Content

If you had a negative balance on your turbo card, you will get a paper check sent to the last address the irs has on file. According to a woman at the IRS, it’s a glitch and just because you see that doesn’t mean you won’t get it.

Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Eligibility for stimulus payments is determined by the IRS based on your adjusted gross income . The IRS says people who qualify for a payment will receive it by mail if they do not get it from direct deposit. “It said it had been deposited, but the account it had been deposited to was closed a few years back,” Victoria wrote. , with many reporting to CBS MoneyWatch that they received a “Payment status not available” message, with no option to update their bank account information. Consumers who used a tax prep service and relied on a tax refund anticipation loan should enter their bank account information into the IRS “Get My Payment” site, according to the Treasury Department. We know how important these funds are for so many Americans and that everyone is anxious to get their money.

Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog.

Taxpayers Confused By Unavailable Status For Stimulus Payment

Those who are eligible and do not get a 2nd COVID-19 relief check may be able to claim it when they file their 2020 taxes as a Recovery Rebate Credit. Taxpayers whose deposits are not successful in this revised attempt will be mailed a check. The IRS will continue to process payments to taxpayers until January 15, 2021. TurboTax also has a Where’s My Refund Tracking step-by-step guide that will show you how to find the status of your IRS or state tax refund. Use TurboTax, IRS, and state resources to track your tax refund, check return status, and learn about common delays. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

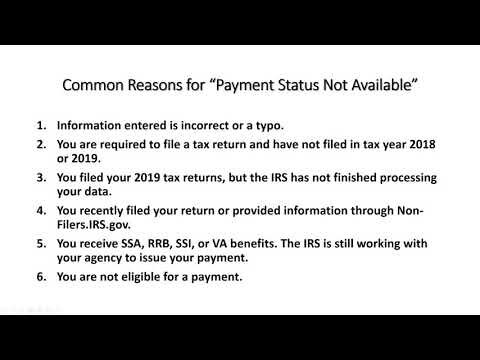

Users who get this message are encouraged to file their taxes early and electronically in order to get their rebate as quickly as possible. If GMP reflects a date your payment was mailed, it may take up to 3 – 4 weeks for you to receive the payment. “We are unable to provide the status of your payment right now because we don’t have enough information yet (we’re working on this), or you’re not eligible for a payment.” The above article is intended to provide generalized financial information designed to educate a broad segment of the public; it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business. When you access the “Where’s My Refund?” tool, you will see three separate boxes to enter your filing status, refund amount and Social Security number.

We have been working tirelessly with the Treasury and IRS to get stimulus payments to our customers. We know how important these funds are for so many Americans and we regret that an IRS error caused a delay. You can sign onto the TurboTax online website and see the status of the federal tax return for 2018. Taxpayers who have checked the status of their stimulus check with the IRS Get My Payment tool and received the message “Payment Status #2 – Not Available” will not receive a second stimulus check automatically, the IRS told CNBC Make It Tuesday night.

However the question remains for some where the IRS got the information for the deposit. One local woman, Ashley Victoria, told 23ABC she was notified her payment was deposited into an account she never used for tax filings.

TurboTax is here to keep you informed and help you file now. during your most recent tax filing , here is what you need to know.

Turbotax Online

You could still receive it because they’re still processing payments. I read this in another group on here, a girl called and was on hold for an hour or so. A TurboTax spokeswoman said the fix also applies to customers who received the “Payment Status #2 – Not Available” message while using the IRS Get My Payment tool. There is no exact measure at this time of how many taxpayers were impacted. The IRS did not have a comment early Tuesday on the scope or cause of the problem. Remember, the payment is $600 for each eligible adult and dependent for people earning up to $75,000, or $150,000 for married couples filing jointly. Those earning more than that are eligible for a reduced payment.

“So I get like the two options of either I don’t qualify for this payment or there’s not enough information,” she added. “Receiving the stimulus would have given me some breathing room. It would have given me an opportunity to say, ‘okay, I can pay off last month’s rent and not be struggling and not be anxious,” Davis, a Pewaukee resident and single mother of two, said. CNET has more information on how that rebate can be claimed here. Please allow a few days after the 15th for the mailing of any check or debit card issued by the IRS.

I received my first payment with no issues and now the IRS site says info not available. We’ll waive or refund standard replacement fees so there’s no cost to you.

- You will be able to check the status of your stimulus check at the IRS Get My Payment tool.

- If you have an AGI of up to $75,000 ($150,000 married filing jointly), you could be eligible for the full amount of the recovery rebate.

- Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

- These loans are basically advances on a tax refund that you expect from the IRS but which are provided by the tax prep services, which sometimes use credit cards, like H&R Block’s Emerald Prepaid MasterCard, to provide the loan to consumers.

