Content

In certain limited circumstances, the IRS may send you a letter or notice communicating the fact that you made an and error and the agency has corrected it in your favor. Now, it is certainly true that the opposite can also be the case and a letter from the IRS should never be taken lightly or ignored, but rushing into a state of immediate panic will not help the situation. Unfortunately, sometimes taxpayers who think that they have done everything right regarding their tax filing duty will nevertheless receive a letter or notice from the IRS.

I know tax issues need to be handled immediately which is why I’m available 24/7. The firm began as Sullivan & Powell PA and through the years transitioned to its now current form. All the information that this computer generates is handled systemically and not a human hand will ever touch a piece of paper you receive. Before you make any contact with the IRS you want to know your rights so you don’t make the situation worse than it already is.

- Tax LienA tax lien is the first major step the IRS takes to collect taxes.

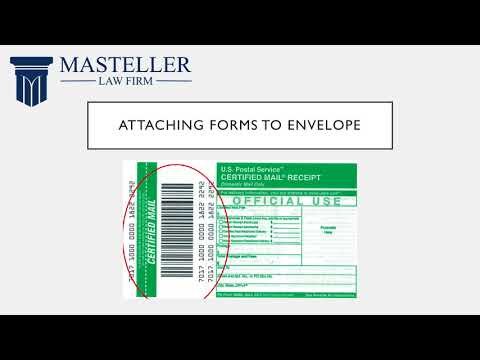

- Proof of mailing evidence for paper-filed tax returns and correspondence is one example, and fortunately there are other PDS options available.

- Postal Service® to mail your tax return, get proof that you mailed it, and track its arrival at the IRS.

- You may get a notice that states the IRS has made a change or correction to your tax return.

- Some Post Office™ locations offer extended hours and late postmarking for tax filers.

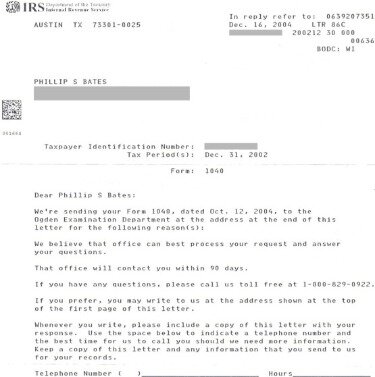

Just because you receive a letter from the IRS doesn’t mean you’re being audited. In many cases, the IRS will send a letter simply asking for additional information or clarification of details listed on your tax return. Assuming that you were totally honest when filling out your tax return, your audit can likely be handled with relative ease. However, if you were intentionally dishonest in your filings, you could end up in hot water. Either way, if you receive an audit letter, the first thing you should do is open it immediately. These same letters are sometimes statutorily required to be sent by certified mail to advise you of your rights. For the IRS’s purposes, it typically will not matter that you don’t sign for the mail (proof of delivery to your “last known address” will be enough – see Footnote 1 below).

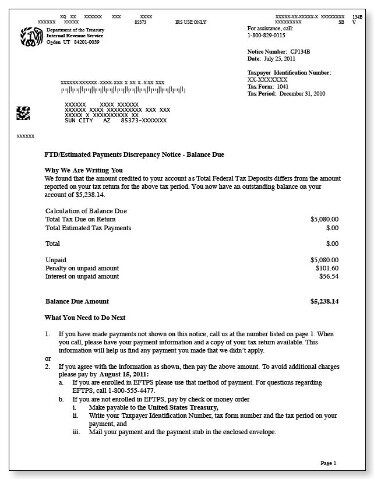

You get the CP 22E notice when an examination tax adjustment on your account results in a balance of at least $5. Send your payment in the enclosed envelope as soon as you receive a CP 22E, or call the IRS to discuss other tax settlement arrangements. This letter from IRS indicates a tax balance that resulted from changes during your return processing. When you receive a CP 11 notice, consider paying the amount due immediately. If you disagree with the letter or can’t pay in full, call the indicated phone number. Getting a notice or letter from the IRS can be unsettling. However, the tax body sends many types of letters to taxpayers, so you shouldn’t always get terrified.

Irs Notice Types

This is done through the issuance of a Letter 1153, together with a Form 2751, which is sent by the Revenue Officer who generally conducted the employment tax examination of the business. If possible, it is best to engage counsel to prepare your protest and argue your appeal before the IRS Appeals Office. If you fail to file an appeal within the 60-day time period, an assessment of the Trust Fund Recovery Penalty will be made against you and collection action will begin by the IRS. We do not contact people by email or social media to ask for personal or financial information.

However, in cases of fraud or failure to file, they could go back much further. The following are samples of actual IRS audit letters that our clients have received. In most mail audits, the IRS requests receipts or documentation to prove the item in question on your return, as well as an explanation of your circumstances that led to the filing.

Tax Bracket Calculator

If you agree with the notice, you usually don’t need to reply unless it gives you other instructions or you need to make a payment. If you’re not satisfied with your purchase and have not filed or printed your return, return it to Intuit within 60 days of purchase with your dated receipt for a full refund (excluding shipping & handling).

