Content

What remains to be seen is how the EV credit will adapt in this growing market. The Tesla Model 3 and Model S, Chevrolet Bolt, and Toyota Prius Prime were some of the top-selling EVs in 2019.

The credit applies for the first 200,000 qualifying vehicles a manufacturer sells. A credit phaseout occurs beginning in the second calendar quarter after that number is reached.

The TIGTA report recommends that, for each credit claimed, the IRS analyze the EV’s vehicle identification number and perform data analytics to ensure compliance with the tax code. It suggests that a third party match VINs with taxpayers and analyze the data accordingly. In addition, TIGTA recommends creating a compliance program and taking appropriate enforcement actions against those that erroneously receive the credit. Only two automakers have currently been phased out, so there’s still a significant amount of tax savings available to taxpayers who pursue the EV credit properly.

Claiming State Rebates And Credits On Top

If the vehicle was used wholly or partially for business, enter the Business/investment use percentagein box 5 to complete Part II of Form 8936. If no entry is made, this will default to 0% business use (100% personal use) and Part III will calculate the allowable amount based on tax liability. If you enter more than the maximum credit amount of $7,500, EF message 1271 will generate preventing e-file until your data entry is corrected. The amount printed on the form will be capped at the $7,500 since that is the max for any vehicle, however, you will be unable to e-file until you correct your entries and ensure it is accurate. The Driving America Forward Act, which would extend the EV credit but with a maximum credit of $7,000, was also proposed in April 2019. This bill would be applicable to an additional 400,000 vehicles to the current ceiling of 200,000 vehicles.

This is not an exhaustive list, so it’s best to reach out directly to the manufacturer of the car to determine if your purchase makes you eligible for this credit. Once the credit has been entered, Form 8936 will need to be attached to the return as a manual PDF attachment by using thePDFscreen. SeeRelated Linksbelow for instructions on PDF attachments. For vehicles with at least four wheels, enter the credit allowable. As of January 21, 2019, the 2018 Form 8936 has not been released yet. Some other 2018 forms have also not been released; they are only partly done with 2018 tax forms and they release more every day. Note that the tax filing season does not start until January 28.

In addition to tax credits, you might want to take a look at just how much money you could save on fuel. The Department of Energy has afuel-economy calculatorthat lets you see just how much money you could put in yoursavings account for future maintenance costsrather than in your tank, depending on fuel efficiency and driving habits. The IRS sends a letter of certification to automakers that notes the make, model, and year of the EVs it sells that qualify for credits.

The credit is only available to the original purchase of the vehicle, and it cannot be claimed if the car was purchased in order to be resold. Individual taxpayers are not required to complete or file Form 8936 on their return if they received the credit from a partnership or s-corporation.

Filing Tax Form 8936: Qualified Plug

While taxpayers who buy electric vehicles may be eligible for a tax credit, a number of criteria must be met to receive the full credit. The Taxpayer Certainty and Disaster Tax Relief Act of 2020 extended the credit for qualified two-wheeled plug-in electric vehicles to cover vehicles acquired in 2021. In some cases, your tax credit could show up as a rebate check in your mailbox, which could help make up the difference in price between an electric car and a gas-powered one. Plus, when you combine those savings withwhat you could save on maintenance and gas, you could really seemore money in the bank. So as you’re considering if going green is right for you, keep in mind that filing one form with the IRS could make a huge difference in the overall price of your car. If you want the full tax credit, you’ll also need to be one of the first 200,000 or so buyers of your selected manufacturer’s electric vehicle.

At a glance, it will appear simple, straightforward, and brief. Unfortunately (as is the IRS’s wont), the instructions complicate things to the extreme, so stick to the form itself unless you have a specific question. First, you need to make sure the plug-in model you are buying qualifies for the full credit. Every all-electric vehicle released in recent years (e.g., Nissan Leaf, Ford Focus Electric, Chevrolet Bolt EV) will work.

- Some other 2018 forms have also not been released; they are only partly done with 2018 tax forms and they release more every day.

- In addition to tax credits, you might want to take a look at just how much money you could save on fuel.

- The VIN of a vehicle can be obtained from the registration, title, proof of insurance, or actual vehicle.

- To help you get a better idea of what you could save, the Office of Energy Efficiency & Renewable Energy keeps track of thefederal, state, local and utility incentivesthat are available.

- Sales of EVs continue to grow, having increased more than 80% from 2017 to 2018.

- After the news of more than $70 million being claimed erroneously, however, the EV credit has attracted wider attention.

The IRS provide tax assistance to taxpayers and pursue and resolve fraudulent tax filings. Stack Exchange network consists of 176 Q&A communities including Stack Overflow, the largest, most trusted online community for developers to learn, share their knowledge, and build their careers.

