Content

Interest on these bonds issued before 2014 is tax exempt. The interest on any qualified bond issued in 2009 or 2010 is not a tax preference item and is not subject to the alternative minimum tax. For this purpose, a refunding bond is treated as issued on the date the refunded bond was issued .

See the Form 6781 instructions for how to report these gains and losses. The qualified covered call options are closed, or the stock is disposed of at a loss during any tax year.

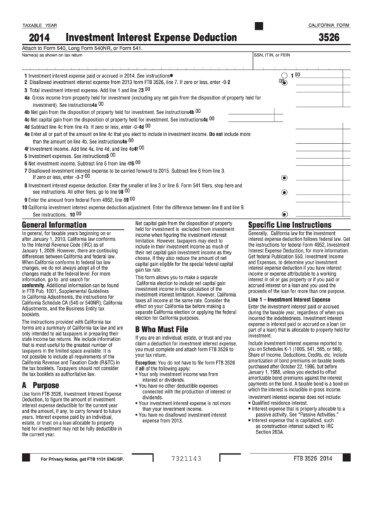

About Form 4952, Investment Interest Expense Deduction

Your identifying number may be truncated on any paper Form 1099-DIV you receive. On Schedule B (Form 1040 or 1040-SR), line 1, include all the interest shown on your Form 1099-INT as well as any other taxable interest income you received. Several lines above line 2, put a subtotal of all interest listed on line 1. Below this subtotal enter “U.S. Savings Bond Interest Previously Reported” and enter the amount figured on the worksheet below. In March 2019, you redeemed a $100 Series EE bond that was part of the distribution you received in 2016. You received $73.24 for the bond the company bought in May 2002. The value of the bond at the time of distribution in 2016 was $70.36.

For the definitions of qualified continuing care facility and continuing care contract, see Internal Revenue Code section 7872. This exception does not apply to a term loan described in earlier that previously has been subject to the below-market loan rules. Those rules will continue to apply even if the outstanding balance is reduced to $10,000 or less. Pay-related loans or corporation-shareholder loans if the avoidance of federal tax is not a principal purpose of the interest arrangement. The borrower generally is treated as transferring the additional payment back to the lender as interest.

For a bad debt, you must show there was an intention at the time of the transaction to make a loan and not a gift. If you lend money to a relative or friend with the understanding that it may not be repaid, it is considered a gift and not a loan. There cannot be a bad debt unless there is a true creditor-debtor relationship between you and the person or organization that owes you the money. Your holding period for nontaxable stock rights includes the holding period of the underlying stock. The holding period for stock acquired through the exercise of stock rights begins on the date the right was exercised. In determining your holding period for shares bought by the bank or other agent, full shares are considered bought first and any fractional shares are considered bought last.

A common example of this type of expense is the application of proceeds from a margin loan, taken out with a brokerage, in order to purchase stock. While the market changes everyday, what you want for your future probably doesn’t. We want to help you move confidently towards the future you imagine with strategies to support you throughout your lifelong journey. returns of ETFs focused on providing a high-yield annual income. In this environment, a fund that all-but promises to pay a consistent distribution is a rare find. From February 2018, the month when HNDL launched, through May 2020, a 28-month time period that saw the Coronavirus Market Crash and Rebound, HNDL handily beat its competition. From 2007 to 2009, the dividend payout from companies in the S&P 500 Index fell 29%, Edward Yardeni, president of Yardeni Research, told the New York Times NYT .

For this purpose, a related person is any related party described under Related Party Transactions, later in this chapter. A sale is generally a transfer of property for money or a mortgage, note, or other promise to pay money. It also explains certain transactions and events that are treated as sales or trades.

How To Calculate Your Investment Income

If you don’t intend to make that election, then you’ll have to adjust the calculator’s results manually. The investment interest expense calculator is fairly straightforward. The calculator asks for your marginal tax bracket, the amount of eligible investment income you receive, and the investment-related interest you pay. It then tells you whether you can deduct all or part of your interest expense, and what the savings will be.

- If they do not have the number at that time, they must provide it within 60 days from the date the number is mailed to them.

- For example, interest on a debt evidenced only by an ordinary written agreement of purchase and sale may be tax exempt.

- However, if you are involved in renting real estate, the activity is not a passive activity if both of the following are true.

- If you claim a deduction of more than $5,000 for an item or group of similar items of donated property, you must generally get a qualified appraisal.

