Remember, your accounting strategy allows you to analyze your firm’s efficiency beyond basic bookkeeping. Technology is transforming every aspect of our lives, including law firm accounting. Considering the intricacy of law firm accounting, you can happily be free of manual ledger entries and cumbersome spreadsheets.

Popular Misconceptions About Law Firm Accounting

Typically, businesses pay a variety of taxes across federal, state, and local levels of government. Your business tax obligations are dependent on several factors like your legal structure, geographic location, your products and services, as well as how your business operates. You will want to work with your bookkeeper, account and/or tax specialist to make sure you are paying all required taxes. Below are a few ways to improve your finances and simplify your law firm tax accounting efforts. Accounting is a world of numbers, and, for law practices, it helps efficiently manage the money flowing in and out of business. Cloud-based accounting solutions enable real-time legal team collaboration from anywhere, providing flexibility without compromising efficiency.

- In cash basis accounting, you record income and expenses when money changes hands.

- Technology is transforming every aspect of our lives, including law firm accounting.

- Regardless of the growth of electronic and online payments, attorneys have to be careful when deciding on a merchant processor for their firm.

- While on-premise accounting software ties you to a physical location and requires high maintenance costs and time-consuming updates, cloud-based accounting software is accessible anywhere.

Law Practice Today Editorial Board

The IRS doesn’t require you to keep records of certain expenses under $75, but we still recommend that to be safe, you keep copies of all records. As every business is different, your choice of the “right bank” depends on the nature of your practice, as well as how you prefer to handle your banking transactions. If you are self-employed, you will need to pay federal self-employment tax. This is essentially FICA and Medicare, only your payment covers both a withholding from your wage and the matching contribution from your company. If you have employees, you’ll have to pay Federal Insurance Contributions Act (FICA).

Understanding Accounts Receivable (Definition and Examples)

Imagine a system that can detect an error in a retainer invoice and automatically suggest corrections, allowing you to devote more time to your clients’ needs and less time to paperwork. Financial compliance is the complex dance of keeping your financial practices in line with regulatory requirements. Profitability, on the other hand, is your firm’s ability to generate profit over costs.

By studying these reports, you will gain valuable insight into your firm’s operations and be able to make effective decisions for your firm. It’s easier to spot opportunities and potential problems and take effective, appropriate action if you regularly read your law firm accounting reports. With financial data, legal accountants present big-picture information and give comprehensive and specific reports of a firm’s financial health. These data are valuable for a law firm’s future sustainability and profitability.

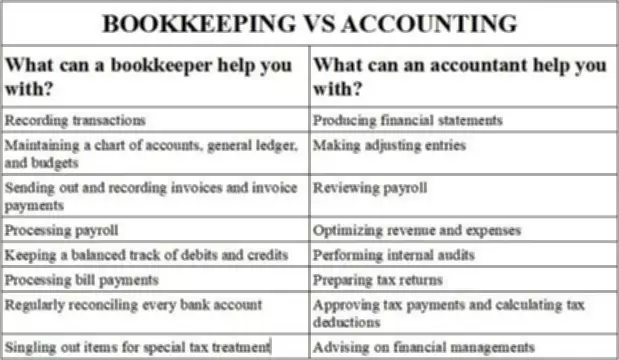

For a more in-depth look into trust accounting, read this article or download our law firm accounting guide on properly managing trust accounts. Law firm accounting is fairly subjective compared to law firm bookkeeping. A critical part of the legal accounting process focuses on analyzing financial reports and KPIs to uncover critical insights and make informed business decisions. This allows you to determine which cases are the most profitable, which ones drain the most resources, and where money is being spent but not made. Unfortunately, far too many firms utilize outdated and ineffective tools to perform their accounting functions.

Cost recovery, which is more intricate than it might seem, involves tracking client-related expenses and billing them appropriately. Everything from postage costs to witness interview fees needs to be considered. Trust account liability almost operates like strict liability, where simply committing an act is proof enough for guilt. Examples of these expenses are fees for transportation, court filings, expert witnesses, transcripts, medical records, etc. Each of these records should be kept for a specific time—some for 10 years, some for as few as three.

If accounting for lawyers seems intimidating, a robust knowledge of the basics can help every practice avoid common mistakes. Familiarize yourself with the generally accepted accounting principles (GAAP) for financial statements that are complete and comparable. Then, review your general ledger to better understand your law firm’s financial transactions. Once you’re geared with this information, refresh your knowledge on how to read the critical financial statements for your practice, like the income and cash flow statements and balance sheets.

Bookkeeping tasks are ongoing and can be performed daily, weekly, or monthly. Whether you do the task yourself or outsource it to a pro, the goal is to make sure your books are accurate, up-to-date, and useful to you and your CPA. If any of these balances don’t match each other, that means there’s a mistake in one of your ledgers.

You should also keep any other documentary evidence that supports an item of income, a deduction, or credit shown on your tax return. We help you do right by your clients and get you home for dinner on time. You can try MyCase today risk-free with a 10-day free trial, which includes access to MyCase Accounting. Plus, no commitment or credit card is required, and you can cancel anytime.