Content

Bought my home for 330k a year ago and a home next store sold for 240k last week. My ARM expires in a year and I’m scared since I’ve heard the horror story’s of un-affordable ARMs. I’ve tried calling my bank but they say they can’t do anything until much closer to my ARM adjusting. When the ARMs up I don’t want to sell but if I can’t afford the mortgage i’ll have to. Any ideas on what steps I should take at this point? If short sell is it my job to convince the bank to forgive the remaining debt on the short sell so I can do the whole mortgage forgiveness thing?

- have to pay the taxes on that forgiven mortgage debt.

- States that have a state income tax may deal with it differently.

- You already answered my question about funds being used for improvements vs. funds used for debt consolidation by answering Jennifer.

- i have a 560k loan with a first of 396k and a 2nd of 167k.

But what happens to loan I owe to the second bank? I have two questions does one have to live in their home two years to qualify for relief under HR 3648. I ask as the text says principal residence is defined by section 121 which refers to having lived in the home two years. Two if not what would be the definition of principal residence.

Feel free to give me a call if you have any questions. Inez – Debt forgiveness is the difference between what is owed on the property and the payoff the lender actually receives when the property closes escrow.

To learn about the tax implications of forgiven debt and whether you can potentially exclude it from your taxable income on your federal tax return, read on. Jennifer, the law that was passed eliminates the federal income tax on forgiven mortgage debt in certain situations, but not all. It does not keep the lender from filing a 1099, because the lender is not in a position to determine whether or not the debt qualifies.

The whole idea of debt foregiveness really upsets me. If someone bought a house for $500,000.00 and now its worth $300,000.00 the bank should give them the difference because they can’t pay that much or don’t want to anymore. When I bought my car I lost 20% of value as soon as I bought it, so does Lexus owe me 12,000.00.

Up to $2 million of forgiven debt is eligible for this exclusion for all filing statuses except for Married Filing Separately (the exclusion limit is $1 million if Married Filing Separately). If you refinance your mortgage, the refinanced debt may be excluded up to the amount of what the mortgage principal was prior to the refinancing. The mortgage crisis has hit many taxpayers hard, and mortgage workouts, refinancing, and home foreclosures have been the results. But there is tax relief available if you have refinanced your mortgage, lost your home through foreclosure, or otherwise had some or all of your mortgage forgiven. A mortgage forbearance agreement is made between a mortgage lender and a delinquent borrower to bring the latter current on mortgage payments over time.

How To Find Out If Your Loan Is Federally Backed

Currently there is a bill in the California Senate that seeks to bring State law on debt forgiveness taxation in line with this new Fed law. David – a short sale is viewed as a charge off – debt settled for less than owed. Chris – Yes, it applies to a deed in lieu assuming the property and debt qualify. Deborah – the refi makes sense if you can afford the payments. If it th refi is close to rent and you can do it, that may be a good option. If you can’t stay in the property, try to line up a rental before your credit takes a hit.

This provision, which has expired and been reinstated several times in the past, was recently revived and extended through 2020 by the Taxpayer Certainty and Disaster Tax Relief Act. There’s a good chance it will be extended again if Congress gets around to it this year or maybe retroactively in 2021. Prepare Form 982 for each exclusion if more than one applies. You might need the help of a tax professional to calculate this accurately. The IRS offers an insolvency worksheet in Publication 4681 to help you get started. Beverly Bird—a paralegal with over two decades of experience—has been the tax expert for The Balance since 2015, crafting digestible personal finance, legal, and tax content for readers.

Mortgage Forgiveness Debt Relief

We have been informed by the mortgage that our payments have not been submitted and that we will soon be in foreclosure. This investor promised to assume the mortage as well as the property but really only filed tranfer of property and continues to collect our money, of which has been steady each month.

When that obligation is subsequently forgiven, the amount you received as loan proceeds is reportable as income because you no longer have an obligation to repay the lender. Im a NY attorney practicing foreclosure defense for 12 years. I try to tell my clients that the only person who gains in a short sale is the broker. I also try to tell people that mortgage brokers now modification experts were the same people that lied to them to get the loan. They have no experience and dont care about the client. Hi Mike, I wouldn’t rely at all on the advise of the lender employee who may or may not have a clue, or worse, an ulterior motive.

Make sure you have an attorney over see the terms in the approval the bank issues. Joe, Yesterday Fed Chairman Bernanke urged lenders to do just that. You start the process by calling your lender and asking for a loan modification package. Sheri, start with the amount of the original loans. Any cash out used for “substantial improvements” also qualifies. In California, the current law would allow the state to tax you. There is a bill pending last time I checked that would have the California law mirror the Federal law.

Or consider contacting the Homeownership Preservation Foundation ; HOPE. HPF is a nonprofit organization that partners with mortgage companies, local governments, and other organizations to help consumers get loan modifications and prevent foreclosures. Stay in your home during the process, since you may not qualify for certain types of assistance if you move out.

