Content

Fees apply when making cash payments through MoneyGram® or 7-11®. Minimum monthly payments apply. Line balance must be paid down to zero by February 15 each year. Year-round access may require an Emerald Savings® account.

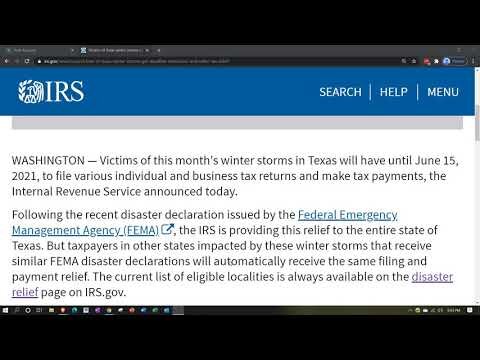

But affected taxpayers who reside or have a business located outside the covered disaster area should call the IRS disaster hotline at to request this tax relief. Individuals and households who reside or have a business in Baldwin, Escambia, and Mobile counties qualify for tax relief. Taxpayers in localities added later to the disaster area will automatically receive the same filing and payment relief. Depending on the circumstances, the IRS may grant additional time to file returns and pay taxes without penalty. We want you to know that the IRS Disaster Assistance and Emergency Relief Program helps taxpayers and businesses recover financially after a disaster. Financial Assistance Within Designated Natural Disaster Areas The president can declare an area a natural disaster and allow financial individual assistance.

Type of federal return filed is based on taxpayer’s personal situation and IRS rules/regulations. Form 1040EZ is generally used by single/married taxpayers with taxable income under $100,000, no dependents, no itemized deductions, and certain types of income . Additional fees apply with Earned Income Credit and you file any other returns such as city or local income tax returns, or if you select other products and services such as Refund Transfer. Available at participating U.S. locations.

Disaster Financial Assistance For Workers And Small Business Owners

The CARES Act creates or boosts programs designed to keep small businesses afloat. An Economic Injury Disaster Loan helps small businesses and nonprofits that are losing money during the coronavirus pandemic and that need funds for financial obligations and operating expenses. Get the latest information from the SBA about the Paycheck Protection Program, including program details, who can apply, loan forgiveness, and frequently asked questions. The Paycheck Protection Program offers loans to help small businesses and non-profits keep their workers employed. If you follow the guidelines, your loan may be forgiven.

- For more information on what the payment status codes mean, see the IRS stimulus payment information center.

- The Economic Injury Disaster Loan advance funds will be made available within days of a successful application, and this loan advance will not have to be repaid.

- The IRS began issuing direct deposits and mailing paper stimulus checks on December 30, 2020 and will continue through January 2021.

- Start one way, finish another.

- , pertaining to like-kind exchanges of property, also applies to certain taxpayers who are not otherwise affected taxpayers and may include acts required to be performed before or after the period above.

Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services.

Press Information

§301.7508A-1 and are entitled to the relief detailed below. For information on services currently available, visit the IRS operations and services page at IRS.gov/coronavirus.

Enrollment in, or completion of, the H&R Block Income Tax Course is neither an offer nor a guarantee of employment. Additional qualifications may be required. Enrollment restrictions apply.

See Tax Relief in Disaster Situations for the latest disaster-related new releases and related guidance. Revenue Procedure , section 8, lists the retirement plan and IRA deadlines that the IRS may postpone because of a disaster. Federal Emergency Management Agency – leads the effort to prepare the nation for all hazards and effectively manage federal response and recovery efforts following any national incident. the preparer is unable to file or pay on their behalf. After a disaster or in other emergency hardship situations, people may be interested in using a charitable organization to help victims.

Irs Announces Tax Relief For Hurricane Sally Victims

Software DE, HI, LA, ND and VT do not support part-year or nonresident forms. Share your docs in a tax office or virtually. Drop off your docs at your local tax office. Chat with your tax pro over video or phone, and approve your return online.

Parents of qualifying children will get a one-time payment of $500 per child. People with incomes higher than those levels will receive partial payments. Individuals earning more than $99,000 and couples earning more than $198,000 will not receive any payment, unless they have children. Individuals, including Social Security recipients, earning $75,000 or less will receive a $1,200 payment. The Treasury Department announced on May 18 that almost four million stimulus payments will go out as prepaid Visa debit cards. Watch this Economic Impact Payment Prepaid Cards video to learn about activating and using the card.

Payroll, unemployment, government benefits and other direct deposit funds are available on effective date of settlement with provider. Please check with your employer or benefits provider as they may not offer direct deposit or partial direct deposit. Faster access to funds is based on comparison of traditional banking policies for check deposits versus electronic direct deposit. Description of benefits and details at hrblock.com/guarantees. Terms and conditions apply; seeAccurate Calculations Guaranteefor details. Get your taxes done by a tax pro in an office, via video chat or by phone. Or do your own with expert, on-demand help.

If you were in this category and you submitted your information by October 15, 2020, you should receive your payment by the end of the year. Get Transcript – Copies or transcripts of filed and processed tax returns can help reconstruct tax records destroyed by natural disasters. For prior tax relief provided by the IRS in disaster situations based on FEMA’s declarations of individual assistance, please visit Around the Nation. Find information on the most recent tax relief provisions for taxpayers affected by disaster situations. Affected taxpayers who are contacted by the IRS on a collection or examination matter should explain how the disaster impacts them so that the IRS can provide appropriate consideration to their case. Taxpayers may download forms and publications from the official IRS website, IRS.gov.

Read about those and other coronavirus-related changes to unemployment benefits. If you didn’t get a payment in 2020, or if you received less than the full amount you were entitled to, such as $500 for each qualifying child, you may be able to get the difference in 2021. See the IRS information for filing for the CARES Act stimulus payment in 2021.

Hurricane Harvey Or Tropical Storm Harvey Covered Disaster Area

This section of our website provides IRS news specific to local areas, primarily disaster relief or tax provisions that affect certain states. IRS is providing a variety of tax relief for those affected by the Coronavirus. For the latest updates, check the Coronavirus Tax Relief page. Recent special tax law provisions may help taxpayers recover financially from the impact of a major disaster in their location.

Check cashing not available in NJ, NY, RI, VT and WY. When you use an ATM, we charge a $3 withdrawal fee. You may be charged an additional fee by the ATM operator .

The SBA’s Economic Injury Disaster Loan provides vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing as a result of the COVID-19 pandemic. The Paycheck Protection Program prioritizes millions of Americans employed by small businesses by authorizing up to $659 billion toward job retention and certain other expenses. The Paycheck Protection Program is providing small businesses with the resources they need to maintain their payroll, hire back employees who may have been laid off, and cover applicable overhead.