Content

So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. We’ve tested some of the most widely used tax-preparation software packages to help you choose the one that’s right for you.

We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy.

Please help us keep our site clean and safe by following our posting guidelines, and avoid disclosing personal or sensitive information such as bank account or phone numbers. Any comments posted under NerdWallet’s official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise. State and IRS Tax Refund & Stimulus Tracking Guide by Tina Orem Everything you need to track your stimulus check, federal tax refund and state tax refund — plus tips about timing. If you send products or inventory to a large, online company that distributes them to buyers for you, you may have created “connections” in many states in addition to your own.

VAT is paid by the consumer, but when you are not a resident of the EU, you are entitled to a refund of your VAT before you return to your home country. Bankrate is compensated in exchange for featured placement of sponsored products and services, or your clicking on links posted on this website. This compensation may impact how, where and in what order products appear. Bankrate.com does not include all companies or all available products. If you tally up your itemized deductions and they don’t exceed the standard deduction amount, you’re better off not itemizing at all.

- This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories.

- If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

- TurboTax can help you with determining your eligibility, calculating the deduction and reporting it on all the correct forms.

- TurboTax will take care of these calculations to ensure that you get the best deductions for your specific situation.

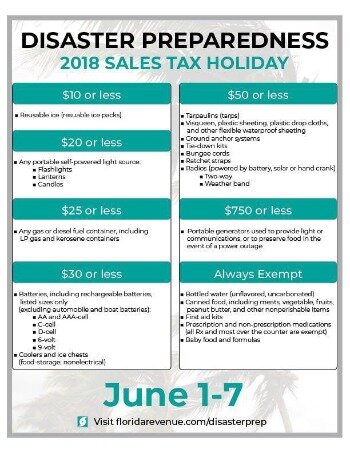

The deduction is available to taxpayers that itemize deductions, not those who take the standard deduction. The deduction is based on adjusted gross income and number of exemptions claimed. Taxpayers who keep all their receipts can deduct actual sales tax and use tax paid. For taxpayers who didn’t keep receipts, the IRS has an online Sales Tax Deduction Calculator to determine the amount of optional general sales tax to claim, or taxpayers can use the Optional State Sales Tax Tables. If you use the optional state sales tax tables provided by the IRS, be sure to consider all forms of income that you took during 2020 to identify your correct income level.

Of course, that type of record-keeping is difficult, and many people won’t have all their receipts. If you don’t know the exact amount of sales tax you paid, you can use the IRS sales tax deductioncalculatorto get an estimate. It takes about 5-10 minutes to enter the information, and you’ll wind up with the amount you can deduct. Also, in addition to the IRS’ estimate of sales taxes you paid in your state, don’t forget to add the sales taxes you paid for the allowable large purchases made during the year as noted above. First, decide whether to take the standard deduction or whether to itemize deductions. If you choose to take the standard deduction, then you can’t itemize deductions, including the sales tax deduction.

This is because the IRS allows you to add these tax payments to the amount of sales tax you’re eligible to deduct when using the optional sales tax tables, which gives you an even bigger deduction. The information contained in this article is not tax or legal advice and is not a substitute for such advice.

Deducting Sales Tax: When Does It Make Sense?

If you live in one area, but work in different area or multiple areas with different tax rates. TurboTax can help you with determining your eligibility, calculating the deduction and reporting it on all the correct forms.

A sales tax is a direct tax on consumption that many states and local governments impose when you purchase goods and services. The amount of tax you pay is typically figured as a percentage of the sale price.

Since you can calculate your deduction using either method, choose the one that gives you the larger deduction. In addition to the lower $5,000 deduction ceiling, there are a few more special rules for those who are married but filing separately. You and your spouse must both itemize or you must both take the standard deduction if you file your federal taxes using the married filing separately status. You have two options for calculating your sales tax deduction, should you decide to take it. You can use your actual sales tax expenses, or you can use the optional sales tax tables that are available through the IRS. The Sales Tax Deduction Calculator has been updated with overseas U.S. Military Personnel who are deployed overseas can use the calculator to determine the sales tax they paid while they were within the United States.

