Content

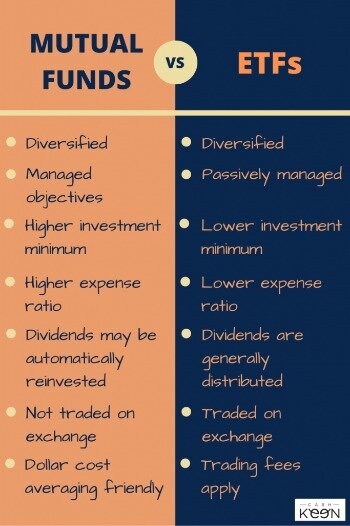

Mutual fund transactions do not include commissions to a brokerage, while some ETF transactions do. Brokers typically charge the standard stock trade commission for ETF purchases and sales. Both can track a market index or seek to outperform the market . Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

- They are considered a portable investment, which offers a nice advantage over mutual funds.

- All of this can be executed with a computer program, untouched by human hands.

- An order to buy or sell an ETF at the best price currently available.

- A good combination of these goals comes from examining an ETF vs mutual fund, the two most popular investment vehicles for buying baskets of securities.

- With target date funds, you start by investing in high-risk, high-reward options and then switch to low-risk, low-reward options as you get closer to retirement.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. As we covered earlier in the potential ETF drawbacks, you may have to consider the size of the bid/ask spread of a low-volume ETF before purchasing it. Mutual funds, by contrast, always trade at NAV without any bid-ask spreads. Before you decide on the mix that’s right for you, let’s look at the benefits and potential drawbacks of each type of investment.

Etf Vs Mutual Fund: Whats The Difference?

That said, according to Morningstar, the average ETF expense ratio in 2016 was 0.23%, compared with the average expense ratio of 0.73% for index mutual funds and 1.45% for actively managed mutual funds. ETFs don’t often have large fees that are associated with some mutual funds. But because ETFs are traded like stocks, you typically pay a commission to buy and sell them. Although there are some commission-free ETFs in the market, they might have higher expense ratios to recover expenses lost from being fee-free. As the name suggests, exchange-traded funds trade on exchanges, just as common stocks do; at the other side of the trade is some other investor like you, not the fund manager. You can buy and sell at any point during a trading session—at whatever the price is at the moment based on market conditions—not just at the end of the day.

A fund manager is hired by the ETF to watch over which stocks or bonds are included in the ETF. “Total stock” funds invest in a combination of small, mid-size, and large companies with varying degrees of value and growth . “Total bond” funds invest in a combination of short-, intermediate-, and long-term bonds with varying degrees of credit quality and risk. An index fund buys all or a representative sample of the bonds or stocks in the index that it tracks.

Mutual funds usually are actively managed to buy or sell assets within the fund in an attempt to beat the market and help investors profit. Passive management isn’t the only reason that ETFs are typically cheaper. Index-tracking ETFs have lower expenses than index-tracking mutual funds, and the handful of actively-managed ETFs out there are cheaper than actively-managed mutual funds.

Mutual Fund Vs Etf Example

But there’s a difference in these payouts to investors, and ETF investors have an advantage here, too. In the category of commissions, ETF investors are real winners. The big-name brokerages have slashed commissions to zero on all ETFs offered on their site. So it won’t cost you anything to trade these funds, though some brokers may impose an early redemption fee.

A passive fund’s performance is measured by how well it replicates its chosen index. If you’re investing in a taxable brokerage account, having more control over capital gains distributions may be a deciding factor.

These different classes may require investors to pay various types of sales loads, expenses, and operational fees, affecting the mutual fund’s basis. In particular, mutual funds often carry 12b-1 marketing or distribution fees. Other differences — such as the ability to buy fractional shares, commission fees, and minimum investments — will vary based on the funds and brokers you’re considering. Some mutual funds have very low minimums, and they’ll go down further if you agree to invest on a regular schedule.

When you sell your shares, the same process occurs, but in reverse. Some mutual funds assess a penalty, sometimes at 1% of the shares’ value for selling early .

More Choices More Ways To Invest How You

Investors in ETFs and mutual funds are taxed each year based on the gains and losses incurred within the portfolios. But ETFs engage in less internal trading, and less trading creates fewer taxable events .

In exchange for your loan, the issuer agrees to pay you regular interest and eventually pay back the entire loan amount by a specific date. Each share of a stock is a proportional share in the corporation’s assets and profits. Not only do ETFs provide real-time pricing, they also let you use more sophisticated order types that give you the most control over your price.

The Balance does not provide tax, investment, or financial services and advice. The information is being presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor and might not be suitable for all investors. Investing involves risk including the possible loss of principal. That’s why it’s critical that you understand the characteristics of your investments, and not just whether the fund is an ETF or mutual fund. A mutual fund or ETF tracking the same index will deliver about the same returns, so you’re not exposed to more risk one way or the other. Mutual funds may pay distributions at the end year, while ETFs may pay dividends throughout the course of the year.

This is called active management, and it often translates into higher costs for investors. Many mutual funds are actively managed by a fund manager or team making decisions to buy and sell stocks or other securities within that fund in order to beat the market and help their investors profit. These funds usually come at a higher cost since they require a lot more time, effort, and manpower. ETFs are still relatively new while mutual funds have been around for ages, so investors who aren’t just starting out are likely to hold mutual funds with built-in taxable gains. Selling those funds may trigger capital gains taxes, so it’s important to include this tax cost in the decision to move to an ETF. Some mutual funds charge a load fee of 3% – 6%, which you must pay either when you make your investment (front-end load fee), or when you sell your investment (back-end load fee). No-load mutual funds are also available, but these will charge other fees, such as annual expense ratios.

To better understand the similarities and differences between investments, including investment objectives, risks, fees and expenses, it is important to read the products’ prospectuses. ETF investors usually face tax implications only when they sell their shares.

Mutual funds remain top dog in terms of total assets, thanks to their prominence in retirement plans such as 401s. U.S. mutual funds had around $21 trillion, at the end of 2019, compared to $4.2 trillion in ETFs, according to the Investment Company Institute. But ETFs have been growing quickly in the last decade, as investors are drawn by their low fees and ease of trading. Most mutual funds—including many no-load and index funds—charge investors a special, annual marketing fee called a 12b-1 fee, named after a section of the 1940 Investment Company Act. The 12b-1 fee is broken out in the prospectus as part of the expense ratio. It can run as high as 0.25% in a front-end load fund and as high as 1% in a back-end load fund. Many investor-right advocates consider these expenses to be a disguised broker’s commission.

For instance, mutual funds and ETFs based on the S&P 500 index are largely going to perform the same for you. But actively managed funds may have widely different results, depending on how they’re invested. While you can place your order at any time, it won’t be filled until the exact price of the fund is tallied up at day’s end. So you won’t know what you’re paying until the transaction is complete. But you’ll always pay the exact net asset value of the fund’s holdings. In contrast, some mutual funds may require you to purchase at least $2,500 to get started, if you’re opening your own individual account, with smaller minimum subsequent deposits.