Content

As with most cities on this list, Memphis keeps its overall taxes low by having no city or state income tax. Like New Hampshire, Tennessee does levy income tax on certain items, such as dividend or interest income, but it leaves wages untaxed. Since the main tax in Memphis is sales tax, lower-income residents pay a higher tax rate, at about 11%, than higher-income residents, who pay about 4.6 to 4.8%.

The dividend’s amount varies year-to year, ranging in recent years from around $900 to over $2,000. TurboTax helps you review various scenarios come tax time and recommends the choice that offers the biggest tax savings. Gas here is taxed at 20 cents per gallon—one of the lowest rates in the country.

That keeps the overall state and local tax burden down for middle-class families and everyone else. However, other taxes in the Sunshine State are just average when compared to other locations. At the bottom of the ranking, Rochester, New York, boasts a whopping 3.4% property tax rate, well above the national average of 1%, and expensive homes that are not appreciating in value, according to GoBankingRates. Alternatively, Jersey City was the only metro area in New Jersey to crack the top of the list, thanks to appreciating home values and relatively affordable prices, even though property taxes were above average. Mesa was ranked third among cities where you can realistically live on minimum wage in another GOBankingRates study, and the low tax rates could be a part of that. The low tax burden in Tucson is likely a welcome relief for its residents. The city has among the 10 lowest median household incomes, and a quarter of its residents live below the poverty line.

Detroit, Cleveland and Milwaukee are three of the four cities with the lowest median household income and the highest average property taxes. With the median home value at $116,700, the average Milwaukee resident will pay $2,988 in property taxes. Most of the least tax-friendly places have high property tax rates, with rates as high as 2.815 percent. At the state level, Americans living in New Jersey and Illinois tend to pay the most in property taxes relative to home values.

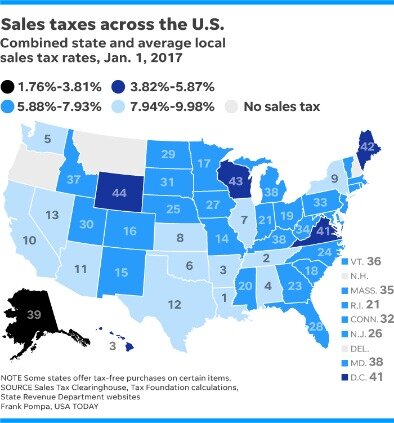

Louisville’s property tax rates are relatively modest, but its local and state income tax rates more than counterbalance that. Its local income tax rate is the sixth-highest overall, and its state income taxes are also higher than average. Twenty-five major cities saw an increase of 0.25 percentage points or more in their combined state and local sales tax rates over the past two years, including 10 with increases in the first half of 2019. A Transit Improvement Area sales tax increase affected rates in both Minneapolis and St. Paul, Minnesota in late 2017. Sixteen cities with populations of 200,000 or more do not impose local sales taxes, though some have state sales taxes as high as 7 percent . Nineteen major cities now have combined rates of 9 percent or higher.

An assessed value is the dollar value assigned to a property for purposes of measuring applicable taxes. Since these discounts don’t automatically show up on your tax bill, it’s important to ask the agency that collects your property tax to find out if you’re eligible. Property taxes are levied by states and local governments annually, based on the assessed value of land and structures owned. Sales taxes are only one of several ways that state governments can reach into your pocket for the cash that keeps them up and running.

Lawmakers Reintroduce Bill To Protect Against Double Taxation Of Financial Transactions

Colorado Springs, which has the lowest effective property tax rate of any large city, doesn’t necessarily top the list because of its housing market. The city has a tax-averse, small government culture and famously during the Great Recession slashed its budget rather than raise revenue to pay for services. For a time, more than a third of streetlights weren’t turned on, employees were laid off, garbage pick-ups were skipped, and lawns and medians were left un-mowed, among other cutbacks.

Milwaukeeans pay a median $3,122 in property taxes on a median home value of $133,600, for an effective property tax rate of 2.17%. However, all 15 counties levy additional taxes, as do many municipalities. As a result, the average combined state and local sales tax rate is 8.4%, which is the 11th-highest in the U.S., according to the Tax Foundation. Tax rankings are based on 2007 tax return computations for a two-income couple earning $75,000 with one school age child.

Sales taxes in the U.S. are levied by state, county and municipal governments, affecting the price you pay for goods and services in different parts of the country. Grow your savings faster with banks offering rates that are significantly higher than the national average! Find the best rates and start earning more interest on your savings by using the Money Talks News savings and CD account comparison tool. Certificates of deposit pay more interest than standard savings accounts. Find the highest nationally available rates for each CD term here from federally insured banks and credit unions.

Auto taxes are another bright spot, being among the lowest of any city. Sioux Falls residents enjoy a low overall tax level since there are neither state taxes in South Dakota nor city taxes in Sioux Falls. Although sales tax in Sioux Falls is rather high, this is offset by the lack of income tax and very low auto taxes. All-in, a family earning $150,000 can expect about 5.9% in total state and local taxes in Sioux Falls. The total amount of tax you pay reaches far beyond what you owe the federal government. Depending on where you live, most likely you’re required to pay additional taxes, including property and sales tax. The disparity between the amount of tax you pay in a low-tax city and that in a high-tax city can be dramatic.

Portland, Oregon, and Anchorage, Alaska, have no state or local sales taxes. Although the sales tax rate of 7.75% is fairly high, consumers only pay this tax on 37.4% of goods, with food and many consumer goods being sales tax exempt. The net result is an average tax rate of just 5.6% for a family earning $150,000. Further, beginning in 2018, the state and local tax cap began limiting the amount that could be deducted against federal income taxes. Revenues raised from property taxes typically pay for things like schools, parks, libraries, transportation infrastructures, police departments, and fire departments.