You should thoroughly review all correspondence received from the IRS, provide copies to your applicable trusted advisers, and respond as necessary. While Soft Letters are not proposing immediate assessment or collection actions, they do indicate that the IRS is concerned about a particular position taken on your return. Failure to timely and properly respond to these letters could have immediate and far-reaching consequences. Attempting to resolve these consequences with an untimely response is often onerous, difficult, costly, and incredibly time-consuming. Please seek advice from a professional if you receive any of the aforementioned letters. You shouldn’t have to call or visit an IRS office for most notices.

She has over 30 years of writing and editing experience, including eight years of financial reporting, and is also a published author of over 30 books. Bogart is not responsible for third party websites hyper linked our website, and does not guarantee or necessarily endorse any content, recommendations, products or services offered on third party sites. Understand how long to store your records to use them as your defense in the event of an IRS notice. Provide supportive information for every tax credit and deduction you want to claim. W Tax Group will refund monies paid under the W Tax Group Client Agreement within the first 15 calendar days without any penalty or obligation.

Although a certificate of mailing seemingly could alleviate the signature problem, the USPS unfortunately is mistaken about the availability of this service for Section 7502 proof of mailing purposes. The tax court addressed this issue specifically in Haaland v. Comm’r, T.C. Memo . The IRS also addressed this issue previously in SCA (12/4/1998). In short, a certificate of mailing does not constitute valid proof of timely mailing.

If you use an IRS-approved private carrier , make sure the return is sent out no later than the date due. Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers. Bird served as a paralegal on areas of tax law, bankruptcy, and family law.

The deficiency notice allows you 90 days to file a Petition in the United States Tax Court to dispute the changes reflected in the deficiency notice. If you fail to file a Petition during the 90-day period, the determined deficiency in tax, together with any related penalty and interest, will be assessed against you. However, if you file a timely Petition with the Tax Court, no assessment of any tax, penalty or interest can be made until the decision of the Tax Court becomes final. Generally, upon filing a Petition, the Government will file an Answer and then refer your case to the IRS Appeals Office for settlement consideration.

The W Tax Group

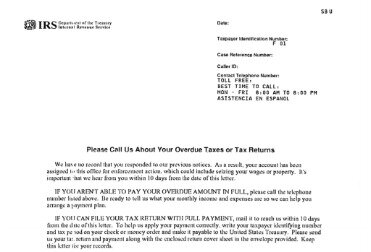

Each letter from the IRS outlines its purpose and guides you on resolving the alleged matter. Below, we explain some essential things about IRS letters. The W Tax Group can examine your tax debt situation and help you come up with a solution to resolve the matter. If you want to appeal a decision made by the IRS in your letter, we can help you with an appeal as well. How you respond to an IRS letter will depend entirely on your unique situation and what they are asking for, but respond you must. You can’t just ignore the situation and hope it will go away. Receiving any kind of letter from the Internal Revenue Service is always a heart-stopping moment.

For example, estimated payments and Form 1040-ES, amended returns, and IRS Form 4868 for tax extensions all have their own individual addresses. The Where to File page on the IRS website provides links for these other forms as well. Always use a secure method, such as certified mail, return receipt requested, when you’re sending returns and other documents to the IRS.

After receiving a CP 23 letter from IRS, pay the balance due without delay or request to create a payment plan. You can also call to ask questions if you have reasons to disagree with the CP 23.

If you had your taxes for the year in question done by a tax professional, contact him or her to ask for clarification about the problem. If he or she is unable to help or if you don’t have a regular tax professional, consult a qualified tax professional right away and ask for a review of your return. Soft letters do not constitute the beginning of an examination, nor do they request books and records, but Soft Letters do request specific additional information about certain tax positions.

Read The Notice Carefully

It will provide confirmation that the IRS has actually received your documents or payment. The IRS has more addresses than you might imagine because its processing centers are located all around the country. The address you’ll use depends on what you’re mailing and where you live. Go to the Where to File page on the IRS website if you’re sending a personal tax return, an amended return, or if you’re asking for an extension of time to file. While all correspondence from the IRS should be taken seriously and thoroughly reviewed, some letters and notices have more legal and serious consequences than others. This article identifies six of the most important letters and notices you might ever (and don’t want to) receive from the IRS, then explains what they mean and how to respond. Some IRS notices are sent via certified mail, such as the Notice of Intent to Levy, while others are mailed via regular post, like changes made to your tax return.

If the IRS tax examiner determines you owe more taxes, and adds penalties, you can simply agree to pay or ask the IRS Appeals Office to review your case. They’ll look at your case and any new information you have and give you an independent analysis. It’s imperative to respond to the IRS as soon as possible with either a phone call or an audit response letter within 30 days. This list is non-exclusive, so the best practice is to open your mail as soon as you receive it , look hard for any deadlines, and consult with a tax professional if you don’t see the deadline. A second element under IRC § 6672 is that the responsible person’s conduct must be “willful” which is interpreted broadly for purposes of the statute.

The IRS sends standard mail when the collection process begins, but the process will escalate if the notices are ignored. The demand letter will include information on how to resolve the debt with options like an offer in compromise or an installment agreement.

Information Needed

If you do have questions, call the phone number in the upper right-hand corner of the notice. Have a copy of your tax return and the notice with you when you call. Keep copies of all letters and notices that you receive from the IRS as well as documents you send to the agency, in case you need to refer to the information in the future.