Multiply that percentage by the number of months you use the property in your business or for the production of income and divide the result by 12. For example, if you converted a vehicle to 50% business use for the last 6 months of the year, you would enter 25% on line 5 (50% multiplied by 6 divided by 12). The IRS will not attempt to collect any understatement of tax liability attributable to reliance on the certification as long as you acquired the vehicle on or before the date the IRS published the withdrawal announcement. I know it is early yet, but I’m trying to get my paperwork together for tax season.

Specific Instructions

I bought my favorite tax software and was eager to enter the information for my 2018 Bolt that I purchased in March 2018. Turns out, the IRS hasn’t released the form for that yet. The tax software initially estimated 1/25/2019 as a release date, but has since moved it to 1/31/2019. Who knows if the paperwork will actually get released by the end of the month with the government shutdown.

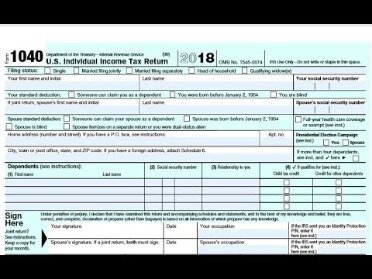

To claim the tax credit, taxpayers are required to complete Form 8936 with their tax return. Form 8936 also determines the exact amount to claim on the EV credit. The total federal tax credit amount is up to $7,500 per EV, and a taxpayer may be eligible for some state and local incentives as well. The credit amount is determined by the vehicle’s battery size. For example, the 2017 BMW i3 is eligible for a $7,500 credit, but the 2017 BMW i8, which is a hybrid, is eligible for only a $3,793 credit. The EV credit was created under the Energy Improvement and Extension Act of 2008.

It might not make any difference because of the shutdown as the President said for months or years but why people keep buying a tax software that doesn’t have an updated form year after year. Still can’t use it to actually file your taxes though so I don’t know how much it would really help anyone at this point though. @kumarplocher, would love to see that 2018 form 8936 that hasn’t been released yet. How are you guys applying for your $7,500 credit because I am at a loss right now.

Depending on your liability and other tax credits you take, you may not see the full tax savings of the tentative credit you calculate on Form 8936. Nonrefundable tax credits cannot reduce your tax bill below zero and also reduce your tax bill for a number of other credits taken before reducing the remaining tax bill for your plug-in electric motor vehicle credit. Today, the electric car tax credit provides a dollar-for-dollar reduction to your income tax bill.2That means that a $7,500 tax credit would save you $7,500 in taxes.

The credit attributable to depreciable property is treated as a general business credit. Any credit not attributable to depreciable property is treated as a personal credit. I’m waiting on some other forms to arrive, but I plan on printing the 2017 form, crossing out 2017 with 2018 and sending that in. Since I’m getting about 9k back, I want my money sooner rather than later. Even if the shutdown were to end today, I expect it would be close to a month before the IRS could get to releasing forms. The material provided on this site is not intended to provide legal, investment, or financial advice or to indicate the availability or suitability of any Capital One product or service to your unique circumstances. For specific advice about your unique circumstances, you may wish to consult a qualified professional.

When you buy a plug-in car, the dealer will give you a copy. | TeslaSo far, Tesla is the only automaker to have itscustomer credits begin to phase out. General Motors will be the next , followed a few years later by Nissan . The Dept. of Energy site that lists tax credit amounts also notes the schedule for the credits to phase out by automaker. But how do you apply for that credit, and who qualifies to claim it? Here are the details for knocking as much as $7,500 off the cost of an electric car.

Enter 100% if the vehicle is used solely for business purposes or you are claiming the credit as the seller of the vehicle. Unless you elect not to claim the credit, you may have to reduce the basis of each vehicle by the sum of the amounts entered on lines 11 and 18 for that vehicle. The phaseout begins in the second calendar quarter after the quarter in which the 200,000th vehicle was sold. Then the phaseout allows 50% of the full credit for 2 quarters, 25% of the full credit for 2 additional quarters, and no credit thereafter.

As a tax credit, the amount of your qualified plug-in electric drive motor vehicle tax credit reduces your tax bill on a dollar-for-dollar basis. In order to claim the credit, you have to have a tax liability you report on your return. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles.

More In Forms And Instructions

It supports it now in that it at least lets you fill out the info, and reflects it in your due/refund, but then it won’t let you file until the 7th. The government might go bankrupt before the asshats in DC ever get it back open. I wonder if the H&R Block form just assumes the draft will be the final version. The IRS website doesn’t show it to be updated in final form, and the IRS is the official resource.

The manufacturer or domestic distributor should be able to provide you with a copy of the IRS letter acknowledging the certification of the vehicle. Use the January 2021 revision of Form 8936 for tax years beginning in 2020 or later, until a later revision is issued. And my return was accepted by the IRS within 1 hour of E-Filing. The financial world has all a buzz about this “Perfect Storm” of a very rough tax season. Huge tax law change and now a shutdown to aggravate an already messy tax situation. If you have a question about your specific tax situation, your accountant would be the one to ask. Subscribe to the newsletter and get some awesome stuff every week.