Some examples of asset accounts include Cash, Accounts Receivable, Inventory, Prepaid Expenses, Investments, Buildings, Equipment, Vehicles, Goodwill, and many more. For something to be an asset, it must meet the three key properties mentioned in question 3. Additionally, an asset must be able to generate cash inflows for the company. Typically, assets are categorized within a company’s general ledger account. Here, asset account reduction is given effect by crediting building A/c and simultaneously giving debit to expense A/c- depreciation.

Non-Current assets are normally valued to cost and are subject to depreciation & amortization throughout their lifespan. Accounts Receivable

Accounts receivable is a right to receive an amount as the result of delivering goods or services on credit. Under the accrual method of accounting, Accounts Receivable is debited at the time of a credit sale. Later, when the customer pays the amount owed, the company will credit Accounts Receivable (and will debit Cash).

Join PRO or PRO Plus and Get Lifetime Access to Our Premium Materials

Fixed assets are resources with an expected life of greater than a year, such as plants, equipment, and buildings. An accounting adjustment called depreciation is made for fixed assets as they age. Depreciation may or may not reflect the fixed asset’s loss of earning power. Some assets are recorded on companies’ balance sheets using the concept of historical cost. Historical cost represents the original cost of the asset when purchased by a company. Historical cost can also include costs (such as delivery and set up) incurred to incorporate an asset into the company’s operations.

Allowance for Doubtful Accounts

The Allowance for Doubtful Accounts is a contra-asset account since its balance is intended to be a credit balance (or a zero balance). When the balance in this account is combined with the balance in Accounts Receivable, the resulting amount is known as the net realizable value of the receivables. The Allowance for Doubtful Accounts is used under the allowance method of reporting bad debts expense. Financial assets represent investments in the assets and securities of other institutions.

Fixed assets

An asset is a resource with economic value that an individual, corporation, or country owns or controls with the expectation that it will provide a future benefit. The purchased land is a non-current asset and the land account of the general ledger with be debited with $100,000. You can create your own master chart of accounts for use in this course and build on it as we go along. You should be able to complete the account type column and some of the account descriptions. Click Chart of Accounts to access a google spreadsheet that you can download and use during the course.

- Land

This account represents the property portion of the balance sheet heading “Property, plant and equipment.” It reports the cost of land used in a business. - Furniture and Fixtures

This account reports the cost of desks, chairs, shelving, etc. that are used in the business. - Let’s take a look at each type of asset and give some examples of them.

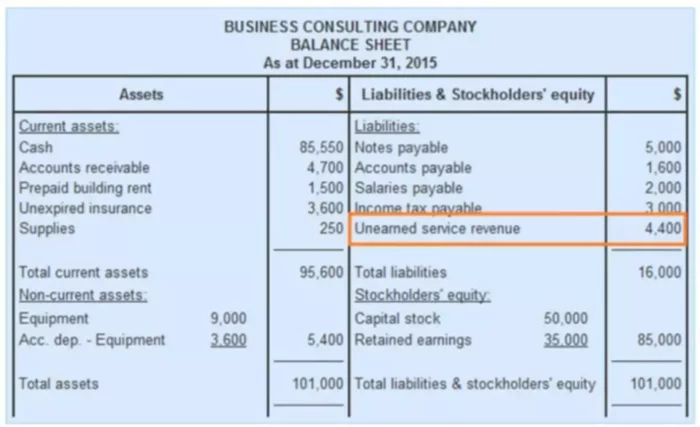

The ending balances in the balance sheet accounts will be carried forward to the next accounting year. Hence the balance sheet accounts are called permanent accounts or real accounts. While cash is easy to value, accountants periodically reassess the recoverability of inventory and accounts receivable. If there is evidence that a receivable might be uncollectible, it’ll be classified as impaired. Or if inventory becomes obsolete, companies may write off these assets.

How Are Current Assets Different From Fixed (Noncurrent) Assets?

These are monies your company owes to vendors or creditors and are expected to pay off within an accounting year. They represent short-term debts, so you report AP on the balance sheet as current liabilities. Other Examples of non-operating assets are short-term investments, marketable securities, and interest income from fixed deposits. Asset accounts are financial accounts that represent the various assets of a company.

Examples of current assets include but are not limited to cash, bank deposits, notes receivables, inventory, supplies, prepaid expenses, and marketable securities. Unlike Non-current assets, these assets can easily be converted to cash within a year or less. Put simply, assets are items or resources that are owned by companies.

Intangible assets

The cost of furniture and fixtures is to be depreciated over the useful lives. Vehicles

This account reports the cost of trucks, trailers, and automobiles used in the business. The cost of vehicles is to be depreciated over the vehicles’ useful lives.

They are bought or created to increase a firm’s value or benefit the firm’s operations. The balances in the asset accounts will be summarized and reported on the company’s balance sheet. Non-current assets are those assets that have a life of more than a year. These assets are, therefore, long term investments of the company and are generally illiquid.