- The bank numbers that these taxpayers see on the IRS’s website belonged to tax preparation firms and were used to take out fees for tax prepper, Nassif said.

After providing some personal information, you can find out when it will arrive. In general, taxpayers without an eligible Social Security number are not eligible for the payment.

Other Ways To Check Your Tax Refund Status

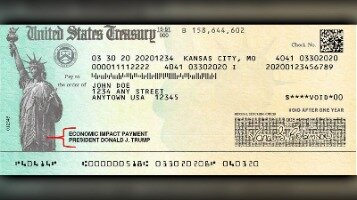

As of Wednesday mid-day, the IRS said more than 6.2 million taxpayers have successfully received their payment status and almost 1.1 million taxpayers have successfully provided banking information. The IRS has begun issuing stimulus payments using the most recent information they have on file, likely from your 2019 tax return, either by direct deposit or by check. The IRS is distributing Economic Impact Payments directly to taxpayers. If the IRS website indicates funds were sent to TPG those funds will be rejected back to the IRS.

Taxpayers will see unclaimed stimulus funds referred to as the Recovery Rebate Credit on Form 1040 or Form 1040-SR of their taxes. Individuals and married couples filing jointly can also claim the Recovery Rebate Credit if they did not receive the full amount of the first stimulus payment. Click here for more information on the Recovery Rebate Credit.

You may also be eligible for additional credits and deductions which can lower your taxable income. TurboTax will ask you simple questions about you and give you the tax deductions and credits you are eligible for based on your entries. By law, unemployment compensation is considered taxable income and must be reported on your income tax return. Any special unemployment compensation authorized by the CARES Act is considered taxable income. Ultimately, the IRS is the sole party with the ability to determine eligibility and distribute stimulus payments. Recovery Rebate Crediton your 2020 taxes you should have the form showing the amount of your payment in front of you when you sit down to file your taxes.

Additionally, if you filed the 2018 federal tax return and there were taxes owed and you selected Direct Debit from your bank account for the taxes owed and the tax payment was debited from your bank account, then the IRS received your tax return. Many people — particularly those who filed their 2019 tax returns with H&R Block and TurboTax — are also reporting that their payments were sent to incorrect bank accounts. Customers of many tax preparation companies, including TurboTax, H&R Block, Jackson Hewitt and others, noticed earlier this week that their stimulus checks had been deposited into bank accounts they did not recognize. The companies soon notified taxpayers that the IRS had erroneously deposited the payments into temporary “pass-through” accounts from previous years that customers no longer had access to. The payments will be deposited into the same bank account that customers received their 2019 tax refunds and many will be available Friday, according to TurboTax, though that will vary by bank. While $600 coronavirus stimulus payments have started hitting bank accounts across the nation, many won’t be receiving checks or direct deposits this time around.

“Because of the speed at which the law required the IRS to issue the second round of Economic Impact Payments, some payments may have been sent to an account that may be closed or, is or no longer active, or unfamiliar. By law, the financial institution must return the payment to the IRS; they cannot hold and issue the payment to an individual when the account is no longer active,” the IRS said. If GMP reflects a direct deposit date and partial account information, then your payment is deposited there. The IRS has recently updated their guidance on payments not received for any reason.

However, this new law allows households with different immigration and citizenship statuses to be eligible to receive $600 per individual and $600 per child with Social Security numbers. The IRS is working hard to deliver Economic Impact Payments to all eligible Americans as quickly as possible. The IRS is moving aggressively to provide additional information and resolve any issues. We appreciate taxpayers’ patience, and we will continue to share information and updates as they become available at IRS.gov/coronavirus. Still, some taxpayers have told CBS that they’ve already received their 2019 tax refunds, didn’t use tax refund loan anticipation service and are still having trouble getting information from the site. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services.

If you receive Supplemental Security Income you will automatically receive your stimulus payment with no further action needed. The Treasury Department, not the Social Security Administration, will make these automatic payments to SSI recipients. You will generally receive the automatic payments by direct deposit, Direct Express debit card, or by paper check, just as you would normally receive your SSI benefits. the IRS announced that they have begun issuing a second round of stimulus payments to eligible tax filers. Only the IRS can issue the stimulus payments, so the agency is encouraging people to check its website for updates about ongoing issues, rather than their financial institutions or tax preparers. It also notes that its phone representatives don’t have additional information beyond what’s on the IRS website.

“The bank account information for TurboTax filers is transmitted to the IRS as a part of the tax return,” the company said in a statement to CBS MoneyWatch. As part of the income tax filing, the IRS receives accurate banking information for all TurboTax filers who receive a tax refund, which the IRS is able to use to deposit stimulus payments.