Content

Several computer software programs are available to help you figure the tax value of your donated stuff. The list of some common items, below, gives you an idea of what your donated clothing and household goods are worth, as suggested in theSalvation Army’s valuation guide. Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories.

• Donate to an IRS-qualified charity. The organization you donated to must be an IRS-qualified charitable organization in order for your gift to count toward a tax deduction. If you’re not sure about the charity, look it up using the IRS’s Exempt Organizations Select Check. But for your 2017 return, you can still itemize as you’ve done in the past. And to get the biggest tax savings, make sure you value your charitable donations correctly. You’ll need to fill in your name, identifying number, and the information for your stock donations overall in Part I. You will only need to worry about Part II if you donated partial interests.

While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. The tax law contains an exception to the good used condition requirement for any single item of clothing or single household item that is worth $500 or more. If a donor gives such an item, it can be in less than good used condition.

Information

H&R Block does not provide immigration services. An ITIN is an identification number issued by the U.S. government for tax reporting only. Having an ITIN does not change your immigration status. You are required to meet government requirements to receive your ITIN.

The important thing is to have a system that makes sense to you and provides all the information that you will need come tax season. If a small filing cabinet has worked for you for the past 20 years – great! Just make sure all the information you need is in there and is clearly labeled.

All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions.

A comparison of the results obtained using these programs and the price guides created by nonprofits found that the software usually gives higher valuations. For any property donations worth $5,000 or more, you must obtain a formal appraisal from a qualified appraiser. The only exception is for marketable securities because they have a clear market value. The basic rule is that you may deduct no more than the property’s “fair market value” at the time of the donation. But fair market value can be a tricky thing.

If you sell the shares with the gain, you will have to pay capital gains tax up to 37%. In this case, you’d be paying $1,060 in taxes. That leaves you with $4,810 of your proceeds in cash to donate to the organization of your choice.

You’ll need to disclose if you retained partial ownership of the stock, gave the stock on a conditional basis, gave rights to your donation to others, or inherited the donation. If you have been granted stock options by your employer, we recommend you exercise the options and hold the stock for at least one year before donating. If you donate the shares before the one year limit is up, your deduction will be limited to the exercise price. You can read about donation strategies for stock options. Choose the stock with the highest gains to maximize your tax savings. Make sure you are donating appreciated stock that you have held for at least a year or more. If you would have short-term capital gain from the sale of the stock, then you have to subtract this appreciation from the fair market value in order to arrive at your deduction.

This means there will be far fewer taxpayers who will itemize their deductions—and give to charities. Stock donations don’t have to be complicated, and deducting them from your taxes doesn’t have to be, either. You’re all set to make this simple change to save the most on your taxes this year.

Additional Menu

Loans are offered in amounts of $250, $500, $750, $1,250 or $3,500. Approval and loan amount based on expected refund amount, eligibility criteria, and underwriting. If approved, funds will be loaded on a prepaid card and the loan amount will be deducted from your tax refund, reducing the amount paid directly to you. Tax returns may be e-filed without applying for this loan. Fees for other optional products or product features may apply.

Additional state programs extra. H&R Block prices are ultimately determined at the time of print or e-file.

Entering Stock Donations Deductions Manually

MetaBank® does not charge a fee for this service; please see your bank for details on its fees. he Rapid Reload logo is a trademark owned by Wal-Mart Stores. Rapid Reload not available in VT and WY. Check cashing fees may also apply.

For tax years beginning after 2017, applicants claimed as dependents must also prove U.S. residency unless the applicant is a dependent of U.S. military personnel stationed overseas. A passport that doesn’t have a date of entry won’t be accepted as a stand-alone identification document for dependents. One state program can be downloaded at no additional cost from within the program.

Valid for 2017 personal income tax return only. Return must be filed January 5 – February 28, 2018 at participating offices to qualify. Type of federal return filed is based on your personal tax situation and IRS rules. Additional fees apply for Earned Income Credit and certain other additional forms, for state and local returns, and if you select other products and services. Visit hrblock.com/ez to find the nearest participating office or to make an appointment. OBTP#B13696 ©2017 HRB Tax Group, Inc. The more generous you are, the more paperwork you’ll have to fill out.

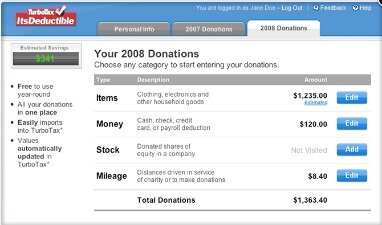

Small Business Small business tax prep File yourself or with a small business certified tax professional. While reading this, I couldn’t grasp what TurboTax process you were talking about. Then, it hit me that you were using the step-by-step data entry method; I always enter my tax data directly into the tax forms.

If you request cash back when making a purchase in a store, you may be charged a fee by the merchant processing the transaction. Always ask the merchant if a surcharge applies when requesting cash back at the point of sale. Vanilla Reload is provided by ITC Financial Licenses, Inc. ITC Financial Licenses, Inc. is licensed as a Money Transmitter by the New York State Department of Financial Services. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

- According to the IRS, a charitable contribution is a voluntary gift made to a qualified organization, without anything of value expected in return.

- Cocatalyst does not provide legal or tax advice.

- You can deduct the amount you paid for a stock or other security, but can’t deduct any appreciation.

- H&R Block online tax preparation and Tax Pro Review prices are ultimately determined at the time of print or e-file.

- Pre-qualified offers are not binding.

ItsDeductible uses market data from online auction sites, including eBay, as well as thrift stores and resale shops to help estimate a dollar value for your donated item. Donation for which you got something in return. Say you bought theater tickets at a charity auction. You can deduct only the amount you paid over the tickets’ face value. If you gave cash, hold on to a bank statement, cancelled check or credit-card receipt showing the amount of the donation. For gifts of cash or property worth more than $250, also keep the written acknowledgement from the charity showing the date and value of the donation. Giving is truly better than receiving, especially when your generosity can provide income tax benefits.

Stock Donation Deductions In Turbotax

Keep this list around when you’re planning your stock donation. It’s a handy reminder of what you need from your organization and the stock donation service you’re using, or your broker.