Content

Jump to the front of the line with priority support via email, live chat, or phone. Please check the contact us link in your my account for the support center hours of operation.

TaxSlayer.com’s “Free” products are excluded from this guarantee. Furthermore, our Maximum Refund Guarantee is based on the schedules and forms supported by TaxSlayer.com. Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund. Turbo, Intuit, QuickBooks, QB, TurboTax, ProConnect, and Mint are registered trademarks of Intuit Inc. Unemployment benefits may be a new and unfamiliar tax topic for many. We handle the reporting on your tax returns and provide guidance on tax withholdings and estimated tax payments.

The IRS offers free tax filing through TaxAct and TurboTax, along with several other services (such as H&R Block), through a “Free File” link on its website. Those earning below a certain gross income amount and/or meet a few other requirements can file free federal and state tax returns. Below are the web-based tax filing services I favor. I should note I have a basic tax return to file, live alone, and live in a state without a state income tax. Someone running a small business, has a family/dependents, or more complicated returns might take those factors into account.

When You File With Us, You Get:

TaxSlayer will not intentionally monitor or disclose any private electronic-mail message unless required by law. TaxSlayer reserves the right to change any information on this Website including but not limited to revising and/or deleting features or other information without prior notice. Clicking on certain links within this Website might take you to other web sites for which TaxSlayer assumes no responsibility of any kind for the content, availability or otherwise. (See “Links from and to this Website” below.) The content presented at this Site may vary depending upon your browser limitations. You may not download and/or save a copy of any of the screens except as otherwise provided in these Terms of Service, for any purpose. However, you may print a copy of the information on this Site for your personal use or records.

If you make other use of this Site, except as otherwise provided above, you may violate copyright and other laws of the United States, other countries, as well as applicable state laws and may be subject to penalties. TaxSlayer does not grant any license or other authorization to any user of its trademarks, registered trademarks, service marks, or other copyrightable material or other intellectual property, by placing them on this Website. Self-Employed Best for contractors, 1099ers, side hustlers, and the self-employed. By accessing and using this page you agree to the Terms of Use.

Major Forms And Schedules Supported

@kevin_n_daveyYou cannot download desktop software to a Chromebook–only to a full PC or Mac. If you want to use a Chromebook to prepare your 2019 tax return, you can use online TT. You want all your tax documents on hand, in one place. Import your W-2s and PDFs from another online tax service or tax preparer. Existing TaxSlayer customers can pull prior year tax information and compare this year’s tax return with last year’s tax return. Offer may change or end at any time without notice. Double-check your entries to be sure you entered all of your information correctly.

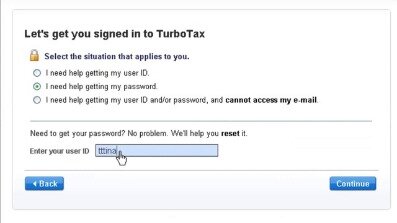

I would open each year in the program and save it as a PDF file, go to File-Save to PDF so you don’t need the program installed to view or print your return in the future like to get a mortgage or loan, etc. You can amend a current year online return using online. But to amend a prior year you need to use the Desktop program which needs a full Windows or Mac computer. Last year, at the public library, I used the Chrome browser and completed my taxes with Turbo Tax. TaxSlayer guarantees 100% accurate calculations or we will reimburse you any federal and/or state penalties and interest charges. We guarantee you will receive the maximum refund you are entitled or we will refund you the applicable TaxSlayer purchase price paid. TaxSlayer Premium is the perfect solution for taxpayers who are self-employed or do freelance work.

If you’re subject to the net investment income tax, we prepare the Form 8960, and include the tax deductions available to you. TaxAct has been the web-based tax filing service I’ve used on my Linux setup for some time now. It works fairly well, works across all platforms, and is somewhat easy to use.

With easy-to-use privacy controls, Chrome lets you customize your settings and browsing experience to how you see fit. With Google apps like Gmail, Google Pay, and Google Assistant, Chrome can help you stay productive and get more out of your browser.

Otherwise, if paid tier services are needed, TaxAct is cheaper to use than TurboTax. You can adjust your privacy controls anytime in your Google settings or learn more. Turbotax Online seems like it should work; I used it with Chrome last time.

