For example, if the borrower went bankrupt, you’ll want to keep that documentation. While finding yourself in this situation is unfortunate, you may be able to take consolation in the form of a tax deduction – even if you don’t own a business. You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. The court said that there was sufficient proof to indicate that a true debtor-creditor relationship existed between Wayne and Stephanie and David. The loan was evidenced by a note executed by Stephanie and David in favor of Wayne; the note was secured by a second mortgage, and interest was charged at a rate well above the market rate. By the summer of 1995, Stephanie was experiencing financial difficulties from having to make 3 monthly payments.

Money given to a corporation should be evidenced as a loan with a loan agreement; otherwise, it may be treated as a nondeductible contribution of capital. A true creditor-debtor relationship must exist between the taxpayer and the borrower. If the taxpayer is related to the borrower, then the IRS may treat the loan as a gift rather than as a true loan. To claim the bad debt deduction, the transaction must have been intended as a loan and not as a gift. Generally, to deduct a bad debt, you must have previously included the amount in your income or loaned out your cash. If you are a cash basis taxpayer, you may not take a bad debt deduction for money you expected to receive but did not.

Henssler is not licensed to offer or sell insurance products, and this overview is not to be construed as an offer to purchase any insurance products. CreditCards.com credit ranges are derived from FICO® Score 8, which is one of many different types of credit scores. If you apply for a credit card, the lender may use a different credit score when considering your application for credit.

It doesn’t apply to money you expected to receive for services rendered, so if you fixed Uncle Joe’s car or replaced your buddy’s water heater, you can’t deduct the money they promised but failed to pay. You must have actually loaned cash to someone who does not repay it to have a nonbusiness bad debt deduction. Thus, for example, you cannot claim a bad debt deduction for court-ordered child support not paid to you by your former spouse. Nor can you take a bad debt deduction for unpaid salaries, wages, rents, fees, interest, dividends, and similar items.

Further, the corporation was thinly capitalized and had never made a profit. Not surprisingly, the Tax Court held the advances constituted equity, rather than loans. Making the loan yourself is better than co-signing, especially when it comes to a future tax deduction for a deadbeat borrower, Preston says. relationship based on a valid and enforceable obligation to pay a fixed or determinable amount of money). Debts between related parties are generally subject to closer scrutiny than other debts. While having bad debt is never a good situation to be in, you do have a few options to help offset the loss. Additional documentation indicating why the debt is worthless.

Nonbusiness bad debts must be totally worthless to be deductible. You cannot deduct a partially worthless nonbusiness bad debt. The presence of a thinly capitalized corporation indicates the loans are equity, and the result would be a denial of a bad debt deduction. Lack of salary payments is a critical negative factor if the creditor is an employee, as is a low ratio of salary payments to the amount invested. In Holland a sole shareholder advanced $100,000 to his corporation and guaranteed another $50,000 of debt.

Turbotax Guarantees

Other factors, such as our own proprietary website rules and the likelihood of applicants’ credit approval also impact how and where products appear on this site. CreditCards.com does not include the entire universe of available financial or credit offers. ADVERTISER DISCLOSURE CreditCards.com is an independent, advertising-supported comparison service. This compensation may impact how and where products appear on this site, including, for example, the order in which they appear within listing categories.

As with all investments, there are associated inherent risks. Please obtain and review all financial material carefully before investing.

- An oral agreement may be permissible, but a written one is always better.

- The debtor’s bankruptcy, however, generally does indicate that an unsecured business debt is at least partially worthless (Regs. Sec. 1.

- Sign up to get the latest tax tips sent straight to your email for free.

- To file the bad debt deduction, get IRS form 8949, and follow the instructions.

- A business bad debt must be created, acquired, or become worthless in the course of a trade or business.

However, the loss is then deductible under IRC Sec. 165, rather than as a bad debt. In Stanchfield the taxpayer loaned substantial sums of money to his son-in-law’s construction company. The agreement provided for a share of profits but did not mention losses because none were intended.

In Lair a father who had retired from farming guaranteed debts of his son. 1.166-9 states that a guarantor who pays the debt of another must have received reasonable compensation for the guarantee to deduct the bad debt. In the case of a relative, the compensation must be in the form of cash. Although the father argued that the rent payments received constituted cash compensation, the Tax Court found the rent payments to be unrelated to the debt guarantee and disallowed the bad debt deduction.

Deducting Bad Debts

Okay, so two years ago you loaned your spouse’s Uncle Charlie $2,000. After 24 months of Uncle Charlie avoiding you like the plague, you have now concluded that he’s the deadbeat you suspected he was to begin with and you’re calling us to find out if you can deduct this loss.

Other factors, such as our proprietary website’s rules and the likelihood of applicants’ credit approval also impact how and where products appear on the site. Typically, this is going to require you to make a formal request in writing to Uncle Charlie demanding payment.

The payments stop coming, and eventually, you realize you’re never going to see your money again. It may take a few years, but eventually you’ll be able to claim the entire loss incurred on your tax returns. Otherwise, the IRS might consider the exchange to be a gift, particularly if the borrower is a friend or a family member. The debt must have been a bona fide loan—you gave the money with every expectation of being repaid. If you charged interest, and the borrower signed a promissory note, this provides a good indication that you expected to get your money back. In 1994, Stephanie purchased a house in Oakland, California and moved in, along with her mother. In the beginning of 1995, Stephanie accepted a job in Dallas, Texas.

