Content

See your Cardholder or Account Agreement for details. Availability of Refund Transfer funds varies by state. Funds will be applied to your selected method of disbursement once they are received from the state taxing authority. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator .

- Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules.

- See Online and Mobile Banking Agreement for details.

- Getting audited is scary, so it’s important to know what kind of support you’re getting from your tax software.

- Business Checking Accounts Business checking accounts are an essential tool for managing company funds, but finding the right one can be a little daunting, especially with new options cropping up all the time.

Experts at NerdWallet suggest that most TurboTax products, including this one, are user-friendly and particularly worth considering for people who don’t know much about finances. For entrepreneurs who aren’t very organized, TurboTax’s Expense Finder feature is hugely valuable. After scanning your bank and credit card transactions, it identifies items you can claim as business expenses. The total is broken down by category, which helps you keep your records in order. All users have access to TurboTax Assistant, a chatbot, or a contact form.

Working With Turbotax Self

Their detailed questions about your tax situation help you maximize your refund or minimize your amount due. Help from real CPAs or Enrolled Agents is available for questions or troubleshooting, depending on the package you purchase. In recent years tax laws have undergone major revisions that could drastically affect the returns of people with complicated tax situations. A pro can not only capture all of your deductions accurately but also set you up for future tax strategies and savings. TurboTax also offers a service to have a CPA or other tax professional review your return and file it for you, for about $100 more. If you’re uncertain that you’ve done everything right or extracted the most from your return, this service could provide added peace of mind, but it’s not something most people need. For taxpayers who like a more hands-on approach to filing, it’s nice to take a peek under the hood.

If you get stuck, you select the help option, then you are given the choice between searching the help center for the answer to your query, or setting up a call with a tax professional if your version includes this option. If you choose the call option, you’re matched with a tax professional and a timed callback window. TurboTax’s desktop products offer U.S. based phone support with TurboTax specialists. These specialists should be able to help you with your problems, but they’re probably not CPAs or EAs. Once you’re done inputting your information, which takes about 30 minutes depending on how complicated your background is and your typing speed, TurboTax moves on to your federal return, then state return.

More Online Tax Preparation Offers

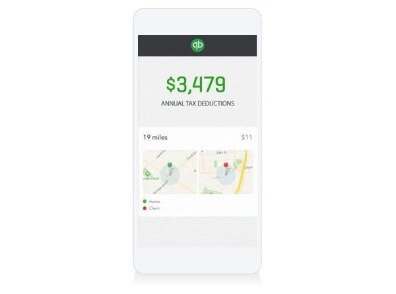

I ensure that I use a third-party app to track all mileage expenses and income. As a former licensed tax professional, I ensure that all of my documentation is in order to give me the peace of mind in the event of an IRS audit.

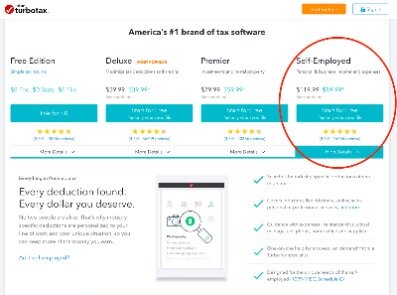

That will cost $29.99 (versus TurboTax’s Deluxe option, which is $90) for the 2020 tax year. In order to file Schedule C with H&R Block, you’ll need to upgrade to the Self-Employed option, which costs $104.99 for a federal filing. It’s great if you can file your taxes for free, but the average filer will need to upgrade to another option. The Deluxe option is enough for many filers. Both Deluxe options include deduction-finding software, help with charitable donations and access to tax financial experts through online chat. If your business is brand new and this is the first year that you’ll be filing a combined (personal/business) return, TurboTax will help you take advantage of any deductions available to you.

Accounting Accounting software helps manage payable and receivable accounts, general ledgers, payroll and other accounting activities. Likewise, if the W-4 form you completed for your employer was accurate, you won’t owe anything on the income reported on your W-2either. The important thing is that you begin making quarterly payments as soon as you begin making money as a self-employed person. They’re due on April 15, June 15, September 15 of the current yearand January 15 of the following year. We also offer full audit representation for an additional fee with TurboTax Audit Defense.

Compare Filing Options

Once you’re set up in TurboTax Home & Business, you can complete your personal details. The navigation screen to the left offers quick access to the Tax Home screen, as well as access to each part of the tax return process, which includes My Info, Federal, State, Review, and File options. Remember, with TurboTax, we’ll ask you simple questions about your income and expenses, and fill out the right tax forms for you to maximize your tax refund.