Download Chrome Today

You may withdraw your consent to cookies at any time once you have entered the website through a link in the privacy policy, which you can find at the bottom of each page on the website. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. Please refer to your advisors for specific advice.

TaxSlayer Self-Employed is the perfect solution for taxpayers who are self-employed or do freelance work. Nothing in our communications with you relating to any federal tax transaction or matter are considered to be “covered opinions” as described in Circular 230.

If you’re a business owner, partner, contractor or gig worker, you may have to pay self-employment tax. However, in my opinion, something like tax filing should be done from a desktop or laptop (or at least an iPad/Surface tablet with a keyboard attachment), not a smartphone. TurboTax is the most popular tax-filing software. Intuit, the company that owns TurboTax, has also been in the tax preparation software game for a long time.

During the registration process, you will be prompted to answer some questions about your 2020 tax year. For example, did you have a mortgage or dependents, or did you have investment income? Based on your answers to these questions, EY TaxChat gives you a fixed-fee quote for preparing your taxes. Please note that this quote may change if we learn that your returns involve additional complexity or filings. I pre-registered for 2020 TaxChat services — Where will I find my 10% discount?

We’re committed to dealing with such abuse according to the laws in your country of residence. When you submit a report, we’ll investigate it and take the appropriate action. We’ll get back to you only if we require additional details or have more information to share. This site uses cookies from Google to deliver its services and to analyze traffic.

In so doing, we play a critical role in building a better working world for our people, for our clients and for our communities. The economic impact of the pandemic has been challenging, with millions receiving unemployment. These funds offer a lifeline, but they’re not tax-free income. If you recently became a US citizen, are a citizen of multiple countries or work in the US under a visa, our team will analyze your scenario to assist and file the appropriate US returns. If paying taxes makes you cringe, tax credits and deductions should make you smile. In most cases, income you earn in another state will be taxed by that state, requiring you to file there, too. For business owners, contractors and gig-workers, the freedom of being your own boss comes with the requirement to pay self-employment tax.

Hire EY professionals to file your taxes from the comfort of your home. Get virtual, one-on-one tax guidance and on-demand preparation from a tax professional. Google uses cookies to deliver its services, to personalize ads, and to analyze traffic. You can adjust your privacy controls anytime in your Google settings. Off-topic Post is disrespectful, about third party products or contains unrelated content or personal information. Google takes abuse of its services very seriously.

- Click here to learn how to notify TaxSlayer if you feel like you are entitled to a refund.

- You may use TurboTax Online without charge up to the point you decide to print or electronically file your tax return.

- EY is a global leader in assurance, consulting, strategy and transactions, and tax services.

- However, Linux and Chromebook users don’t have as many choices.

- You can save up to $100 when you file with TaxSlayer!

If you have cryptocurrency transactions, or own a business that transacts using cryptocurrency, this information must be reported on your annual return. The good news is our EY tax professionals are here to address the complexities of your tax filings. EY TaxChat™ can help you navigate through these complexities of state filing requirements. For those with investments in real estate, virtual currencies or partnerships, we will calculate income or losses and file the supplemental forms required. From savings accounts, to a diversified portfolio of stocks, bonds and mutual funds, these holdings generate varying types of investment income, each with distinct tax rates. With EY TaxChat, you’ll have access to a dedicated and experienced tax professional.

Which Turbotax Cd

You will be able to import your investment data, etc. When you use online TurboTax your tax file is stored online with TurboTax, but before mid-October you should always save your return as a tax file and as a pdf. And if you have a printer connected with your Chromebook, of course you will be able to print your return.

However, TurboTax has usually had problems working on Linux systems. Traditionally, Intuit would actively block browsers on Linux operating systems from using TurboTax’s web service, for unclear reasons. While there’s workarounds and reports of it working OK, I’d stick with TaxAct instead if you’re running a Linux installation. There’s no mention of Linux support, but this help page states Linux users should use the web version. I’ve used TaxAct on Linux for some years now, without any problems. Keep people and data secure with seamless updates and intuitive policy enforcement. Chrome works hard to protect your data and privacy online.