They are likely fraudulent attempts to steal your Social Security number or other personal information. Think twice or three times before giving out credit card or other financial information online. Being aware of common tax scams and how to address them can help you keep yourself and your information secure at tax time. It starts with your phone ringing — the most prevalent tax scam making the rounds this year. Don’t think you’re the only one singled out for this tactic; aggressive, threatening phone scams occur regularly across the country. For example, you might be asked to click on a link to confirm your identity or update your information.

Please email us at story ideas credit com with ideas or visit us on Facebook or Twitter. Intuit said the email mimicks the company’s brand and tells recipients they need to confirm their accounts. Here’s what part of the email says, according to a screenshot on Intuit’s website.

When it’s time to update, Intuit will give you instructions on how to manually update from the product or direct you to enter the website name and do so manually. Some of its products have an “auto-update” feature which is the preferred method.

No legit email would ever say click this link and enter information. Schedule a demotoday to see how you can protect your business from getting hooked by these types of phishing attempts. The personal information collected through TurboTax, and ultimately sent to the IRS is highly sensitive information. Our name, address, and social security number are displayed prominently, often in triplicate.

Top 10 Tax Scams

It’s asking any taxpayer who receives suspicious emails purporting to be from a tax software provider, or from the IRS, to forward them to. Luckily, the Komando listener figured out this TurboTax version was malicious before her husband and daughter uploaded any tax returns. But it was a grueling task to remove the malware from the device. She ended up having to restore the computer to a week before the malicious software was installed and ran antivirus software multiple times before it was finally gone. Think of these scammers as wolves in sheep’s clothing who pose as legitimate tax preparers or professionals, but actually intend to steal your money.

- Phishing emails usually contain messages directing the recipient to a “spoof website”—a bogus version of a legitimate business’ website.

- It’s one of many circulating this tax season targeted towards taxpayers.

- Rather than rely on revenue from display ad impressions, Credit.com maintains a financial marketplace separate from its editorial pages.

- However, these complex tax-avoidance schemes are often illegal, and the IRS prosecutes scammers who create and sell them, along with taxpayers who participate.

Instead of searching for TurboTax software online, make sure to get DIY tax software from a trusted source. You can get it directly from sources likeIntuit, Amazon or Best Buy. Her husband found the malicious TurboTax software by doing a simple Google search. The results from the search included malicious links, which is something scammers have been doing more of lately.

Credit Tools

But the sender’s goal is to steal your personal or financial information, including passwords, Social Security number and credit card data, and use it to commit fraud. Phishing emails may also contain attachments that embed malicious codes and can harm your computer. Phishing emails usually contain messages directing the recipient to a “spoof website”—a bogus version of a legitimate business’ website. The messages often appear to be from an organization that the recipient is associated with financially, such as a bank or the Internal Revenue Service. If you suspect that you are the victim of a scam, contact the IRS Identity Protection Specialized Unit at .

And while the Internal Revenue Service takes steps to protect your information from identity theft, that doesn’t mean that thieves stop trying to steal sensitive information. Watch out for scams and schemes this tax season to keep your clients’ information secure. If you lost a family member from a disease or another tragedy, con artists can close in. These scammers target taxpayers who might want to make a tax-free donation to a particular charity. If you get a phone call or email soliciting money to fight disease or assist victims, don’t give out cash or financial info. Instead, look up the charity on the Exempt Organizations Select Check tool to see if it’s legitimate.

How To Detect Irs

Other scammers claim they can use IRS forms to transfer funds from the Social Security Administration to the tax authorities. The victim, they claim, will get a check from the IRS, but that’s not likely to happen. Your best bet for avoiding this kind of scam is to ask for references from tax preparers before you sign on the dotted line. If the caller threatens you with police arrest, deportation or immediate criminal action—they’re not from the IRS. Phone calls demanding immediate cash payments are made by criminals who impersonate tax agents.

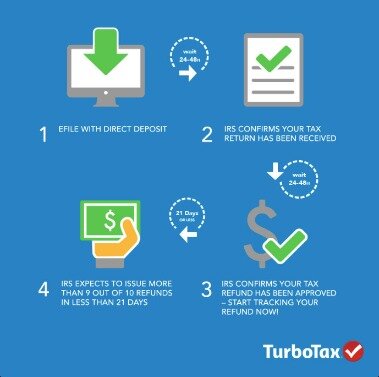

You may accept the tax preparation help without realizing that the scammer intends to file an exaggerated, incorrect return and then make off with the extra large refund. We’ll search more than 350 tax deductions and credits to find every tax break you qualify for. It’s free to start, and enjoy $10 off TurboTax Deluxe when you file.

TurboTax Live offers real tax experts and CPAs to help with your taxes—or even do them for you. You get unlimited tax advice year round year, so you can be 100% confident your return is done right, guaranteed. TurboTax Live experts are highly knowledgeable, with an average 12 years experience in professional tax preparation. Their tax advice, final reviews, and filed returns are guaranteed 100% accurate. The scammer may claim your software is corrupted or out of date, and then request remote access to your computer to update the software. Of course, they’ll actually use that remote access to take over your account and steal your information. The IRS has a dedicated Tax Scams webpage where the agency publishes warnings and updates about the current crop of scams that are being used.

Fraudulent Emails From The irs

Even search results from trusted search engines can lead you to a spoofed site. It will never ask you for your banking or credit card information in an email. Also, it won’t ask for private information about your employees in an email.

In fact, we maintain a strict and important firewall between the editorial and business departments. Our mission as journalists is to serve the reader, not the advertiser. In that sense, we are no different from any other news organization that is supported by ad revenue. The offers that appear on Credit.com’s website are from companies from which Credit.com receives compensation. This compensation may influence the selection, appearance, and order of appearance of the offers listed on the website.

Email Phishing Scams From Fraudulent Clients

These scammers often target families that have lost a loved one to a particular disease, knowing that the family might wish to make a donation in the loved one’s name to help prevent future tragedies. If you receive a telephone call or even an in-person solicitation to make a donation to a charity, don’t give the person cash or your financial information. Instead, verify the legitimacy of the charity by using the IRS Exempt Organizations Select Check tool. Often, the tax scammers are hoping to connect with a newcomer to the US, someone who might not know how the IRS works.

If you suspect you have received a phishing email from Intuit, please forward it immediately to We will look into each reported instance. This is always the number one thing in phishing security training.