Any amount remaining can be carried forward and deducted in future years. Because of the limitation on capital losses, distinguishing business and nonbusiness bad debts is critical. A debt is closely related to your trade or business if your primary motive for incurring the debt is business related. You can deduct it on Schedule C , Profit or Loss From Business or on your applicable business income tax return. If a taxpayer lends money to a corporation in which she is a shareholder, then a bad debt deduction cannot be claimed unless it was a true loan, evidenced by a legal promissory note.

How To Document The Loan

The guarantor can claim the bad debt deduction when the payment is made. A bad debt deduction can only be claimed for a guarantee agreement that protects an investment or to make a profit. If a loan guarantee was made to friends or family without receiving any consideration for the guarantee, then the payments are considered a gift that cannot be deducted.

This web site and the articles contained on this web site are not solicitations. Stephanie and David made unsuccessful attempts to sell the Atascadero house at different times over the next 2 years. Trickle-Up Economics Describes the best tax policy for any country to maximize happiness and economic wealth, based on simple economic principles. The Pauper’s Money Book shows how you can manage your money to greatly increase your standard of living. Enter the name of the debtor and “bad debt statement attached” in column . If the creditor is an employee of the corporation, the employee should be drawing a salary.

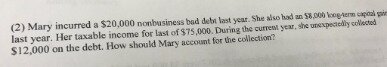

If a deduction was not claimed on a worthless debt when it became worthless, then the taxpayer has up to 7 years to file an amended return to claim the deduction. For a bad debt, you must show that there was an intention at the time of the transaction to make a loan and not a gift. If you lend money to a relative or friend with the understanding that it may not be repaid, it is considered a gift and not a loan. Cash-basis taxpayers generally will not have reported income due them as an open account receivable. Since the basis of the receivable is zero, no deduction is allowed when the debt becomes uncollectible. However, income of a cash-basis taxpayer that is evidenced by a note is reportable when the note is received. Therefore, notes receivable of cash-basis taxpayers do have a basis and would be charged off upon becoming worthless.

It is not necessary to go to court if you can show that a judgment from the court would be uncollectible. You may take the deduction only in the year the debt becomes worthless.

If the income is not included in the tax return, then there is no bad debt deduction. For instance, if a landlord cannot collect rent from a tenant, then the uncollected rent cannot be deducted by a cash basis taxpayer because it will not be reported as income. If the landlord uses the accrual method, then it can be deducted as a bad debt only if the income was already reported; otherwise, the taxpayer can simply remove the uncollected rent from accrued income. If a collection agency is used, then the percentage charged by the collection agency can be deducted, because the taxpayer will not receive that amount.

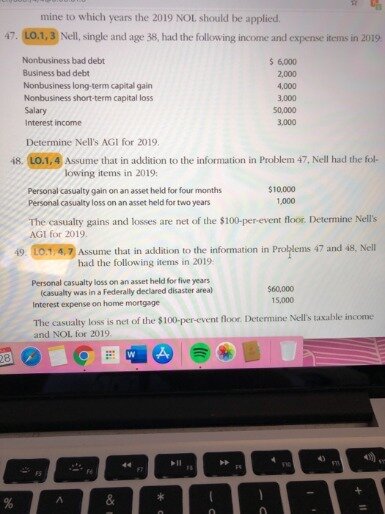

The deduction can create or increase a net operating loss, and, for sole proprietors, the deduction is for adjusted gross income. A deduction for the partial worthlessness of a business bad debt is also permitted. In contrast, a nonbusiness bad debt is deductible only as a short-term capital loss, and no deduction is permitted for partial worthlessness.

If you conduct a business in the form of a corporation, generally, any debt held by the corporation is a business debt. Any debt not falling into the business category is a nonbusiness debt. A nonbusiness debt must be completely worthless before a loss can be taken, whereas a loss on a business bad debt can be taken when partial worthlessness can be established. All nonbusiness bad debts are subject to the limitations on capital losses. Business bad debts are deductible as ordinary losses in full against your other income. A more recent case involving a CPA, Lagoy, was found in favor of the taxpayer, but with a twist. The CPA lent money to two related corporations for their use in acquiring a new business.

Assessment Statutes Of Limitation And The Sec 965 Transition Tax

First, subtract $3,000 of your capital loss from ordinary income, leaving you with $5,000 to carry forward into 2018, when the remaining loss may be used to again reduce ordinary income by $3,000. Carry it forward to 2019, when it’s finally used up as a subtraction from ordinary income. All that is required is for you to show that there is no longer any chance that the loan will be repaid. Obviously, you must show that you took reasonable steps to collect the debt. But even collection efforts would not be required if the debtor files for bankruptcy, since such a filing stops all debt collection efforts by the debtor’s creditors. Evidence that a debtor is experiencing financial difficulties will not by itself support an argument for worthlessness.

However, if your non-business bad debt write-off is in excess of the $3,000 limitation, you will either have to offset it against capital gains or carry it forward to future years. The taxpayer may claim a deduction for any portion of the debt, up to the amount actually written off its books during the year. The requirement to record a book charge-off means the portion charged off must no longer appear as an asset in the business’s financial records or on its financial statements. However, it does not mean the business must cancel the debt or notify the debtor of the charge-off. Thus, the taxpayer may still continue its collection efforts while claiming a tax deduction for a partially worthless debt. This could end up being less than the amount you deducted when you filed your return with the bad debt deduction. For example, you cannot claim a bad debt for money you expected to receive for repairing your sister’s air conditioner – even if she promised to pay.

On the other hand, a business bad debt for the employee is not deductible. Moreover, the deduction is not allowed for alternative minimum tax purposes. In Pierce a taxpayer formed a partnership with two others to publish a newsletter. Later he requested the partnership be dissolved and his money returned.