This includes publishing or syndicating our work on platforms or apps such as Apple News, Google News, etc. Justin Elliott is a ProPublica reporter covering politics and government accountability. To securely send Justin documents or other files online, visit our SecureDrop page.

“When someone finds or steals your mobile phone they have access to everything on it and in this case, your tax return,” he said. The views expressed on this blog are those of the bloggers, and not necessarily those of Intuit. Third-party blogger may have received compensation for their time and services. Click here to read full disclosure on third-party bloggers.

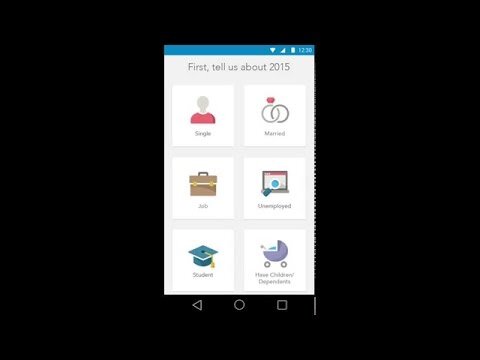

They may also tell you how to get to the screens where that information should appear. They display context-sensitive questions and answers that can further educate you before you answer a question. They also offer chat, phone, and email help, and host online communities. H&R Block is a comprehensive, easy-to-use tax service that helps e-filers claim relevant income, deductions, and credits. It’s an excellent choice for simple and complex returns, both in terms of its user experience and help options. All TurboTax online products, including Free Edition, are now compatible when accessing through a browser on the iPhone, Android, Kindle Fire, iPad and other tablets. As the leader in tax preparation, more federal returns are prepared with TurboTax than any other tax preparation provider.

Turbotax Return App

Last year, about 72% of taxpayers received a refund of close to $3,000, Greene-Lewis said. This year, the IRS has said that it will issue nine out of 10 tax refunds within 21 days or less if you e-file with direct deposit, she said.

TurboTax for iPad and SnapTax customers pay when they are done. All pricing for TurboTax mobile apps is available on the App Store, Android Market, or Amazon App Store for Android. That still leaves out individuals who receive Supplemental Security Income, or SSI, or veterans benefits. TaxAct Express also employs two-factor authentication and Touch ID, so your information remains secure and confidential.

Otherwise, tap the “Type it in Myself” option and then type in your W-2 information. After SnapTax processes your information, you will see a screen with the data filled in. MyBankTracker has partnered with CardRatings for our coverage of credit card products. MyBankTracker and CardRatings may receive a commission from card issuers.

Tax Tips From Turbotax

At that point, I wasn’t paying TurboTax any more so I went off on my own. Eventually I got it figured out, but not without massive disruption to my school work. None of that help was thanks to TurboTax which sends you to FAQs that don’t really apply.

Online tax preparation sites and their companion mobile versions have radically changed the way we file our income taxes. In fact, as of October of 2020, 71,761,000 self-prepared returns had been e-filed for the 2019 tax year, according to the IRS.

Credit Karma Tax

Definitely easier to do, rather than typing everything out. It’s kinda demeaning when you go to a tax servicer and get a $300 return on federal and like 200 on state and you get charged $250 to file. I paid a decent price and got my biggest return in 20 years since I’ve been working and that’s filing single/head of household.

TaxAct lets you file standard W-2 wages, receive dependent credits, education credits, saver’s credits, and earned income credits. You’re eligible for free tax filing if you have a simple tax situation, much like TurboTax’s requirements. You can even freely switch between working on your taxes on your phone and doing them on your computer or tablet. TurboTax can handle almost any tax situation, so nearly everyone is eligible to use the smartphone app. Occasionally, you’ll have to upload forms or input numbers for your income and expenses. Many companies have made the majority of their money by trying to simplify the tax filing process for consumers.

- H&R Block is a comprehensive, easy-to-use tax service that helps e-filers claim relevant income, deductions, and credits.

- While at first e-filing on a phone was limited to the simplest of returns, mobile devices have been able for years now to deal with even the most complex tax situations.

- These offers do not represent all deposit accounts and credit cards available.

- It’s not exactly a secret that this Free File program isn’t working well.

- Credit score ranges are provided as guidelines only and approval is not guaranteed.

- Learn how they work and whether your tax situation makes you eligible to use these mobile tax-filing apps.

Tap the word “Free,” then tap “Install,” and then enter your Apple ID at the prompt. While the SnapTax app itself is free to download and try out, you must pay a fee from within the app when you have finished processing your taxes before you can file them. The TurboTax SnapTax app, made by Intuit, is only for taxpayers who have an income of $80,000 or less if filing as an individual, or $100,000 if filing as a married person. You can only use it to declare income from W-2 forms, interest or unemployment compensation. If you use SnapTax, you cannot have dependents or own a home or real estate. The app is the official app of the Internal Revenue Service. You can use it to check your refund status, make payments, get helpful tips, and get tax preparation assistance.

What Happens After Youve Filed?

Who wants to go through all of those forms after a long day at work or give up a full Saturday to get the documentation together? Well, procrastinate no more—these handy apps will help you seriously simplify the process. Some partners offer free federal and free state tax return preparation; some charge a fee for state return preparation.

If you’re not wedded to using TurboTax, H&R Block’s 1040 EZ Tax App, available for both iPhone and Android, is the one for you. You’ll get the convenience of filing from your smartphone, plus the reassurance of knowing you’ll get free audit support and representation from an H&R Block agent. View a “personal tax guide” video that provides tax guidance and insight. Easily capture all of the information from your W-2 forms with your device’s camera. Get support for Free, Basic, Plus, Premium, and Freelancer products and a personalized product recommendation. Use the Help Center to get answers and expert advice for any tax questions you have.

Once you’ve decided you like the software and know which version you should purchase, you can purchase it. If you’re not sure what version of TaxAct is right for you, you can start filing for free. That means no manual entry of numbers from complicated forms and fewer opportunities for mistakes. You cannot itemize deductions, be self-employed, have earned capital gains, or be involved in other complicated tax situations.

All four apps will track your tax return’s status for you, so you can know what’s going on with your taxes at all times. The tax preparation companies have plenty of time to ensure that the software reflects the appropriate tax rules for that filing year. H&R Block offers a tax return app to go along with its in-person tax preparation service. Another screen on the app provides three kinds of tax help.

Who Should Not Use These Apps?

If you share republished stories on social media, we’d appreciate being tagged in your posts. We have official accounts for ProPublica and ProPublica Illinois on both Twitter (@ProPublica and @ProPublicaIL) and Facebook. Any website our stories appear on must include a prominent and effective way to contact you. This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

About eight million people used the TurboTax app to file their returns on mobile last year. Like Turbo Tax’s SnapTax, H&R Block’s app allows you to simply take a picture of your W-2 to import your income data for filing. It won’t help those with more complicated tax situations, either, but it does have the added benefit of free filing for both your federal and state returns. If you need to file income taxes and you prefer to file them electronically, you might want to do your taxes from your iPhone. The iPhone, a cellphone made by Apple, has a touch-sensitive display upon which a keyboard appears when you need to type something such as tax information. Apple’s App Store carries TurboTax Snap Tax, the only app available for filing taxes on the iPhone as of the date of publication. Find out which mobile apps are the best for preparing your tax returns right from the convenience of your smartphone.