Here is a list of our partners and here’s how we make money. Save their receipts and be sure to make the appropriate deductions. Offers.com is among the federally registered trademarks of Ziff Davis, LLC and may not be used by third parties without explicit written permission.

But remember, it’s an extension to file, not an extension to pay. If you think you will owe, be sure to make any payment by April 18. To start your Free File tax return, you first need all your documents including your income statements such as Form W-2. Businesses are required to provide their employees with their Forms W-2 by Jan. 31.

The desktop version of the software generally has an online equivalent. For instance, if you choose the TurboTax Desktop Basic, you can find many of the same features in the TurboTax Free online option. These options are best for those who own a home and have children or dependents, prefer a bit more CPA or EA help, or even those who have experienced some sort of major life change and have questions. It’s meant for those who want to maximize deductions and credits with a professional’s help. TurboTax’s pricing may change throughout tax season. Expect deals early on in filing season to lure customers in. Be prepared for price increases as the tax deadline nears.

It includes all the features in the Premier option, as well as software-based guidance tailored to freelancers, contractors, and small business owners. Many tax preparation services and software claim to get you the maximum refund. Every service should, in theory, prepare your tax return optimally based on your situation. They cannot create new deductions or credits or make you eligible for tax benefits you don’t qualify for.

If your tax situation requires you to use TurboTax Deluxe, the software will tell you once you’ve entered information that triggers the upgrade. You can avoid surprises and see which forms are available for each version of TurboTax on its comparison page. If you don’t qualify for IRS Free File by TurboTax, start with TurboTax Free Edition. For people who aren’t sure whether they’d be better off itemizing or taking the standard deduction, TurboTax helps you figure that out. Even if you think you might want to itemize, start with the Free Edition; you’ll be able to upgrade to Deluxe later on if you must, such as to take the Health Savings Account deduction. Small-business owners, active stock traders, and those with complex real estate situations are best served by a professional tax preparer. In these cases, there are simply more chances to miss valuable deductions if you prepare your return yourself, and the results probably aren’t worth the time you’d spend entering all the info.

TurboTax Deluxe and higher each come with one free state download, but e-filing state returns cost extra. As of December 2020, the full price for a state e-file is $25, but TurboTax anticipates price increases in March 2021. The Self-Employed option helps with finding deductions specific to your field. This is important as the more you can deduct from your taxable income, the lower your inevitable tax bill may be. You get one-on-one help from a TurboTax product specialist on-demand, as well as an audit assessment. TurboTax offers four tiers of pricing in three different sets of options.

If, for whatever reason, you cannot meet the April 18 tax deadline this year, you also can use Free File to submit an extension to file. Just look for the companies that are offering free extensions.

Appointment Scheduling 10to8 10to8 is a cloud-based appointment scheduling software that simplifies and automates the process of scheduling, managing, and following up with appointments. We’ll automatically import your QuickBooks Self-Employed income and expense accounts and classify them for you. We’ll call out potential red flags and uncover deductions you may have missed, for total peace of mind. have multiple sources of income, we’ll help you get every deduction you qualify for.

TurboTax Self-Employed is designed for freelancers, independent contractors, consultants, and small business owners who currently operate without corporate status. TurboTax also offers a corporate version designed for C and S corporations. We may receive compensation from partners and advertisers whose products appear here. Compensation may impact where products are placed on our site, but editorial opinions, scores, and reviews are independent from, and never influenced by, any advertiser or partner.

Save money by tracking mileage, business expenses, and receipts all year long. File your taxes with Self-Employed Online Assist and you’ll have access to an actual tax professional on-demand and wherever you need. Small Business Small business tax prep File yourself or with a small business certified tax professional. Another con is that manually inputting your information takes a good chunk of time, so the automatic upload option is recommended. All in all, the best feature of TurboTax is the user experience of the software.

Jennifer Mansfield, CPA, JD/LLM-Tax, is a Certified Public Accountant with more than 30 years of experience providing tax advice. Tax season is a good time to take stock of your overall financial picture. Finding the right financial advisor that fits your needs doesn’t have to be hard. SmartAsset’s free tool matches you with financial advisors in your area in 5 minutes. If you’re ready to be matched with local advisors that will help you achieve your financial goals, get started now.

From the beginning,TurboTax makes it easy to determine which plan is right for you. TurboTax options include the TurboTax Free plan, which is only suitable for simple tax returns.