If you also receive a note for $6,000 that has an issue price of $6,000, your gain is $9,000 ($10,000 + $6,000 – $7,000). If you finance the buyer’s purchase of your property and the debt instrument does not provide for adequate stated interest, the unstated interest that you must report as ordinary income will reduce the amount realized from the sale. If you acquired a stripped tax-exempt bond or coupon after October 22, 1986, you must accrue OID on it to determine its adjusted basis when you dispose of it. For stripped tax-exempt bonds or coupons acquired after June 10, 1987, part of this OID may be taxable. You accrue the OID on these obligations in the manner described in chapter 1 under Stripped Bonds and Coupons. If your debt instrument is a covered security, your broker will report a basis amount that is adjusted for OID included in income. A bond purchased at par value has no premium or discount.

Investment Products

In the case of a partnership, any such election shall be made by the partnership. For purposes of this subsection, the term “business interest” means any interest paid or accrued on indebtedness properly allocable to a trade or business.

Report all interest on the bonds acquired before the year of change when the interest is realized upon disposition, redemption, or final maturity, whichever is earliest, with the exception of the interest reported in prior tax years. If you plan to cash your bonds in the same year you will pay for higher education expenses, you may want to use method 1 because you may be able to exclude the interest from your income. To learn how, see Education Savings Bond Program, later. If you have used method 1, you generally must report the interest on these bonds on your 2019 return. The last Series E bonds were issued in 1980 and matured in 2010.

Your basis in the instrument is increased by the amount of OID you include in your gross income. If you bought an OID debt instrument at a premium, you generally do not have to report any OID as ordinary income. You bought a debt instrument at a premium if its adjusted basis immediately after purchase was greater than the total of all amounts payable on the instrument after the purchase date, other than qualified stated interest. If you had OID for the year but did not receive a Form 1099-OID, you may have to figure the correct amount of OID to report on your return. In most cases, you must report the entire amount in boxes 1, 2, and 8 of Form 1099-OID as interest income.

But the new co-owner will report only his or her share of the interest earned after the transfer. But, if the bonds were reissued in your name alone, you do not have to report the interest accrued at that time.

If you make the guarantee as a favor to friends and do not receive any consideration in return, your payments are considered a gift and you cannot take a deduction. On January 11, 2019, you bought a mutual fund share for $40. On February 8, 2019, the mutual fund paid a $5 dividend from tax-exempt interest, which is not taxable to you. If it were not for the tax-exempt dividend, your loss would be $6 ($40 − $34). However, you must increase the sales price from $34 to $39 (to account for the $5 portion of the loss that is not deductible). You can deduct only $1 as a short-term capital loss.

Box 3 of your Form 1099-INT should show the interest as the difference between the amount you received and the amount paid for the bond. However, your Form 1099-INT may show more interest than you have to include on your income tax return. For example, this may happen if any of the following are true. The effect of this election is that qualified dividends and net capital gains included in net investment income are taxed at ordinary tax rates, not at the lower long-term capital gains tax rates. There are a variety of limitations on the deductions that can be claimed on investment interest expenses. The deduction may not be claimed if the proceeds from the loan went towards a property that generates nontaxable income, such as tax-exempt bonds. The deduction on investment interest also cannot be larger than the investment income that was earned that year.

, except that you sold an additional 50 shares on December 12, 2019. You do not need to refigure the average basis of the 150 shares you owned at that time because you acquired or sold no shares, and had no other adjustments to basis, since the last sale. The average basis of the shares you still hold after a sale of some of your shares is the same as the average basis of the shares sold. The next time you make a sale, your average basis will still be the same, unless you have acquired additional shares . You can make the election to use the average basis method at any time. The election will be effective for sales or other dispositions of stocks that occur after you notify the custodian or agent of your election.

They must provide this number to all persons to whom they acted as a material advisor. They must provide the number at the time the transaction is entered into. If they do not have the number at that time, they must provide it within 60 days from the date the number is mailed to them. For information on penalties for failure to disclose and failure to maintain lists, see Internal Revenue Code sections 6707, 6707A, and 6708. Congress has enacted a series of income tax laws designed to halt the growth of abusive tax shelters. In many cases, however, losses from tax shelters produce little or no benefit to society, or the tax benefits are exaggerated beyond those intended.

The limitation does not apply to interest earned from investments. The deduction for depreciation, amortization, or depletion is only applicable through 2021, so businesses that are capital intensive can expect higher tax bills in 2022.