Tax Bracket Calculator

On her tax returns for the tax years in question—2009 and 2010—the taxpayer excluded from tax the loan forgiveness amount under the special tax law provision for mortgage debt. The insolvency exclusion would apply if the total of all your debts exceeded the value of all your assets at the time of the cancellation of the debt. But home equity debt—that which wasn’t used to buy, build, or substantially improve the main home—and other types of canceled debt, suchas credit cards, might qualify for tax-free treatment under this exclusion. All your debt will be acquisition debt if your only loan was the original mortgage used to buy the principal property. Only the outstanding balance on the original acquisition debt mortgages will count for refinanced loans. Part of your debt will be home equity debt if you did a debt consolidation refinance or took cash out, or if you had a home equity line of credit used for purposes other than to acquire a house.

The firm agreed to forgive the other half of the obligation. Any outstanding interest that’s not paid isn’t considered income because it isn’t taxable to you. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Cancelled debt can be a challenging tax situation especially during hard financial times.

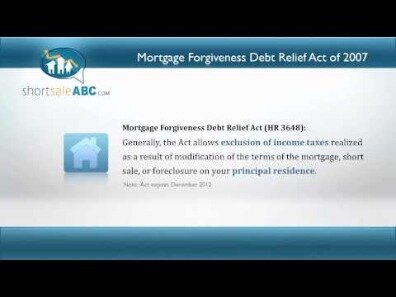

If the amount forgiven or canceled is $600 or more, the lender must generally issue Form 1099-C, Cancellation of Debt, showing the amount of debt canceled. An exclusion is also available for the cancellation of certain nonbusiness debts of a qualified individual as a result of a disaster in a Midwestern disaster area. The Mortgage Debt Relief Act of 2007 generally allows taxpayers to exclude income from the discharge of debt on their principal residence. The proper form will be selected for you by the eFile.com tax software during your online tax return preparation. Donyale, I’m very sorry I missed your comments earlier. I’m not sure I could have provided much additional information, though.

Exceptions And Exclusions

Further extended through 2025 by the Consolidated Appropriations Act in December of 2020. In 20 years, American Financial Solutions has assisted over 450,000 people in paying off over $9 Billion in debt. Our certified counselors will help you determine your current financial situation, make a plan to get out of debt, set financial goals and plan for the future. You are insolvent when your total debts exceed the total fair market value of all of your assets. Assets include everything you own, e.g., your car, house, condominium, furniture, life insurance policies, stocks, other investments, or your pension and other retirement accounts.

Foreclosures and evictions of eligible loans were halted until December 31, 2020 but were extended by President Biden’s executive order on his first day in office until March 31, 2021. Under the CARES Act legislation, you will not be charged late fees or reported to credit bureaus.

Joe, probably not, but they may ask for a note if you do a short sale. Feel free to give me a call if you have any specific questions.

“Senate Finance Committee Chairman Max Baucus (D-Mont.) won passage today of legislation offering tax relief to American families caught in the subprime mortgage crisis.” The QPRI exclusion now applies to debt discharged before January 1, 2021, and also applies retroactively to debts that were forgiven in 2018 and 2019. The exclusion also applies to debts forgiven as the result of a written agreement entered into before January 1, 2021, even if the actual discharge happens later. Subsequently, the firm terminated the taxpayer’s employment. In accordance with the promissory note, it demanded repayment of the $500,000 loan. The parties eventually agreed to settle the issue by having the taxpayer pay only half of the outstanding amount.

There will be no additional fees, penalties, or additional interest added to your account. You do not need to submit additional documentation to qualify other than your claim to have a pandemic-related financial hardship. If you are facing financial hardships, you should ask for forbearance immediately. Completing the CAPTCHA proves you are a human and gives you temporary access to the web property. Also does anyone know which states are debt forgiving? Does the Mortgage Forgiveness Act apply in California?

Michigan Senator Debbie Stabenow introduced similar legislation, S. Since then, thousands of distressed homeowners, forced to choose between the lesser of two evils, made the decision to give the property back to the bank to avoid the phantom income tax potential of a short sale. The QPRI exclusion originally applied to mortgage debt on a principal residence that was forgiven only in the years 2007 to 2010.

Extension Of The Mortgage Debt Relief Act

Until the Consolidated Appropriations Act of 2021, certain canceled mortgage debt of up to $2 million—or $1 million if you were married and filing a separate return—could be excluded from income . With the extension through 2025, the exclusion applies to certain canceled mortgage debt up to $750,000, or $375,000 if married filing separately, starting in tax year 2021.

We now have to move out of state, and I am sure our property value has decreased below what our current principle is. Should we wait until we actually list our house on the market and see what our offers are before we approach the lenders for a short sale? Or should be get it appraised now – and ask for some sort of readjustment? I’m going through a bankrupcy and thought I would do everyone a “favor” – and ease my conscious – by trying to sell the house. I owe $262k on the first and $62k on the second mortgage. I was just offered $226k and have now learned of the “dangers” of a short sale – I thought I was helping the bank out instead of just walking away. Now I find I have to pay the take on the difference in a short sale.

For example, if you can show that you’ve reduced other expenses, your loan servicer may be more likely to negotiate with you. information about the monthly gross income of your household, including recent pay stubs. If you are having trouble making your payments, contact your loan servicer to discuss your options as early as you can.

Ordinarily, when $600 or more of debt is forgiven or canceled by a creditor, the amount that has been forgiven is considered income for federal tax purposes, whether the debt is a mortgage or another kind of credit. When it’s clear you won’t be repaying the money you received, tax law recognizes the money as income.