Excise Taxes

Oakland’s average property tax rate is a modest 0.87 percent, which ranks at the 15th lowest of the cities on this list. However, with a median home value of $746,100, the third highest, the total estimated property taxes wind up being $6,641 per annum, the fifth highest on this list. Omaha wound up in the top 10 least tax-friendly cities, however, because it is one of the 11 cities with average property taxes over 2 percent and has a relatively steep income tax rate. The largest city in Orange County, Santa Ana offers lower sales tax rates and real estate taxes than many other cities in Southern California.

- One of the few downsides of Billings is paying a higher-than-average gas tax.

- A matching tool like SmartAsset’s can help you find a person to work with to meet your needs.

- Census Bureau’s American Community Survey was used to find median household incomes.

- New Orleans is among the poorest cities in America, with a median income of $36,999, but its residents avoid a heavy tax burden at least.

- Indeed, three small cities in New Jersey and Connecticut have effective property tax rates over 3.0 percent.

That’s based on a 6% state tax rate and local rates that can be as high as 2.5%. Plus, at 9.23%, the Tax Foundation’s average combined state and local sales tax rate for Washington is the fourth-highest in the country. However, according to the Tax Foundation, the average combined state and local sales tax rate is 6.96%, which isn’t too bad. On top of that, state and local income taxes, property tax and sales tax can drastically increase the tab, depending on where you live. Colorado Springs has the lowest average property tax rate on the list at just over a half percent. Boston is among the cities with the 10 highest median household incomes, and the low property tax rates mean workers are hanging on to a relatively large slice of those earnings. Texas is one of the states with no income tax, but Fort Worth has the third-highest average property tax rate on the list.

Adding a sales tax onto a purchase makes everything you buy a little more expensive, and it’s not just state sales taxes that you have to concern yourself with. Some counties and cities tack on their own taxes in addition to the state’s, making the bill for certain merchandise even higher. Hawaii has the broadest sales tax in the United States, taxing many products multiple times and, by one estimate, ultimately taxing more than 100 percent of the state’s personal income. This base is far wider than the national median, where the sales tax base applies to 36.2 percent of personal income. Tax experts generally recommend that sales taxes apply to all final retail sales of goods and services but not intermediate business-to-business transactions in the production chain.

Kansas City, Mo

As of July 17, 2019, there were 11,113 total sales tax jurisdictions across the country according to Vertex, Inc. I am a fiscal policy expert, national journalist and public speaker who has spent more than 15 years writing about the many ways state and local governments collect and spend taxpayer money.

The state of Louisiana has some of the lowest property taxes in the country, and New Orleans is no exception. On average, homeowners in the Big Easy pay just 0.7% of their home’s value in real estate taxes every year. After all, its top marginal income tax rate of 8.95% is 7th highest in the country. That rate, however, only applies to income earned after a taxpayer’s first $40,000 of earnings, which in practice means that middle-class taxpayers pay a far lower rate. The District also helps middle-class homeowners with its “Homestead Deduction” on real estate, which reduces taxable value of eligible properties by $70,200.

In the best spots, the combination of low taxes and affordable homes that are still increasing in value make owning property more desirable compared with some of the country’s pricier locales. Hialeah, Florida, just outside of Miami, came out on top of the list of best cities in which to own a home and save on taxes.

These recommendations would result in a tax system that is not only broad-based but also “right-sized,” applying once and only once to each product the market produces. Despite agreement in theory, the application of most state sales taxes is far from this ideal. Housing markets on the lower-tax list tend to have higher home values than the ones on the higher-tax list. Meanwhile, most of the actual property taxes paid on the low-tax list are comparable or lower than the high-tax list — even though home values on the second list are much higher. Here are the small and midsize cities with the highest property taxes.

We assumed that the average taxpayer would spend 70% of disposable income on taxable goods. We took 70% of the disposable income applied the total state and local sales tax rate to that amount to calculate the sales tax bill. Unlike the other top 5 low tax cities, Honolulu is in a state that collects income taxes and sales taxes. While most major cities collect about 1% of home values in annual real estate taxes, Honolulu collects less than a third of a percent. That means that, for the hypothetical taxpayer used in our study, real estate taxes in Honolulu would total under $800 per year—far less than in any other city. According to the non-profit Tax Foundation, the average effective income tax rate for all U.S. households is 18.1%. That is lower than the highest marginal rate paid by most year-round workers, (at least 25% for any individual with an adjusted gross income of more than $36,901)—but it also doesn’t capture the full picture.

Oklahoma City

Higher taxes, though, didn’t prevent it from being the largest city in Ohio where your paycheck stretches the furthest, GOBankingRates reported. Large cities in the West generally top the list of those with the lowest effective tax rates.

You’ll want to look at the cost of housing, of course, but make sure you consider the impact of state and local taxes on your bottom line, too. New Mexico’s only city among the 52 largest also features a lower-than-average property tax rate and a relatively light state income tax burden.

Portland is one of the cities where the cost of living will rise the most in 2018, according to a GOBankingRates study. On top of that, Denver has its own 3.65% tax rate, in addition to a 1% sales tax to support the regional transit system, and a 0.10% rate to support cultural facilities. All that adds up to a total sales tax rate of 7.65%, lower than that of many major cities, including New York, Chicago and Los Angeles. Not surprisingly, the highest property taxes surround the biggest cities. “The suburbs of New York City, both in New York and surrounding states, have traditionally the highest property taxes in the country in real dollars,” says Mark Ryan, an independent Realtor in Ann Arbor, Michigan. “Even as a percentage of home purchase price, these areas remain near the top.” Still, Delaware has a higher median household income and, as an added bonus, the state has no sales tax.