Content

The tax identity theft risk assessment will be provided in January 2019. The tax identity theft risk assessment is based on various data sources and actual risk may vary beyond factors included in analysis. Starting price for simple federal return. Starting price for state returns will vary by state filed and complexity.

Depreciation allows businesses to express the results of their financial transactions more fairly and accurately. It is vital to the success of enterprises that employees understand the basic idea of depreciation. After all, depreciation is a foundational concept in tracking financing and accounting business transactions.

- Year-round access may require an Emerald Savings®account.

- The modified accelerated cost recovery system allows a business to recover the cost basis of certain assets that deteriorate over time.

- You will still be required to login to further manage your account.

- The student will be required to return all course materials, which may be non-refundable.

- Remember, the bouncy castle costs $10,000 and has a salvage value of $500, so its book value is $9,500.

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Auto Mechanic Tax Deductions

The exception is the units of production method. Under this method, the more units your business produces , the higher your depreciation expense will be. Thus, depreciation expense is a variable cost when using the units of production method.

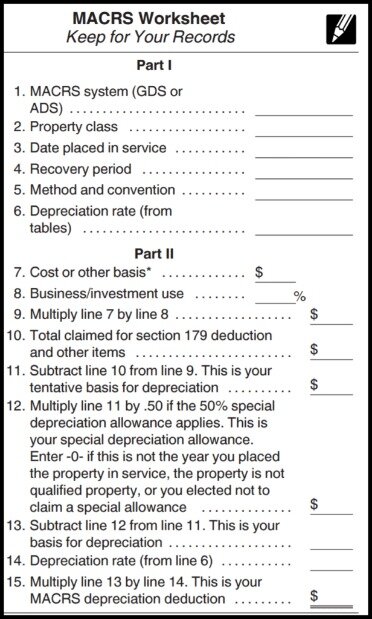

Since the tax rules for MACRS are complex, the 100-plus pages of the IRS Publication 946 provide complete guidance on depreciating assets with MACRS. The IRS provides guidelines on which assets are eligible for MACRS and what useful life figure should be used. This will give you your annual depreciation deduction under the straight-line method. Both of these accelerated depreciation features come with limits and qualifications, so check with your tax professional to see if you qualify. See this article on changes to rules for section 179 and bonus depreciation as part of the Tax Cuts and Jobs Act of 2017. Bonus depreciation for the purchase of “new to you” property. Office furniture and miscellaneous assets depreciate over a period of seven years.

You can file Form 1040X through the H&R Block online and software tax preparation products or by going to your local H&R Block office. How do I update or delete my online account?

Refunds

Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply.

According to the international accounting standards, any capital expenditure should be capitalized and booked as a non-current asset on the balance sheet. Inventory is a current asset whereas computer equipment is a non-current asset. Either way, your payments are spread out, and eventually you become the owner. Here you record the computer as an asset, and you will also record what you owe on the lease or loan as a liability. Part of your monthly payment goes toward reducing that liability and part is expensed as an interest payment. Depreciation is also recorded every period.

By adopting GAAP, all enterprises can speak the same “financial reporting language,” simplifying measurement and making universal comparison possible. Official IRS Forms and Instructions for filing under both Section 179 and MACRS are found online.

Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation. Referred client must have taxes prepared by 4/10/2018. H&R Block employees, including Tax Professionals, are excluded from participating.

How Is Depreciation Calculated?

Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services.

All tax situations are different and not everyone gets a refund. Fees apply if you have us file an amended return. The IRS allows taxpayers to amend returns from the previous three tax years to claim additional refunds to which they are entitled. Applies to individual tax returns only. Available only at participating H&R Block offices.

You sign an agreement to lease a computer for x months at a charge of $y per month. The vendor delivers the computer for you to use for the duration of the lease provided you continue to make the monthly payments. When the lease expires, you could either renew it or return the equipment. Each week, our TechRepublic financial team answers your questions about the mysteries of making those budget sheets balance. This week, a TechRepublic member asked a question about computer purchases.

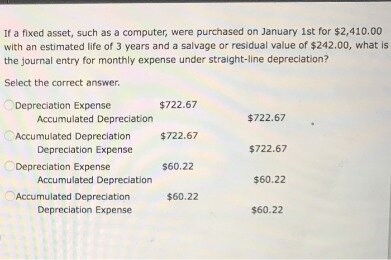

The way you depreciate PCs will have an impact on your company’s bottom line. In this edition of Ask the Accountants, find out why understanding a few accounting terms can make a difference. Most enterprises follow the guidelines regarding depreciation formulated by the Generally Accepted Accounting Principles . The GAAP provisions were established by theFinancial Accounting Standards Board , which creates the agreed upon framework for all financial transactions.

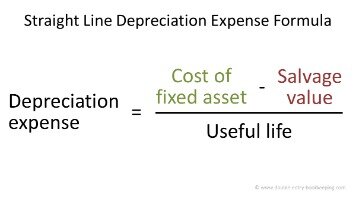

However, I’ll show you the depreciation of equipment through all depreciation methods. Depreciation is a quantitative measure of how much the asset has been used. It is a non-cash revenue expenditure annually reported on the income statement of every entity holding fixed assets. As you can see, making the decision on how to account for purchases of equipment involves a series of trade-offs. As always in matters involving taxes and accounting, you should consult with your accountant or finance department and choose the system that best fits your company. For the next two years, you won’t show any expense for these computers.

Your party business buys a bouncy castle for $10,000. Its salvage value is $500, and the asset has a useful life of 10 years. At AssetWorks, we understand that managing assets can be a challenge. Of course, there are many software programs out there that will not only help you track your organizations assets but will also calculate depreciation and produce reports for you. To calculate depreciation, we must first identify the acquisition cost, salvage value, and useful life. For our playground structure, let’s say the cost was $21,500.

For tax depreciation, different assets are sorted into different classes, and each class has its own useful life. One way to make the expense approach more accurate is to use an accelerated depreciation technique. In our case, this method may more accurately reflect how a computer loses value over time.

Some of them can be added to the depreciable value of the property. Those include features that add value to the property and are expected to last longer than a year. Examples include a new furnace, new windows, or new flooring. For example, let’s say the assessed real estate tax value for your property is $100,000. The assessed value of the house is $75,000, and the value of the land is $25,000. So 75% of your property’s value is the house. Often, the challenge is knowing how much you paid for each.

About H&r Block

Computers, office equipment, light vehicles, and construction equipment depreciate over a period of five years. He previously worked for the IRS and holds an enrolled agent certification. It’s a good idea to consult with your accountant before you decide which fees to lump in with the cost of your property. You divide the asset’s remaining lifespan by the SYD, then multiply the number by the cost to get your write off for the year. That sounds complicated, but in practice it’s pretty simple, as you’ll see from the example below. Since the asset is depreciated over 10 years, its straight-line depreciation rate is 10%.

As defined by the Internal Revenue Service , depreciation is an income tax deduction that allows a business to recover the cost basis of certain property. It is an annual allowance for the wear and tear, deterioration, or obsolescence of the property. Most tangible assets are depreciable. Likewise, certain intangible assets, such as patents and copyrights, are depreciable. A Section 179 expense deduction allows businesses to take a deduction for the entire value of the property or asset in the first year. The deduction is capped at $1,020,000 as of the 2019 tax year—the return you’ll file in 2020.