Content

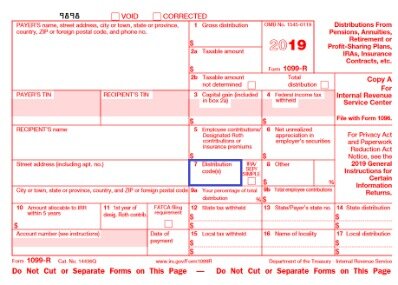

The PATH Act moved up the deadline, specifically for 1099-MISC forms which included box 7 income, to January 31. Form 1099-NEC was originally retired after the 1982 income tax year. At first glance, this may look like a major overhaul but at the end of the day, the tax implications remain the same. The treatment of business income, self-employment income, and self-employed independent contractor taxes remain unchanged. The key is planning and knowing what to expect. An entry in Box 7 for nonemployee compensation would usually be reported as self-employment income on Schedule C Profit or Loss from Business. The payer of the miscellaneous income did not withhold any income tax or Social Security and Medicare taxes from this miscellaneous income.

Nonemployee CompensationNonqualified deferred compensation, Box 12. Nonqualified Deferred Compensation, Nonqualified deferred compensation income. The cost of group-term life insurance paid on behalf of a former employee (report on Form W-2).

Each 1099 should be reported on its own column of Schedule E. If more than three columns are needed, then Schedule E should be repeated. My parents sold their oil and gas overriding interest. The company that purchased their interest showed the amount paid for the purchase in Box 7 – Non-employee compensation on their 1099-Misc. Reporting it this way makes the sales proceeds subject to self-employment tax which doesn’t seem correct for an overriding interest. Am I missing something, or does the 1099 seem incorrectly prepared to you? Appreciate any insight you have before I call and request an explanation or a change to the 1099.

The payment has (together with other payments described in , , and , above, made to the same individual) an aggregate present value of at least three times the individual’s base amount. Commissions paid to nonemployee salespersons that are subject to repayment but not repaid during the calendar year. You made payments to the payee of at least $600 during the year. If the following four conditions are met, you must generally report a payment as NEC. Additionally, the IRS encourages you to designate an account number for all Forms 1099-NEC that you file. See part L in the 2020 General Instructions for Certain Information Returns. If you are required to file Form 1099-NEC, you must furnish a statement to the recipient.

If you are a business that paid a vendor or an independent contractor or a freelancer or any other individual who in no way constitutes as your employed worker, then you have to send a copy of the Form 1099-NEC to them. Please note that the print version of this PDF will not be valid because it does not support scanning procedures specified by the IRS.

For information on the valuation of fringe benefits, see Pub. 15-B, Employer’s Tax Guide to Fringe Benefits. You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

Major Changes To File Form 1099

Royalty income is reported on Form 1099-MISC, Box 2, Royalties. The oil and gas company will generally also report related expenses, including production tax.

The sample is sent by you to the party that is providing paid services. Remember, it’s important to insert in an income and payment in the samples you provide carefully, for them to coincide in all sources. Otherwise, the IRS will have questions, request additional information, and possibly add fines. In most cases, you are obliged to provide details about all taxable income, that is not connected with salary or any earnings received from any source, instead of employment. The 1099-MISC is necessary to provide miscellaneous earnings details with all funds you pay for work made by an organization or person, not hired by a company. The Form 1099 series is a very strong tool, needed for IRS to make the taxpayer to complete an informational return.

Moreover, the royalty interest participates in the production revenue without incurring an obligation to pay the costs of developing and operating the interest. The working interest generally bears all costs of developing and operating the property, and fully participates in the revenues of the wells. Working interest is considered a trade or business. If a business made a payment or compensated a contractor or vendor for their services, and the amount is at least $600 in total, then such nonemployee compensations have to be reported in Box 7 of Form 1099-MISC. The MISC form is the last iteration of the form – for now – that includes Box 7. This notorious spot on the form is where employers and contractors reported non-employment compensation. In most cases, these are funds generated through contracted work, like a temporary hire or freelancing.

Using an integrated accounting software, like that offered from AMS, can prevent against mistakes, miscalculations, and missing forms. This means users can buy the main platform, our 1099/W-2 filer, and select specific add-on tools to create customized software.

Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card or account. See your Cardholder or Account Agreement for details.

