Content

Fees for other optional products or product features may apply. Limited time offer at participating locations. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office.

One reason for this is because long-term capital gains are taxed at a lower rate (no higher than 15% for most taxpayers) than the ordinary income tax rate. Finally, both would also pay 25% on their earnings over the $300,000 threshold. For the individual with $360,000 in taxable income, that would come to $15,000 (25% of $60,000).

When you look at your paycheck, you can see taxes that are taken out of your take-home pay for various reasons. We’ll cover those in this section.

State restrictions may apply. Additional training or testing may be required in CA, MD, OR, and other states. Valid at participating locations only. This course is not open to any persons who are currently employed by or seeking employment with any professional tax preparation company or organization other than H&R Block. The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable.

Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details. H&R Block does not provide audit, attest or public accounting services and therefore is not registered with the board of accountancy of the State in which the tax professional prepares returns.

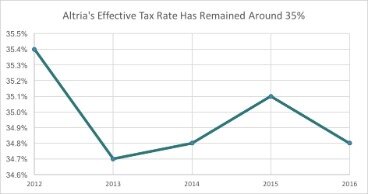

What Does effective Tax Rate Mean?

All prices are subject to change without notice. H&R Block is a registered trademark of HRB Innovations, Inc.

Most of your income would fall in the 0%, 10% and 12% ranges, but the very last of your income would fall in the 22% range. That said, your marginal tax rate would be 22%. In actuality, income is taxed in tiers. When your income reaches a different tier, that portion of your income is taxed at a new rate. Your marginal tax rate or tax bracket refers only to your highest tax rate—the last tax rate your income is subject to.

Estimate Your Tax Bracket

Starting price for simple federal return. Price varies based on complexity. Starting price for state returns will vary by state filed and complexity. Personal state programs are $39.95 each (state e-file available for $19.95).

May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17).

How do I update or delete my online account? These tax rate schedules are provided to help you estimate your 2019 federal income tax. TurboTax will apply these rates as you complete your tax return. I agree with rcj007, effective tax rate should be calculated by dividing the total income tax payable by the total taxable income. I cannot believe Turbo Tax continues to calculate it incorrectly. That lessens my confidence in them regarding everything else they do. This is an optional tax refund-related loan from MetaBank®, N.A.; it is not your tax refund.

I can only conclude that this is a bug in their software and I hope that this comment puts those users at ease that were similarly concerned when they saw their calculated effective tax rate. In the Tax History report, Turbotax calculates an effective tax rate, but does not include ‘Other Taxes’ in that calculation. The 3.8% Net Investment Income Tax happens to be lumped into ‘Other Taxes’ on the IRS forms, hence is not used in TurboTax’s effective tax calculation. I do not know where they are getting that information however, you can find your effective tax rate at the bottom of your 2-year comparison. It is also stated on the TurboTax Filing Instructions page if you print a copy of your return. If the income as defined above is zero or less, the effective tax rate is set to zero.”

You can find your effective tax rate at the bottom of your 2-year comparison. It is also stated on the TurboTax Filing Instructions page which is included when you print a copy of your return. For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials.

And 2020 Tax Brackets: Find Your Federal Tax Rate Schedules

Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. The effective tax rate typically refers only to federal income taxes and doesn’t take into account state and local income taxes, sales taxes, property taxes, or other types of taxes an individual might pay.

H&R Block is not affiliated with Fidelity Brokerage Services or their affiliates. H&R Block is solely responsible for the information, content and software products provided by it. Fidelity cannot guarantee that the information and content supplied is accurate, complete, or timely, or that the software products provided produce accurate and/or complete results. Fidelity does not make any warranties with regard to the information, content or software products or the results obtained by their use. Fidelity disclaims any liability arising out of your use of these H&R Block products or the information or content furnished by H&R Block.

Having a rough idea of your tax bracket can help you estimate the tax impact of major financial decisions. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX. It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor. There, you can add Text and/or Sign the PDF. Dummies has always stood for taking on complex concepts and making them easy to understand.

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. When you prepare your tax return online with efile.com, we apply the correct tax rates and do all the math for you while guaranteeing 100% accuracy. See more benefits of using efile.com. For a more detailed estimate of your taxes, use the free income tax estimator and tax calculator. Sean and Casey are married taxpayers who file jointly with taxable income of $117,000, putting them in the 22% tax bracket. Their total federal tax for the year was $17,457, so their effective tax rate was 14.9%.

The Difference Between Regressive, Proportional, And Progressive Taxes

One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra.

- It’s possible to calculate your effective tax rate by looking at the Form 1040 and dividing the number on line 16, the “Total Tax,” by the number on line 11, the “Taxable Income.”

- These dividends, just like short-term capital gains, are taxed as ordinary income.

- Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options.

- Effective tax rate is your total federal income tax obligation divided by your taxable income.

- For simple tax returns only, file fed and state taxes free, plus get a free expert review with TurboTax Live Basic.

- You might place less than with the big names or you might pay more.

These dividends, just like short-term capital gains, are taxed as ordinary income. Small Business Small business tax prep File yourself or with a small business certified tax professional. The world of taxes in a single article. Good luck out there with your Uncle Sam. Auto, homeowners, and renters insurance services offered through Credit Karma Insurance Services, LLC (dba Karma Insurance Services, LLC; CA resident license # ). These adjustments can be valuable.

But for the individual with $500,000 in taxable income, the tax would be $50,000 (25% of $200,000). Their total tax obligations would be $55,000 and $90,000, respectively.

Effective tax rate is your total federal income tax obligation divided by your taxable income. Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify. No cash value and void if transferred or where prohibited.

Homeowners who buy or refinance at today’s low rates may benefit from recent rate volatility. Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options.

TaxAct is solely responsible for the information, content and software products provided by TaxAct. Fidelity disclaims any liability arising out of your use of these TaxAct software products or the information or content furnished by TaxAct. The use of the TurboTax branded tax preparation software and web-based products is governed by Intuit’s applicable license agreements. Intuit, the Intuit logo, TurboTax and TurboTax Online, among others, are registered trademarks and/or service marks of Intuit Inc. in the United States and other countries and are used with permission. Intuit is not affiliated with Fidelity Brokerage Services or their affiliates.

One state program can be downloaded at no additional cost from within the program. Additional state programs extra. H&R Block prices are ultimately determined at the time of print or e-file. Want to dig deeper on the math here? Check out our tax brackets article for a full explanation.

This article was fact-checked by our editors and a member of the Credit Karma Tax® product specialist team, led by Senior Manager of Operations Christina Taylor. It has been updated for the 2020 tax year. A tax rate is the percentage at which an individual or corporation is taxed. Both individuals would pay 10% on their first $100,000 of income, or $10,000. Both would then pay 15% percent on their income between $100,000 and $300,000, or $30,000 (15% of $200,000).

Year-round access may require an Emerald Savings®account. he Rapid Reload logo is a trademark owned by Wal-Mart Stores.