Content

Any logs, such as a notation on your calendar of the call date, time, to whom and for what business reason, also will bolster your business deduction claim. On the flip side of that telephone taxability coin is the tax deduction for your own, bought-it-yourself cell phone when you use it to conduct business. Cellphones are a legitimate deductible expense if you’re self-employed and use the phone for business. It’s recommended that you obtain an itemized bill to prove it. But you can deduct as a business expense the cost of business-related long-distance charges on that phone. And if you have a second landline phone specifically for business use, its full cost is deductible.

Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money’s sole discretion. Fees apply for approved Money in Minutes transactions funded to your card or account. Unapproved checks will not be funded to your card or account. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for data usage.

This date is more than a literary reference. The Ides of March apply each year to many business taxpayers. Today is the tax filing deadline for partnerships (Form 1065 with K-1 schedules) and S corporations . Official tax statements aren’t the only things you’ll need to help you file.

If Your Employer Provides A Phone

A cell phone provided by an employer is generally considered a benefit that the employer can deduct as a necessary expense, provided it is primarily used for business purposes. If its purpose is primarily personal, it is not considered a business expense.

All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled.

Valid receipt for 2016 tax preparation fees from a tax preparer other than H&R Block must be presented prior to completion of initial tax office interview. May not be combined with other offers. Offer period March 1 – 25, 2018 at participating offices only. To qualify, tax return must be paid for and filed during this period. Visit hrblock.com/halfoff to find the nearest participating office or to make an appointment. OBTP# B13696 ©2018 HRB Tax Group, Inc.

Make sure to digitize this document so you don’t have to retain the physical piece of paper. Evidence of your monthly cell phone charge – your bill or bank statement should cover this. Let’s say I use my phone for business purposes from 9AM to 5PM on Monday through Friday, that’s 40/hours per week. Let’s say my normal waking hours are 8AM to 10PM (14/hours per day).

You Are Leaving H&r Block® And Going To Another Website

Valid for an original 2019 personal income tax return for our Tax Pro Go service only. Must provide a copy of a current police, firefighter, EMT, or healthcare worker ID to qualify.

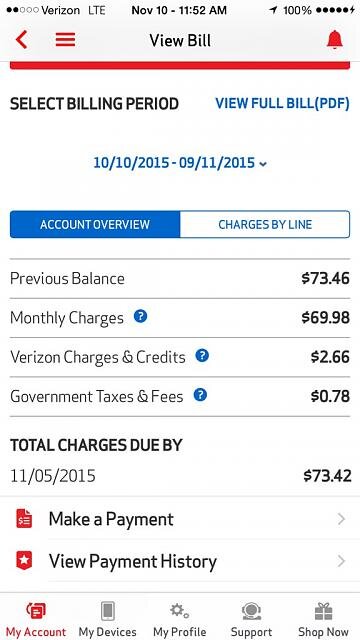

However, if a question ever arises, daily logs may help establish that a call was made for a business purpose. The best way to establish this percentage is by using your phone bill – if it itemizes your calls. Most cellular provider bills aren’t itemized, but you can log on to the provider’s website to access a log of all your calls for the month. Print out the logs and save them for several years in case you are audited. In practice, a super simple way to gather this documentation is to take your cell phone bill, print it out, and write your proration calculation on the top.

Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you.

You may depreciate the cost of your cell phone even if your employer provided it to you. Using this form, you will report all of your business’s income and any write-offs of business expenses, such as cell phone deductions, qualified rent, home office deduction, and more. In most situations, your cell phone is only partially deductible because of personal use.

You are not able to deduct these expenses. The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office.

- For most freelancers or independent contractors, I do not recommend going this route because it would require you to spend hundreds of extra dollars per year, AKA less money in your pocket.

- Although the home office deduction is designed primarily for the self-employed, you may use it as an employee if your employer requires you to work at home for his convenience rather than yours.

- if your return is audited, you would likely have to justify your reasoning.

- You are required to meet government requirements to receive your ITIN.

For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. H&R Block provides tax advice only through Peace of Mind® Extended Service Plan, Audit Assistance and Audit Representation. Consult your own attorney for legal advice.

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. How do I update or delete my online account?

The difference in cost between an expensive plan needed for the business and a cheaper plan that would have been sufficient for your personal use. Kristin Meador is a Certified Public Accountant with over 5 years experience working with small business owners and freelancers in the areas of tax, audit, financial statement preparation, and profit planning. While she’s not hiking in the Smoky Mountains or checking out new breweries (@travelingcpachick), she’s working on growing her own financial services firm. Kristin is an advocate and affiliate partner for Keeper Tax. One of the most confusing parts of being a freelancer is doing your own taxes, so I recommend leaning on a tax filing software designed for freelancers to do the hard work for you. The right tax software will walk you through how to fill out Schedule C, so you don’t have to worry about whether or not you filled it out correctly.

Never Deduct These 9 Expenses (but You Can Write Off Some Related Costs)

She writes as the tax expert for The Balance. Some crew members may elect to use a percentage of each bill (e.g. 80%, 75%, 50%). if your return is audited, you would likely have to justify your reasoning. Interest – Business interest expense is an amount charged for the use of money you borrowed for business activities.

Businesses can deduct employee cell phone expenses on the main form of the business tax return. Attach a statement detailing the breakdown of expenses included in other deductions. The new tax law that went into effect in 2018 nearly doubled the standard deductions. As a result, only 13.7 percent of taxpayers are expected to itemize expenses on their 2019 returns, according to the not-for-profit Tax Foundation. Prior to the enactment of the Tax Cuts and Jobs Act, nearly one-third of filers itemized expenses to reduce their taxable income.

Figuring out how much of your mobile phone expenses you can write off will take some documentation and number-crunching. Given that time is money, it might be more cost effective to have a second phone and make that your business phone, using it for nothing else. In the 21st century, cellphones are indispensable business tools. Business owners use them to check email and Slack channels, manage payments and bank deposits and, of course, talk and text. The IRS allows a cellphone tax deduction for self-employed people, but it’s not as easy to claim the write-off as you might like.

Social Security Taxes (unless You Overpay)

For example, if 50 percent of calls made each month are work-related, the business can reimburse and deduct 50 percent of all cellphone-related expenses. The best way to substantiate this expense is to get an itemized copy of the phone bill and mark off calls made for business purposes.

Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. If 70 percent of your minutes in a given month are for business calls, for example, you can deduct 70 percent of your monthly bill on your taxes. The personal use of the cellphone is not deductible as a business expense of the company. Business use of your phone is tax deductible – but only business use. You can’t use your phone to make a few work-related calls each day then write off your entire bill for the month. If 60 percent of your calls are business-related, you can deduct 60 percent of your cell bill for that month.

Are Cell Phones Business Expenses Or Employee Benefits?

Are you ready to file your 2020 tax return? With all the delays last year due to COVID-19, it seems like that prior tax season just finished. But time and taxes wait for no taxpayer. The Internal Revenue Service, which started 2021 by delivering more coronavirus economic relief payments, says it will be ready for our returns. The monthly tips and reminders a little further down this column should help us focus on our taxes and make the filing of them by go more smoothly.