Content

Check cashing not available in NJ, NY, RI, VT and WY. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator . See your Cardholder Agreement for details on all ATM fees.

Audit services constitute tax advice only. Consult an attorney for legal advice. Description of benefits and details at hrblock.com/guarantees. Emerald Cash Rewards™ are credited on a monthly basis. Rewards are in the form of a cash credit loaded onto the card and are subject to applicable withdrawal/cash back limits. Merchants/Offers vary.

Transferring funds from another bank account to your Emerald Card may not be available to all cardholders and other terms and conditions apply. There are limits on the total amount you can transfer and how often you can request transfers.

Turbotax Online

After 20 days, comments are closed on posts. Intuit may, but has no obligation to, monitor comments. Comments that include profanity or abusive language will not be posted. Click here to read full Terms of Use. Turbo Tax emailed me to let me know that my federal return was accepted by the irs today ( early 1/26/14 ). Since the IRS will not start processing refunds until the 31st, when should I expect my direct deposit refund.

Make sure you have your correct social security numbers before sitting down to file your taxes. Incorrect social security numbers for you, your spouse, and dependents will cause you to miss out on valuable tax deductions and credits. After you have re-created your 2013 amended return, you will be able to amend it. A listing of additional requirements to register as a tax preparer may be obtained by contacting CTEC at P.O. Box 2890, Sacramento, CA ; or at

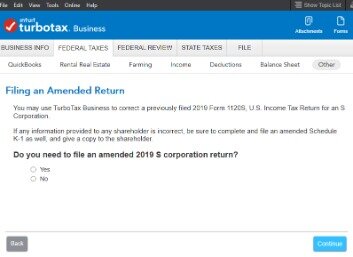

This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X. Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice. You can’t cancel your completed tax return. Once the IRS begins accepting tax returns on 1/31, if they accept your tax return they may adjust it for you if not you will need to amend. If your tax return is rejected, you can fix your tax return and add the W-2 you left out and resend it. Starting price for simple federal return.

It’s a secure PDF Editor and File Storage site just like DropBox. Your selected PDF file will load into the DocuClix PDF-Editor. There, you can add Text and/or Sign the PDF. Select one or more state and download the associated Back Tax Year Forms. Complete, sign and mail in the forms to the address on the form. From Jan. 1 – Jan. 31, 2020, you should only use the 2020 W-4 Form (the 2013 W-4 is no longer relevant).

Power of Attorney required. Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. Terms and conditions apply. H&R Block tax software and online prices are ultimately determined at the time of print or e-file. All prices are subject to change without notice. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Additional terms and restrictions apply; SeeFree In-person Audit Supportfor complete details.

Third-party blogger may have received compensation for their time and services. Click here to read full disclosure on third-party bloggers. This blog does not provide legal, financial, accounting or tax advice. The content on this blog is “as is” and carries no warranties. Intuit does not warrant or guarantee the accuracy, reliability, and completeness of the content on this blog.

Well Help You Make Corrections Or Updates To Your Irs Accepted 2018 Tax Return

The requested file was not found on our document library. The signed Amended Tax Return and all the supporting documents are forwarded to the Department of the Treasury, Internal Revenue Service, Austin, Texas.

This includes any new 1099 or W-2 you receive if you under-reported your income. If you are claiming a new deduction or credit, any document that supports your eligibility to claim it such as a receipt will be helpful. It’s also a good idea to have a copy of your original tax return available. You can also prepare your amended return in TurboTax. To do this, you need to use the version of TurboTax that applies to the tax year you need to amend.

I had m taxes done with turbo tax and irs accepted on the 10th. I check wheres my refund and it stills says processing. Is it something wrong or is that normal. Lisa Lewis is a CPA and the TurboTax Blog Editor. Lisa has 15 years of experience in tax preparation.

Additional state programs extra. Most state programs available in January; release dates vary by state.

Can I Use Tax Preparation Software To Amend My Return?

OBTP#B13696 ©2017 HRB Tax Group, Inc. Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income . Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer. Available at participating U.S. locations.

- Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment.

- Not sure where to start?

- Your transcript shows most of the lines from your tax return, including income, deductions, credits, and tax payments.

- This includes any new 1099 or W-2 you receive if you under-reported your income.

- See local office for pricing.

MetaBank® does not charge a fee for this service; please see your bank for details on its fees. State e-file available for $19.95. In Part III of Form 1040-X, you’ll need to provide a clear explanation for your reasons for filing an amended return. Column A. This column shows the numbers previously reported on your tax return. Use the copy of your tax return you gathered in Step 1 to complete this column.

For example, California uses Schedule X. Other states do not. The Hawaii form, for example, is Schedule AMD. Second, get the proper form from your state and use the information from Form 1040X to help you fill it out. Or, when done editing or signing, create a free DocuClix account – click the green Sign Up button – and store your PDF files securely. Or, click the blue Download/Share button to either download or share the PDF via DocuX.

If You Used 2019 Turbotax Free, Basic, Deluxe, Or Premier To File

The process for filing an amended return is fairly straightforward. Here’s a step-by-step guide. If you’re outside of that window, you can’t claim a refund by amending your return.

At participating offices. Only available for returns not prepared by H&R Block. All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. All tax situations are different.

Offer valid for returns filed 5/1/ /31/2020. If the return is not complete by 5/31, a $99 fee for federal and $45 per state return will be applied. Prices based on hrblock.com, turbotax.com and intuit.taxaudit.com (as of 11/28/17). TurboTax® offers limited Audit Support services at no additional charge. H&R Block Audit Representation constitutes tax advice only. Consult your attorney for legal advice.

The student will be required to return all course materials, which may be non-refundable. Discount is off course materials in states where applicable. Discount must be used on initial purchase only. Not valid on subsequent payments. Expires January 31, 2021. CTEC# 1040-QE-2355 ©2020 HRB Tax Group, Inc.

H&R Block does not automatically register hours with WGU. Students will need to contact WGU to request matriculation of credit. Additional fees may apply from WGU. Severe penalties may be imposed for contributions and distributions not made in accordance with IRS rules. Fees apply when making cash payments through MoneyGram® or 7-11®. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year.

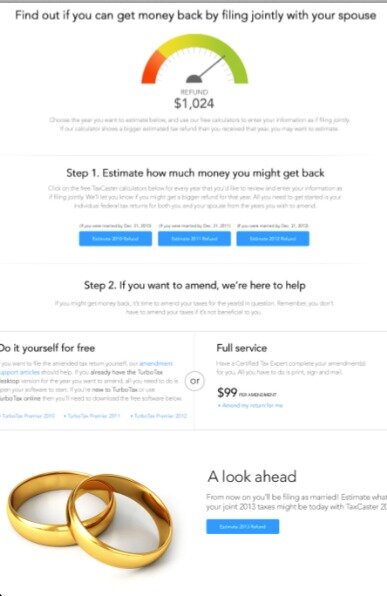

I got married July 13, 2013 and lost my job July 5, 2013, can my husband claim me the rest of the year and as injured spouse. Also we have separate turbo tax accounts and do we file married on one account or do I need to file on both accounts as married. It may be because of your states cohabitation laws. Unfortunately, in some states it is illegal to cohabitate. I live in VA and that is the case. Even though my sons father and I live together and have done so for 13yrs I cannot claim him on my taxes. Western Governors University is a registered trademark in the United States and/or other countries.

Even though it’s already 2014 there is still time to contribute to your IRA, putting more money in your nest egg and increasing your tax refund. You have up until the day you file your taxes to make a contribution for 2013 and lower your taxes. Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. Enrollment restrictions apply. There is no tuition fee for the H&R Block Income Tax Course; however, you may be required to purchase course materials. State restrictions may apply.

One personal state program and unlimited business state program downloads are included with the purchase of this software. Additional personal state programs extra. Enrolled Agents do not provide legal representation; signed Power of Attorney required.