Lender Reviews

Self-Employed Best for contractors, 1099ers, side hustlers, and the self-employed. If necessary, take your tax-free forms to Customs at the airport before you leave the EU. They will verify your purchase and ask to see your passport before stamping your forms. We are an independent, advertising-supported comparison service. , from adjusting daily and monthly habits to making long-term changes.

This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. But if you sell your products through Amazon’s FBA program , you send inventory to Amazon first. That relationship could require you to collect sales tax from customers in other areas where Amazon does business.

You can make it easier on yourself by saving your receipts and maintaining a spreadsheet. Be disciplined about entering the sales tax from each receipt regularly to keep a running tally that’s easy to reference at tax time. Otherwise, you’ll be faced with a mountain of receipts at tax time that all need adding up.

More In Credits & Deductions

Actual sales taxes on these items are deductible even if consumers paid less than the general sales tax rate on these items. The IRS allows you to deduct the actual sales taxes you paid, as long as the tax rate was no different than the general sales tax rate in your area. Tax Calculator by Chris Hutchison Estimate how much you’ll owe in federal taxes, using your income, deductions and credits — all in just a few steps.

The word “nexus” is used by the law to describe the connection sellers must have with a particular area before they are required to charge and collect taxes for online sales there. You are most likely being asked for your state and local sales tax rate.

If your AGI is halfway through the phase-out zone, for example, your sales tax deduction would be cut in half. For most taxpayers, AGI is basically taxable income before subtracting personal and dependent exemptions, and standard or itemized deductions.

For people who take the standard deduction on their 2009 returns next spring, the sales tax deduction will be added to their standard deduction. For example, the standard deduction for married couples for 2009 is $11,400.

Youre Our First Priority Every Time.

People who live in a state that does not impose income taxes often benefit most from this deduction. However, you might also be better off deducting sales taxes instead of income taxes if you make large purchases during the year and your total sales tax payments exceed those for state income tax. You can use either the actual sales taxes you paid or the IRS optional sales tax tables. Beginning with tax years after 2017, the amount of state and local taxes, including sales tax, is limited to a maximum of $10,000. The IRS expects that you’ll take full advantage of every deduction available to you. If you determine that itemizing expenses is your best option, consider taking the state and local tax deduction that offers the bigger tax break. If itemizing proves to be the better course of action, taxpayers then must choose between taking the state and local income tax deduction or the sales tax deduction.

The deduction for your sales tax payments is only available if you itemize. To make this determination, add up all of your expenses that are eligible to be itemized, including your sales taxes.

It might also make sense if you purchased a big-ticket item, like a car or a trailer. If you do itemize your deductions, the IRS says that you can deduct what you paid in state and local generalsalestax or your state, local, and foreignincometax for the year. If you didn’t keep track of all your purchases and have no idea how much you might have spent on sales tax, the IRS has a solution for you.

Likewise, if you started making a lot more money, you may have paid a lot more state income tax during the year, which means deducting your state and local income taxes might be the better choice. Most people are familiar with sales tax—that extra percentage stores collect from customers in many states.

If you’re online seller trying to decide if you need to collect sales tax, first determine if your home state has a sales tax at all. Most states do impose sales taxes, but several—like Alaska and Oregon—do not. States usually exempt certain purchases such as prescription and nonprescription drugs and food items from sales tax. Of all the states that impose a sales tax, only Illinois charges the full rate of tax on these items.

The downside to this method is that it requires a lot of meticulous record-keeping, but it can result in a higher deduction. If your state has a significant income tax rate and you have a steady income from a well-paying job, you’d have to tally up a lot of sales taxes during the year to make claiming this deduction worth your while. When you’re filing taxes, you can either claim the standard deduction or itemize your deductions—you can’t do both. If you want to claim sales taxes, you’ll have to itemize them on Schedule A of the federal Form 1040. Here’s what you need to know if you’re considering writing off your sales tax costs on your federal tax returns. Paying a sales tax can sting, particularly when you’re purchasing a big-ticket item like an automobile or furniture, but the Internal Revenue Service provides a bit of a silver lining—a federal sales tax deduction.