The Send A Friend coupon must be presented prior to the completion of initial tax office interview. A new client is defined as an individual who did not use H&R Block or Block Advisors office services to prepare his or her prior-year tax return. Discount valid only for tax prep fees for an original 2017 personal income tax return prepared in a participating office. May not be combined with any other promotion including Free 1040EZ. Void if sold, purchased or transferred, and where prohibited. Must be a resident of the U.S., in a participating U.S. office. Referring client will receive a $20 gift card for each valid new client referred, limit two. Gift card will be mailed approximately two weeks after referred client has had his or her taxes prepared in an H&R Block or Block Advisors office and paid for that tax preparation.

However, the real estate agent or property manager must use Form 1099-MISC to report the rent paid over to the property owner. See Regulations sections 1.6041-3, 1.6041-1, Example 5, and the instructions for box 1. Be sure to report each payment in the proper box because the IRS uses this information to determine whether the recipient has properly reported the payment.

Quickbooks, Qb, Turbotax, Proconnect And Mint Are Registered

Previously, the Combined Federal/State Filing Program (CF/SF) allowed businesses to forward the e-files to the states for compliance. But with the introduction of Form 1099-NEC, this may not be possible.

- Previously, the Combined Federal/State Filing Program (CF/SF) allowed businesses to forward the e-files to the states for compliance.

- Due to federally declared disaster in 2017 and/or 2018, the IRS will allow affected taxpayers an extended filing date to file and pay for their 2017 taxes.

- Since the 1099-NEC will be a common form, this will likely be a short-term issue that will be resolved at some point – but not for 2020.

- Most personal state programs available in January; release dates vary by state.

- As a result, it would penalize the filer for every return filed, not just the Box 7 related filings.

The second TIN should not be included in the box is if you received a notification from IRS that the TIN of the other/another party is provided incorrectly. First of all, include the name of payer and the full postal address, postal code or ZIP and telephone number.

Enter any excess golden parachute payments. An excess parachute payment is the amount over the base amount (the average annual compensation for services includible in the individual’s gross income over the most recent 5 tax years). See Q/A-38 through Q/A-44 of Regulations section 1.280G-1 for how to compute the excess amount. For example, persons who have not furnished their TINs to you are subject to withholding on payments required to be reported in boxes 1, 2 , 3, 5 , 6, 8, 9, and 10. Use box 2 to report royalty payments from intangible property such as patents, copyrights, trade names, and trademarks. Report the gross royalties paid by a publisher directly to an author or literary agent, unless the agent is a corporation.

Ways To Work With Your Tax Pro

For details, see the 2020 General Instructions for Certain Information Returns. The general backup withholding rules apply to this payment. Other information returns are required for some or all of a payment under another section of the Code, such as section 6041. Are not reportable by you in box 1 of Form 1099-NEC.

Both cardholders will have equal access to and ownership of all funds added to the card account. See Cardholder Agreement for details.

Take advantage of expert tax services in an office or virtually. You’ll always get your max refund. Small Business Small business tax prep File yourself or with a small business certified tax professional. File with a tax pro At an office, at home, or both, we’ll do the work. If you have any payment that is in excess of the regular golden parachute expenses, then include them in the thirteenth box.

This sample is one of the most frequently used tax samples – therefore you need to get familiar with its general details better.

File Form 1099-MISC by March 1, 2021, if you file on paper, or March 31, 2021, if you file electronically. The definitions of terms applicable for chapter 4 purposes that are referenced in these instructions.

Any farmers whom a rent should also include the payment sum here. Additionally, coin-operated machines are also included in the form. The bottom left of the form is made to provide information about section 409a income and deferrals. Next is a box subdivided into two parts which include the id numbers of both parties. This is convenient because the IRS identifiers are located together.

Consult an attorney for legal advice. When you complete the sample in electronic format, there is no need to fill out several copies. The template you completed can easily be shared with all governmental institutions and individuals that are providing their services to your business. If the company purchased something that costs more than $5000, then this should be mentioned in the sample. But there is no requirement of providing the full sum you paid. Just check the box and include all details in the schedule C.

State Reporting May Become More Difficult In The Short Term

The person will continue to receive these royalty payments while the well is still producing. This should be reported on Schedule E, page 1, as Royalties Received. Any operating expenses and depletion that is normally 15 percent of the income amount is also reported on Schedule E. This income is not subject to self-employment income. For working interest owners, the lease bonus and lease payments are reported on Form 1099-MISC, Box 7, Nonemployee Compensation. This amount should report this income on Schedule C, Gross Receipts and Sales.