the fact. The IRS is required to notify you by mail of any tax that you owe, so be sure to open your mail. Keep your mailing address up to date, and communicate with the IRS if you’re having financial problems. Before the garnishment starts, the IRS will send your employer a letter informing them of the garnishment. They must comply with the garnishment order within one pay period. Making other arrangements with the IRS to pay the taxes that are due.

Your disposable income is established by subtracting required deductions from your total paycheck. Required deductions include things like federal and state taxes, state unemployment insurance taxes, Social Security, and required retirement deductions.